Huntington National Bank 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

h

t Thin

g

Teamwork Do the Ri

g

ht Thin

g

Accountabilit

y

C

ommunication

C

o

n

s

Improvement In

c

l

us

i

on

P

ass

i

o

n

Se

rvi

ce

T

ea

mw

o

rk Accountabilit

y

Do t

h

i

n

g

Inclusion Passion

S

ervice Do the Right Thing Teamwork

C

ommunicat

i

g

ht Thin

g

Co

mm

u

ni

cat

i

on

C

ontinuous Improvement In

c

l

usio

n P

ass

i

o

n

Se

r

v

o

untabilit

y

Do the Ri

g

ht Thin

g

Accountabilit

y

C

ommunication

C

ontinuous

m

munication

C

ontinuous Improvement

D

o t

h

e

R

i

gh

t

Th

in

g

I

nc

l

usion

P

assi

o

Passion

S

ervice Teamwork Accountabilit

y

C

ommunication

C

ontinuous

t

abilit

y

Do the Ri

g

ht Thin

g

C

ommunication Continuous Improvement In

c

l

u

e

ment In

c

l

usion

Passion Service Teamwork Accountability Do the Right

T

Accountability Do the Right Thing

C

ommunication

C

ontinuous Improvem

e

m

unication Continuous Improvement Inclusion Passion

Se

rvi

ce

T

ea

mw

o

rk

c

lusion Passion

S

ervice Teamwork

A

ccountabilit

y

D

o t

h

e

R

ig

h

t

Th

ing

k

A

ccountab

i

l

i

t

y

Do the Right Thing Communication

C

ontinuous Improve

m

o

the Right Thing

C

ommunication Continuous Improvement Inclusion Pass

m

unication Continuous Improvement

I

n

c

l

us

i

o

n Passion Do the Ri

g

ht Thin

g

Accountab

i

l

i

t

y

Do the Right Thing Accountability

C

ommunication

C

onti

n

g

Teamwork Communication

C

ontinuous Improvement Passion Service

o

vement Inclusion P

assion

Service Teamwork Accountability

D

o the R

ig

h

bility

Co

mm

u

ni

cat

i

on

Continuous Improvement Do the Right Thing In

c

l

usio

h

e R

i

ght Th

i

ng Inclusion Passion Service

C

ommunicatio

n

Continuous

n

tabilit

y

C

ommunication Continuous Im

p

rovement Inclusion Do the Ri

g

ht

i

cation Continuous Improvement Inclusion Passion Service

Teamwork

k

rvice T

ea

mw

o

r

k

Accountability Do the Right Thing

k

Co

mm

u

ni

cat

i

o

n

C

onti

h

t Thin

g

Communication Continuous Im

p

rovemen

t

In

c

l

us

i

o

n P

ass

i

o

n

Se

rv

o

vement

I

n

c

l

us

i

on

P

ass

i

o

n

Se

rvi

ce

T

ea

mw

o

rk Accountabilit

y

Do the Ri

gh

Accountability Do the R

i

ght Th

i

ng

C

ommunication

C

ontinuous Improvem

e

u

ntabilit

y

C

ommunication

C

ontinuous Improvement Do the Ri

g

ht Thin

g

In

cl

t

ion

C

ontinuous Improvemen

t

Inclusion Passion

S

ervice Do the Right Thi

n

o

vement Inclusion Passion Do the Ri

g

ht Thin

g

C

ommunication

C

ontinuous

h

t Thin

g

Accountabilit

y

C

ommunication

C

ontinuous Improvement Do the

R

n

C

ontinuous Improvement Passion

S

ervice Teamwork

A

ccountability D

o

ce

T

ea

mw

o

rk Accountab

i

l

i

t

y

Do the Ri

g

ht Thin

g

Passion

Se

rvi

ce

T

ea

mw

o

m

provement Do the R

i

ght Th

i

ng Inclusion Passion

S

ervice Accountab

i

l

i

ty

S

ervice

C

ommunication

C

ontinuous Improvement Inclus

i

o

n

Do the Ri

g

ht

e

ment

I

nclus

i

on Do the Right Thing Passion Service Teamwork

A

ccount

a

Se

rvi

ce

T

ea

mw

o

rk Accountab

i

l

i

t

y

Co

mm

u

ni

cat

i

o

n

C

ontinuous Im

p

rove

m

Welcome

2015 Annual Report

Table of contents

-

Page 1

... Teamwork clusion Passion Service Teamwork Accountability Do the Right Thing k Accountability Do the Right Thing Communication Continuous Improvem o the Right Thing Communication Continuous Improvement Inclusion Pass 2015 Annual Passion Report Do the Right Thing munication Continuous Improvement... -

