Hyundai 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2004_80

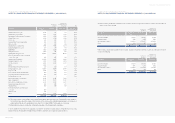

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

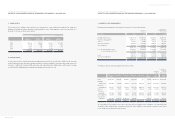

If the realizable value subsequently recovers, in case of a security stated at fair value, the increase in value is recorded in current

operations, up to the amount of the previously recognized impairment loss, while for the security stated at amortized cost or acquisition

cost, the increase in value is recorded in current operation, so that its recovered value does not exceed what its amortized cost would

be as of the recovery date if there had been no impairment loss.

When transfers of securities between categories are needed because of changes in an entity’s intention and ability to hold those

securities, such transfer is accounted for as follows: trading securities cannot be reclassified into available-for-sale and held-to-

maturity securities, and vice versa, except when certain trading securities lose their marketability. Available-for-sale securities and

held-to-maturity securities can be reclassified into each other after fair value recognition. When held-to-maturity security is reclassified

into available-for-sale security, the difference between the book value and fair value is reported in capital adjustments. Whereas, in

case available-for-sale security is reclassified into held-to-maturity securities, the difference is reported in capital adjustments and

amortized over the remaining term of the securities using the effective interest method.

Investment Securities Accounted for Using the Equity Method

Equity securities held for investment in companies in which the Company is able to exercise significant influence over the operating

and financial policies of the investees are accounted for using the equity method. The Company’s share in the net income or net loss

of investees is reflected in current operations. Changes in the retained earnings, capital surplus or other capital accounts of investees

are accounted for as an adjustment to retained earnings, capital surplus or capital adjustments.

Property, Plant and Equipment and Related Depreciation

Property, plant and equipment are recorded at cost, except for assets revalued upward in accordance with the Asset Revaluation Law

of Korea. Routine maintenance and repairs are expensed as incurred. Expenditures that result in the enhancement of the value or

extension of the useful lives of the facilities involved are treated as additions to property, plant and equipment.

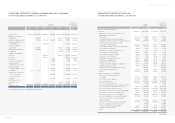

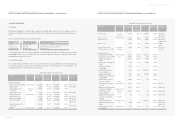

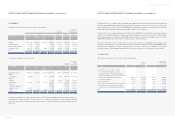

Depreciation is computed using the straight-line method based on the estimated useful lives of the assets as follows:

Useful lives (years)

Buildings and structures 2 – 60

Machinery and equipment 2 – 20

Vehicles 2 – 10

Tools, dies and molds 2 – 10

Other equipment 2 – 10

The Company assesses any possible recognition of impairment loss when there is an indication that expected future economic

benefits of a tangible asset is considerably less than its carrying amount, as a result of technological obsolescence, rapid declines in

market value or other causes of impairment. When it is determined that an asset may have been impaired and that its estimated total

future cash flows from continued use or disposal is less than its carrying amount, the carrying amount of a tangible asset is reduced

to its recoverable amount and the difference is recognized as an impairment loss. If the recoverable amount of the impaired asset

exceeds its carrying amount in subsequent reporting period, the amount equal to the excess is treated as the reversal of the impairment

loss; however, it cannot exceed the carrying amount that would have been determined had no impairment loss been recognized.

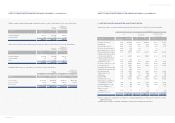

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

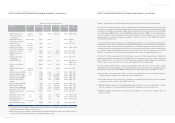

Investment Securities Other Than Those Accounted for Using the Equity Method

Classification of Securities

At acquisition, the Company classifies securities into one of the three categories; trading, held-to-maturity or available-for-sale. Trading

securities are those that were acquired principally to generate profits from short-term fluctuations in prices. Held-to-maturity securities

are those with fixed or determinable payments and fixed maturity that the Company has the positive intent and ability to hold to maturity.

Available-for-sale securities are those not classified as either held-to-maturity or trading securities. Trading securities are classified as

short-term investment securities, whereas available-for-sale and held-to-maturity securities are classified as long-term investment

securities, except for those whose maturity dates or whose likelihood of being disposed of are within one year from balance sheet date,

which are classified as short-term investment securities.

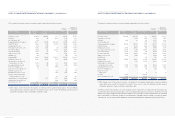

Valuation of Securities

Securities are recognized initially at cost, which includes the market price of the consideration given to acquire them and incidental

expenses. If the market price of the consideration is not reliably determinable, the market prices of the securities purchased are used

as the basis for measurement. If neither the market prices of the consideration given nor those of the acquired securities are available,

the acquisition cost is measured at the best estimates of its fair value.

After initial recognition, held-to-maturity securities are stated at amortized cost. The difference between their acquisition costs and face

values of held-to-maturity securities is amortized over the remaining term of the securities by applying the effective interest method and

added to or subtracted from the acquisition costs and interest income of the remaining period. Trading securities are valued at fair

value, with unrealized gains or losses included in current operations. Available-for-sales securities are also valued at fair value, with

unrealized gains or losses included in capital adjustments, until the securities are sold and if the securities are determined to be

impaired, the lump-sum cumulative amount of capital adjustments are included in current operations. However, available-for-sales

securities that are not traded in an active market and whose fair values cannot be reliably estimated are accounted for at their

acquisition costs. For those securities that are traded in an active market, fair values refer to those quoted market prices, which are

measured as the closing price at the balance sheet date. The fair value of non-marketable debt securities are measured at the

discounted future cash flows by using the discount rate that appropriately reflects the credit rating of issuing entity assessed by a

publicly reliable independent credit rating agency. If application of such measurement method is not feasible, estimates of the fair

values may be made using a reasonable valuation model or quoted market prices of similar debt securities issued by entities

conducting similar business in similar industries.

Securities are evaluated at each balance sheet date to determine whether there is any objective evidence of impairment loss. When

any such evidence exists, unless there is a clear counter-evidence that recognition of impairment is unnecessary, the Company

estimates the recoverable amount of the impaired security and recognizes any impairment loss in current operations. The amount of

impairment loss of the held-to-maturity security or non-marketable equity security is measured as the difference between the

recoverable amount and the carrying amount. The recoverable amount of held-to maturity security is the present value of expected

future cash flows discounted at the securities' original effective interest rate. For available-for-sale debt or equity security stated at fair

value, the amount of impairment loss to be recognized in the current period is determined by subtracting the amount of impairment

loss of debt or equity security already recognized in prior period from the amount of amortized cost in excess of the recoverable amount

for debt security or the amount of the acquisition cost in excess of the fair value for equity security. For non-marketable equity securities

accounted for at acquisition costs, the impairment loss is equal to the difference between the recoverable amount and the carrying

amount.