JP Morgan Chase 2008 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2008 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

the worst of the crisis. We will do whatever it takes

to ensure that our liquidity remains a strong part of

our fortress balance sheet so that we can maintain

flexibility during challenging times to be in a posi-

tion to support our clients.

• We avoided short-term funding of illiquid assets,

and we essentially do not rely on wholesale funding.

(Of our $1 trillion of deposits, approximately $300

billion is referred to as “wholesale,” but it essentially

is comprised of deposits that corporate clients leave

with us in the normal course of business – i.e., they

are “sticky” and not like brokered certificates of

deposit or “hot money” that move on a whim for one

basis point.) Simply put, we still follow the financial

commandment: Do not borrow short to invest long.

D. The acceptance of government TARP

On October 13, 2008, I went to Washington, D.C., with

eight chief executives of other financial firms. There,

we were asked by the Secretary of the Treasury, the

Chairman of the Federal Reserve, the Office of the

Comptroller of the Currency (OCC), the FDIC and the

New York Federal Reserve Bank to agree to accept a

package of capital from the government. As part of its

Troubled Asset Relief Program (TARP), the U.S. gov-

ernment was proposing some powerful measures to

help fix the collapse in the credit and lending markets.

They prevailed upon the nine of us to set an example

for others by accepting this capital infusion as a sign

of our unanimous support of these measures. The logic

was that a massive infusion of capital into the U.S.

banking system would pave the way for the industry

as a whole to extend more credit than they otherwise

would have provided. The government’s view was also

that if any of the banks declined the TARP funds, then

many of the additional banks might not want to be

tainted by their acceptance of the TARP money

because it might be viewed as a sign of weakness.

We felt then that accepting the TARP funds was the right

thing to do for the U.S. financial system – even though it

may not have been as beneficial for JPMorgan Chase as

it was for some of the others

In short, we did not ask for the TARP capital infusion,

and we did not feel we needed it (our Tier 1 capital at

year-end would have been 8.9% without it). In fact,

the TARP program had asymmetric benefits to those

accepting it; i.e., it was least beneficial to strong com-

panies like ours and vice versa. That said, we believe

that accepting the TARP funds was the right thing to

do for the U.S. financial system – and that JPMorgan

Chase should not be parochial or selfish and stand in

the way of actions that the government wanted to take

to help the whole financial system.

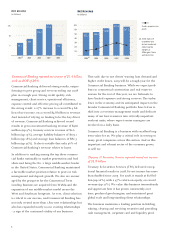

7.5

8.0

8.5

9.0

7.0

6.5

9.5

10.0

2004 2005 20072006

8.7%

8.3%

8.5%

8.2%

8.7%

8.4%

7.2%

8.4%

2008

9.6%

10.9%

(a)

11.0%

10.5

Peer Comparison of Tier 1 Capital Ratios

Tier 1 Capital Ratio — JPMorgan Chase

Average Tier 1 Capital Ratio — Peers

(Bank of America, Citi, Wells Fargo

and Wachovia; 2008 peer capital ratio

excludes Wachovia)

(a) 2004 data are unaudited pro forma

combined, reflecting the merger of

JPMorgan Chase and Bank One