Hyundai 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2004_84

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

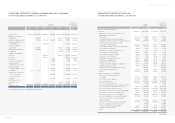

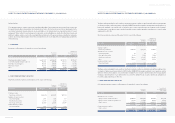

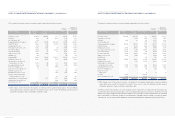

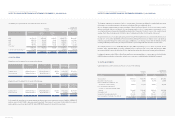

The gain or loss on valuation of these derivatives related to the fair value of KIA shares is recognized in current operations. As of

December 31, 2004, all premiums to be paid by the Company are recorded as accounts payable – other in current liabilities of

24,168 million (US$ 23,154 thousand) and long-term other accounts payable in long-term liabilities of 60,492 million

(US$57,954 thousand), after deducting the present value discount of 11,891 million (US$11,392 thousand) and the present value

of all premiums on the effective date of contracts is recorded as deferred derivative assets in other assets. Also, as of December 31,

2004, all premiums to be received by the Company are recorded as accounts receivable-other in current assets of 3,962 million

(US$3,796 thousand) and long-term other accounts receivable in non-current assets of 9,771 million (US$9,361 thousand), after

deducting the present value discount of 2,115 million (US$2,026 thousand) and the present value of such premiums on the

effective date of contract is recorded as deferred derivatives liabilities in other long-term liabilities. As of December 31, 2003, all

premiums to be paid by the Company are recorded as long-term other accounts payable in long-term liabilities of 89,864 million

(US$86,093 thousand) and accounts payable – other of 27,706 million (US$ 26,543 thousand), after deducting the present value

discount of 20,959 million (US$20,080 thousand). Also, as of December 31, 2003, all premiums to be received by the Company

are recorded as long-term other accounts receivable of 14,745 million (US$14,126 thousand) and accounts receivable-other of

4,547 million (US$4,356 thousand), after deducting the present value discount of 3,441 million (US$3,297 thousand). The

present value discount is amortized using the effective interest method.

Accounting for Foreign Currency Transaction and Translation

The Company and its domestic subsidiaries maintain their accounts in Korean won. Transactions in foreign currencies are recorded

in Korean won based on the prevailing rates of exchange on the transaction dates. Monetary accounts with balances denominated in

foreign currencies are recorded and reported in the accompanying financial statements at the exchange rates prevailing at the balance

sheet dates. The balances have been translated using the market average exchange rate announced by Seoul Money Brokerage

Services, Ltd., which was 1,043.80 and 1,197.80 to US$1.00 at December 31, 2004 and 2003, respectively, and translation

gains or losses are reflected in current operations.

Assets and liabilities of subsidiaries outside the Republic of Korea are translated at the rate of exchange in effect at the balance sheet

dates; income and expenses of subsidiaries are translated at the average rates of exchange prevailing during the year, which was

1,146.14 and 1,191.60 to US$1.00 in 2004 and 2003, respectively. Cumulative translation debits or credits, which occurred in

the translations of financial statements of foreign subsidiaries and branches, are recorded as capital adjustments.

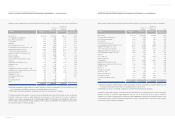

Income Tax Expense

Income tax expense is determined by adding or deducting the total income tax and surtaxes to be paid for the current period and the

changes in deferred income tax assets (liabilities).

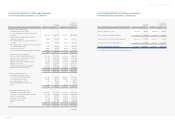

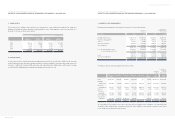

Earnings per Common Share

Primary earnings per common share is computed by dividing net income, after deduction for expected dividends on preferred stock,

by the weighted average number of common shares. The number of shares used in computing earnings per common share is

217,655,607 and 218,173,808 in 2004 and 2003, respectively. Earnings per diluted common share is computed by dividing net

income, after deduction for expected dividends on preferred stock and addition for the effect of expenses related to dilutive securities

on net income, by the number of the weighted average number of common shares plus the dilutive potential common shares. The

number of shares used in computing earnings per diluted common share is 218,223,739 and 218,859,929 in 2004 and 2003,

respectively.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

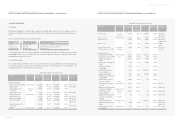

Stock Options

The Company and its subsidiaries compute total compensation expense to stock options, which are granted to employees and

directors, by the fair value method using the option-pricing model. The compensation expense has been accounted for as a charge to

current operations and a credit to capital adjustments from the grant date using the straight-line method.

