JP Morgan Chase 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

Soon, hundreds returned to work that night. By the

weekend, thousands of people from around the world

were working around the clock. These professionals

ably managed the due diligence work and gave us the

confidence we needed to complete the deal. Their

Herculean effort over that weekend and the next sever-

al months made it possible for us to sign and close the

deal in about 75 days. If you could have seen what I

saw during that intensely stressful time, you would

have been very proud of the team at JPMorgan Chase.

B. The purchase of WaMu

On September 25, the Federal Deposit Insurance

Corporation (FDIC) seized the banking assets of

Washington Mutual in the largest bank failure in

history. Moments later, we acquired the deposits,

assets and certain liabilities of Washington Mutual

for approximately $1.9 billion. We now know that

JPMorgan Chase was the only bank prepared to act

immediately. We acquired WaMu’s 2,200 branches,

5,000 ATMs and 12.6 million checking accounts, as

well as savings, mortgage and credit card accounts.

Importantly, we did not acquire the assets or liabilities

of the bank’s holding company or assume the $14

billion of senior unsecured debt and subordinated

debt of Washington Mutual’s banks.

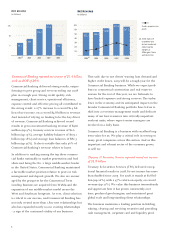

The deal was financially compelling – it was immedi-

ately accretive to earnings, and it will add an estimated

$2 billion or 50 cents per share to our 2009 results and

increasingly more thereafter. To achieve these antici-

pated earnings, we did not rely on heroic revenue

assumptions. Instead, we mostly relied on expected

cost savings (net of the large investments in the

technology and refurbishment of the branches) of $1.5

billion. We now expect to achieve cost savings of more

than $2 billion. We also plan to complete all rebrand-

ing and system conversions by the end of this year.

With the acquisition of WaMu, we purchased approxi-

mately $240 billion of mortgage and mortgage-related

assets, with $160 billion in deposits and $38 billion in

equity. We immediately wrote down most of the bad

or impaired assets (approximately $31 billion), proper-

ly reserved for the remaining assets, and established

reserves for severance and close-down costs. After

recognizing all of these costs, we believe that we now

have a relatively “clean” company that came with

approximately $4 billion in “good” common equity.

Our due diligence on WaMu’s assets was extensive,

and our assumptions were conservative. We assumed

that home prices would go down another 10% (from

the day we closed), providing a healthy margin for

error. However, if home prices go down more than

expected, say 20%, all other things being equal, this

could cost us $5 billion-$10 billion more. Even under

these circumstances, we think the transaction will

remain a great deal, at a great price for our sharehold-

ers. We are confident that it will add enormous value

to JPMorgan Chase in the future.

Given our conservative nature, we sold $11.5 billion in

common stock the morning after the deal announcement

to maintain our strong capital base. The capital raise –

upsized due to strong response from investors – was the

largest U.S. common stock follow-on offering ever exe-

cuted. In addition, WaMu’s retail deposits contributed

to our stable funding base and liquidity position.

In prior years, we consistently expressed our desire to

broaden our retail footprint to attractive regions such

as the West Coast and Florida – as long as the plan

made good sense financially and we could execute the

transaction effectively. The WaMu transaction aligned

perfectly with this criteria. Specifically, it expands our

retail franchise into fast-growing new markets with

established branches; bolsters our presence in our

significant footprint states; and, over time, will allow

us to extend the reach of our commercial banking,

business banking, credit card and wealth management

efforts. These additional businesses were not heritage

strengths of WaMu but, in effect, can be built on top

of the WaMu branches and we hope eventually will

add another $500 million to our earnings (this will

take many years and was not built into our original

assumptions). An expanded product line, together

with enhanced systems, will benefit former WaMu

customers tremendously.