Incredimail 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Incredimail annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The market for wallpapers, screensavers and photograph management tools is highly competitive, and if we cannot compete effectively,

we may not be able to generate revenues or achieve significant market share.

Our product is a desktop enhancer and offers brand-

new graphically enriched ways to view and enjoy personal photos. Our PhotoJoy

product focuses on further enhancing the capability for enjoying personal photos. These products that were first introduced in 2006, and

subsequently enhanced in 2008, currently compete in the market for wallpapers, screensavers and PC software managing and presenting personal

photographs, aiming to offer a creative, personal and entertaining experience for PC users. Our main competitors in these areas include

Screensavers.com, Picasa by Google, and webshots©

by American Greetings Corp. (NYSE: AM). Competition with these products could

require increased investments in R&D and Marketing expenses as well as cause fewer downloads and registrations of our product.

Many of our competitors have more established brands, products and customer relationships than we do, which could inhibit our market

penetration efforts even if they may not offer a similar variety, currently free of charge, such as American Greetings Corp. (webshots©).

If we

are unable to achieve continued market penetration, we will not be able to compete effectively.

In addition, many of our other current and potential competitors have significantly greater financial, research and development and sales

and marketing resources than we have. These competitors could use their greater financial resources to acquire other companies to gain enhanced

name recognition and market share, as well as to develop new technologies, products or features that could effectively compete with our product.

Demand for our products could be diminished by equivalent or superior products and technologies offered by competitors. See “

Item 4.B

Business Overview — Competition” for additional discussion of our competitive market.

We may use a substantial portion of our invested resources to acquire an unspecified business. These acquisitions could divert our

resources, cause dilution to our shareholders and adversely affect our financial results.

We may use a portion of our invested resources to acquire complementary products, technologies or businesses. In December 2006, we

acquired the assets of a transaction processing company called BizChord Consulting Corporation and, although a relatively small acquisition, in

December 2008, we decided to terminate BizChord’s independent activities and restrict its activity to processing the Company’

s own

transactions. As a result, since the acquisition, we have written off our entire investment. Prior to such acquisition our management had no

experience making acquisitions or integrating acquired businesses. Negotiating potential acquisitions or integrating newly-

acquired products,

technologies or businesses could divert our management’s attention from other business concerns and could be expensive and time-

consuming.

Acquisitions could expose our business to unforeseen liabilities or risks associated with the business or assets acquired or with entering new

markets. In addition, we might lose key employees while integrating new organizations. Consequently, we might not effectively integrate any

acquired products, technologies or businesses, and might not achieve anticipated revenues or cost benefits. In addition, future acquisitions could

result in customer dissatisfaction, performance problems with an acquired product, technology or company, or issuances of equity securities that

cause dilution to our existing shareholders. Furthermore, we may incur contingent liability or possible impairment charges related to goodwill or

other intangible assets or other unanticipated events or circumstances relating to the acquisition, and we may not have, or may not be able to

enforce, adequate remedies in order to protect our Company. If any of these or similar risks relating to acquiring products, technologies or

businesses should occur in the future on a scale that is larger than the effect of the acquisition described above, our business could be materially

harmed.

Our investment portfolio may be impaired by disruptions in the financial and credit markets.

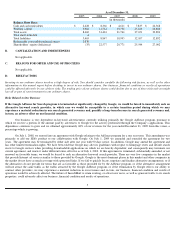

Our investment portfolio currently consists of securities of US government agencies as well as corporate debt securities, which the

Company classified at December 31, 2009 as "available-for-

sale" marketable securities or cash equivalents. As of December 31, 2009, we hold

approximately $6 million in corporate debt securities and $7 million in securities of US government agencies.

Due to significant disruptions in the financial and credit markets in the past, corporate debt securities in our portfolio could be subject to

a possible increased risk of default due to bankruptcy, lack of liquidity, operational failure or other factors affecting the issuers of those

securities. In addition, securities in our portfolio are subject to other risks, such as credit, liquidity, market and interest rate risks, which may be

exacerbated by the recent market disruptions. We may be required to adjust the carrying value of our investment securities due to a default, lack

of liquidity or other event.

9