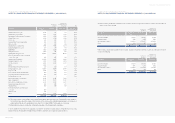

Derivative Instruments

All derivative instruments are accounted for at fair value with the valuation gain or loss recorded as an asset or liability. If the derivative

instrument is not part of a transaction qualifying as a hedge, the adjustment to fair value is reflected in current operations. The

accounting for derivative transactions that are part of a qualified hedge based both on the purpose of the transaction and on meeting

the specified criteria for hedge accounting differs depending on whether the transaction is a fair value hedge or a cash flow hedge.

Fair value hedge accounting is applied to a derivative instrument designated as hedging the exposure to changes in the fair value of

an asset or a liability or a firm commitment (hedged item) that is attributable to a particular risk. The gain or loss both on the hedging

derivative instruments and on the hedged item attributable to the hedged risk is reflected in current operations. Cash flow hedge

accounting is applied to a derivative instrument designated as hedging the exposure to variability in expected future cash flows of an

asset or a liability or a forecast transaction that is attributable to a particular risk. The effective portion of gain or loss on a derivative

instrument designated as a cash flow hedge is recorded as a capital adjustment and the ineffective portion is recorded in current

operations. The effective portion of gain or loss recorded as a capital adjustment is reclassified to current earnings in the same period

during which the hedged forecasted transaction affects earnings. If the hedged transaction results in the acquisition of an asset or the

incurrence of a liability, the gain or loss in capital adjustment is added to or deducted from the asset or the liability.

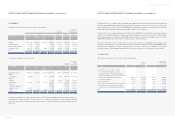

The Company and its domestic subsidiaries entered into derivative instrument contracts including forwards, options and swaps to

hedge the exposure to changes in foreign exchange rate. As of December 31, 2004 and 2003, the Company and its domestic

subsidiaries deferred the loss of 17,051 million (US$16,335 thousand) and 83,863 million (US$80,344 thousand), respectively,

on valuation of the effective portion of derivative instruments for cash flow hedging purposes from forecasted exports as capital

adjustments. The Company and its subsidiaries recognized loss on valuation of the ineffective portion of such derivative instruments

and the other derivative instruments in current operations.

In 2004 and 2003, the Company and its subsidiaries recognized the net gain of 79,037 million (US$75,720 thousand) and the net

loss of 39,548 million (US$37,888thousand), respectively, on valuation of the ineffective portion of such instruments and the other

derivative instruments in current operations.

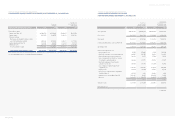

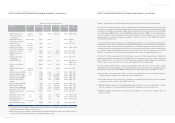

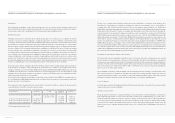

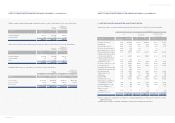

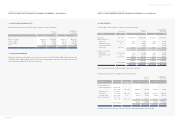

The Company entered into derivative instrument contracts with the settlement for the difference between the fair value and the

contracted initial price of Kia Motors Corporation shares as follows:

(*) The Company has the position of seller.

Contract Parties Derivatives Period Number of Initial Price

Kia shares

Credit Suisse First Boston International Equity swap September 17, 2003 ~

September 8, 2008 12,145,598 US$8.2611

Credit Suisse First Boston International Call option (*) " 12,145,598 US$11.5300

Credit Suisse First Boston International Equity swap " 21,862,076 US$8.2611

JP Morgan Chase Bank, London Branch Equity swap " 14,574,717 US$7.8811