JP Morgan Chase 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

We think the government acted boldly in a very tough

situation, the outcome of which could have possibly been

far worse had it not taken such steps

The government acted quickly and boldly – taking

unorthodox steps to try to right the ship. It had to act

with urgency while dealing with complex and rapidly

changing problems that did not lend themselves to

simplistic solutions. While we will never actually

know, we believe, as many economists and analysts do,

that without these and other actions the government

has taken to date, things could have been much worse.

So while it is easy to criticize the timing, marketing or

consistency of the effort – we also recognize how hard

it is to act boldly in difficult and dangerous times. We

should remind ourselves of what President Theodore

Roosevelt expressed nearly a century ago:

“It is not the critic who counts; not the man who points

out how the strong man stumbles, or where the doer of

deeds could have done them better. The credit belongs

to the man who is actually in the arena, whose face is

marred by dust and sweat and blood; who strives

valiantly; who errs, who comes short again and again,

because there is no effort without error and shortcom-

ing; but who does actually strive to do the deeds; who

knows great enthusiasms, the great devotions; who

spends himself in a worthy cause; who at the best

knows in the end the triumph of high achievement, and

who at the worst, if he fails, at least fails while daring

greatly, so that his place shall never be with those cold

and timid souls who neither know victory nor defeat.”

We hope that our leaders will continue to be bold

and brave in seeking solutions to these once-in-a-

generation problems.

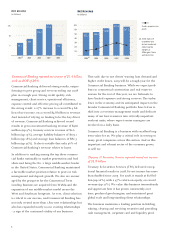

Banks are lending, and the TARP is probably helping

It is important to recognize that TARP capital is only

14% of our total capital. It is also important to recog-

nize that to the extent we use the money and lose it,

the risk is 100% ours because we still owe the money

back to the government. Despite that, we, and other

banks, are trying to use TARP capital to benefit share-

holders, clients and communities. In the fourth quarter

of 2008 alone, we extended more than $150 billion in

new credit to consumers, businesses, municipalities

and not-for-profit organizations, including nearly $30

billion in home lending and $2.8 billion in auto lend-

ing. We increased loans and commitments to govern-

ment units, health care companies and not-for-profits

by 33% in 2008 and plan to increase lending to these

groups by $5 billion in 2009. We also completed sever-

al major syndicated leveraged finance loans, and, in

one critical instance, we bought the entire $1.4 billion

bond issue from the state of Illinois when no one

else would bid for it, giving Illinois the financing for

payroll and other important needs. Finally, we remain

very active in the interbank market (where banks lend

to each other) and have had on average $40 billion to

$50 billion out in the interbank market each night.

While total lending by banks fluctuates according to

the markets and changing credit conditions, we do

believe that TARP has enabled many banks to increase

their lending in certain key areas – more than they

otherwise would have done.

While we clearly understood that there might be

potential (mostly political) unintended consequences

of TARP, we believed that it would help the U.S.

financial system at that critical moment.