Hyundai 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

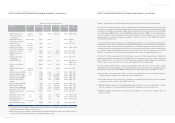

Hyundai Motor Company Annual Report 2004_86

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

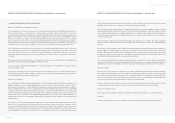

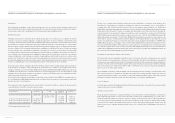

Trading securities and available-for-sale securities in short-term investment securities are stated at fair value with the resulting net gain

on valuation of trading securities amounting to 913 million (US$875 thousand) recognized in current operations, and the differences

between the acquisition costs and fair value of available-for-sale securities owned directly by the Company and the Company’s

ownership portion of such difference that occurred in the available-for-sale securities owned by its subsidiaries are recorded in capital

adjustments (see Note 16).

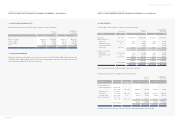

Short-term investment securities as of December 31, 2003 consist of the following:

Trading securities and available-for-sale securities in short-term investment securities are stated at fair value with the resulting net loss

on valuation of trading securities amounting to 28,534 million (US$23,822 thousand) recognized in current operations, and the

differences between the acquisition costs and fair value of available-for-sale securities owned directly by the Company and the

Company’s ownership portion of such difference that occurred in the available-for-sale securities owned by its subsidiaries are

recorded in capital adjustments (see Note 16).

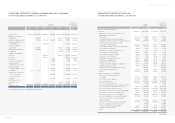

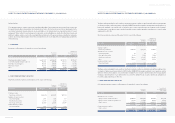

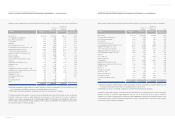

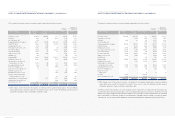

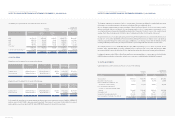

5. LONG-TERM INVESTMENT SECURITIES:

(1) Long-term investment securities as of December 31, 2004 and 2003 consist of the following:

Description Acquisition Book value Book value

cost

Trading securities

Beneficiary certificates 55,168 26,634 $25,516

Available-for-sale securities

Government bonds 58 58 56

Asset backed securities 11,993 11,993 11,490

Beneficiary certificates 158,666 212,147 203,245

Other 136,521 136,521 130,792

Held-to-maturity securities

Government bonds 6,445 6,445 6,174

368,851 393,798 $377,273

Korean won

(in millions)

Translation into

U.S. dollars (Note 2)

(in thousands)

Description 2004 2003 2004 2003

Available-for-sale securities

Equity securities stated at fair value 558,802 512,589 $535,353 $491,080

Equity securities stated at acquisition cost 192,608 173,243 184,526 165,973

Debt securities 2,120,040 1,704,053 2,031,079 1,632,547

2,871,450 2,389,885 2,750,958 2,289,600

Held-to-maturity securities

Debt securities 13,301 81,270 12,743 77,860

2,884,751 2,471,155 $2,763,701 $2,367,460

Korean won

(in millions)

Translation into

U. S. dollars (Note 2)

(in thousands)

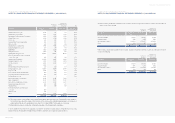

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

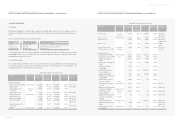

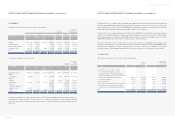

Reclassifications

For comparative purposes, certain accounts in the consolidated subsidiaries’ financial statements were reclassified to conform to the

Company’s financial statement presentation. Such reclassifications had no effect on the net income or the net equity reported in the

consolidated subsidiaries’ financial statements. Assets and liabilities in the financial industry are classified by method of current

arrangement. When method of current arrangement is impossible, assets and liabilities are classified to other financial assets and

liabilities. In addition, certain accounts in the consolidated financial statements of the prior period were reclassified for comparative

purposes. Such reclassifications had no effect on the consolidated net income or net equity in the accompanying financial statements

of the prior period.

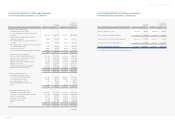

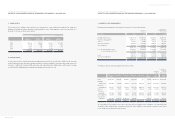

3. INVENTORIES:

Inventories as of December 31, 2004 and 2003 consist of the following:

Accounts 2004 2003 2004 2003

Finished goods and merchandise 4,297,037 2,844,499 $4,116,725 $2,725,137

Semi finished goods and work in process 794,303 829,780 760,972 794,961

Raw materials and supplies 866,274 650,427 829,923 623,134

Materials in transit 976,921 1,155,321 935,928 1,106,841

Other 6,007 18,502 5,755 17,726

6,940,542 5,498,529 $6,649,303 $5,267,799

Korean won

(in millions)

Translation into

U. S. dollars (Note 2)

(in thousands)

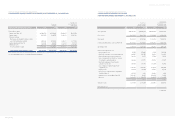

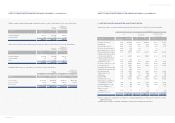

4. SHORT-TERM INVESTMENT SECURITIES:

Short-term investment securities as of December 31, 2004 consist of the following:

Description Acquisition Book value Book value

cost

Trading securities

Beneficiary certificates 240,396 241,309 $231,183

Available-for-sale securities

Government bonds 1,009 1,009 967

Asset backed securities 11,167 4,667 4,471

Beneficiary certificates 222,057 222,726 213,380

Held-to-maturity securities

Government bonds 1,507 1,507 1,444

476,136 471,218 $451,445

Korean won

(in millions)

Translation into

U.S. dollars (Note 2)

(in thousands)