JP Morgan Chase 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

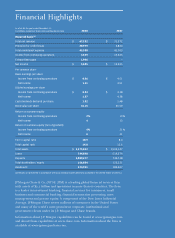

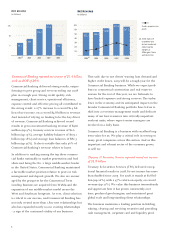

2004 2005 2006 2007 2008

Investment Bank $ 3,654 $ 3,673 $ 3,674 $ 3,139 $ (1,175)

Retail Financial Services 3,279 3,427 3,213 2,925 880

Card Services 1,681 1,907 3,206 2,919 780

Commercial Banking 992 951 1,010 1,134 1,439

Treasury & Securities Services 231 863 1,090 1,397 1,767

Asset Management 879 1,216 1,409 1,966 1,357

Corporate (4,172) (3,554) 842 1,885 557

JPMorgan Chase $ 6,544 $ 8,483 $ 14,444 $ 15,365 $ 5,605

5

Card Services reported net income of $780 million with

an ROE of 5%

Card Services’ full-year net income was $780 million,

down 73% year-over-year as charge-offs increased from

$5.5 billion in 2007 to $8.2 billion in 2008 (up 48%).

The net charge-off rate was approximately 5% of loans.

In 2008, Card Services increased net revenue by 8%

and grew managed loans by 3% (excluding WaMu).

In 2008, we added 14.9 million new credit card

accounts. By investing in activities to further engage

current cardmembers and attract new customers, we

continued growing the business. These activities

included renewing contracts with important partners

(AARP, Continental, Disney, Marriott and United) and

enhancing our customer service. Equally important,

Chase kept credit open and available to customers and

businesses in a safe and sound manner and extended

more than $84 billion in new credit.

With the WaMu acquisition, Chase became the largest

credit card issuer in the nation, with more than 168

million cards in circulation and more than $190 billion

in managed loans. Yet, being the biggest does not

mean we are the best. We will continue to invest in

areas that will make us the best in the business.

Specifically, our focus will be on responsive customer

service, valued loyalty and rewards programs, and

upgraded systems and infrastructure. In addition, our

ability to do a better job underwriting and to give our

customers added value through cross-selling is a huge

competitive advantage in both the card and retail

banking businesses.

Our focus on sound risk management extends to the

card business. Early in this crisis, we responded quick-

ly to leading indicators of change and made consider-

able risk management improvements. This included:

raising the credit-score threshold for direct-mail mar-

keting and increasing the number of applications that

are subject to our thorough review process. We regu-

larly manage our customers’ credit lines, based on

their willingness and ability to pay. While we are

lowering credit lines for customers who show signs

of increased risk or inactivity, we also are raising lines

for our most creditworthy customers. In addition, we

are closing accounts that have been inactive for long

periods of time because we know from experience that

these accounts are extremely risky.

Looking ahead, we expect losses will continue to

increase from 5% to 9%, essentially tracking the rate

of unemployment. To prepare for higher losses, we

increased our reserves from $3 billion to $8 billion and

are intensifying our collections efforts. At the same

time, we have expanded our use of flexible payment

programs to help those customers experiencing finan-

cial distress: In 2008, we saw 600,000 new enrollments

in payment programs, and we anticipate, and are

prepared for, that number to increase.

We do not expect 2009 to be a good year for the credit

card business. In fact, we do not expect to make any

money in Card Services this year. However, once this

crisis is over, we believe that our ongoing investments

in service quality, rewards programs and enhanced

infrastructure will ultimately make us one of the best

credit card companies in America.

Earnings by Line of Business (in millions)

(a)

(a) 2004 data are

unaudited pro

forma combined,

reflecting the

merger of

JPMorgan Chase

and Bank One