Page 2

... bank holding company headquartered in Columbus, Ohio, with a network of more than 750 branches and more than 1,500 ATMs across six Midwestern states. Founded in 1866, The Huntington National Bank and its affiliates provide consumer, small business, commercial, treasury management, wealth management... -

Page 3

... third consecutive year of share price outperformance. We continued to deliver on our commitment to be good stewards of shareowners' capital, executing our strategies and driving strong results within our aggregate moderate-to-low risk appetite. Looking ahead to 2016, The Huntington National Bank is... -

Page 4

...our mobile app, our online banking through Huntington.com, and our image-enabled teller platform and ATMs. Customers can also choose a more personal touch by visiting one of our more than 750 fullservice branches, some of which are open 7 days a week, in addition to our wealth and investment offices... -

Page 5

... Commercial Real Estate (CRE) portfolio over the past five years, the portfolio posted modest, disciplined growth in 2015. On the consumer side, our Fair Play philosophy and consumer-friendly products distinguish us from our banking competition. Our significant systems investment in our home lending... -

Page 6

... core focus on small and middle market enterprises. We also refocused on the core by exiting businesses that we no longer viewed as core to the strategy and the franchise. At the end of the year, we sold our mutual funds servicing and advisory businesses: Huntington Asset Services, Unified Financial... -

Page 7

... differentiate Huntington in the marketplace by demonstrating what we stand for - doing the right thing for our shareowners, customers, colleagues, and communities. We will continue to deliver good financial results, we will maintain our risk disciplines, and we will drive increased shareowner value... -

Page 8

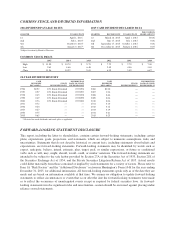

... 2012 2013 2014 2015 $1.00 1.06 0.66 0.04 0.04 0.10 0.16 0.19 0.21 0.25 Restated for stock dividends and stock splits as applicable. FORWARD-LOOKING STATEMENT DISCLOSURE This report, including the letter to shareholders, contains certain forward-looking statements, including certain plans... -

Page 9

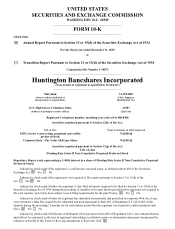

... No file such reports), and (2) has been subject to such filing requirements for the past 90 days. Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule... -

Page 10

... by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2015, determined by using a per share closing price of $11.31, as quoted by... -

Page 11

...Related Shareholder Matters and Issuer Purchases of Equity Securities Selected Financial Data Management's Discussion and Analysis of Financial Condition and Results of Operations Introduction Executive Overview Discussion of Results of Operations Risk Management and Capital: Credit Risk Market Risk... -

Page 12

... Owners and Management and Related Stockholder Matters Equity Compensation Plan Information Item 13. Certain Relationships and Related Transactions, and Director Independence Item 14. Principal Accountant Fees and Services Part IV. Item 15. Exhibits and Financial Statement Schedules Signatures 193... -

Page 13

... ATM AULC Basel III Asset Based Lending Asset-Backed Securities Allowance for Credit Losses Automobile Finance and Commercial Real Estate Available-for-Sale Asset-Liability Management Committee Allowance for Loan and Lease Losses Adjustable Rate Mortgage Accounting Standards Codification Accounting... -

Page 14

...loans (credit quality indicators section of Footnote 3). Regional Banking and The Huntington Private Client Group Real Estate Investment Trust Risk Oversight Committee Risk-Weighted Assets Special Assets Division Small Business Administration Securities and Exchange Commission Supplemental Executive... -

Page 15

UPB USDA VA VIE XBRL Unpaid Principal Balance U.S. Department of Agriculture U.S. Department of Veteran Affairs Variable Interest Entity eXtensible Business Reporting Language 7 -

Page 16

... loans. Other financial services available to consumer and small business customers include investments, insurance, interest rate risk protection, foreign exchange, and treasury management. Huntington serves customers primarily through our network of branches in Ohio, Michigan, Pennsylvania, Indiana... -

Page 17

..., foreign exchange, and interest rate hedging services. The Institutional Sales, Trading & Underwriting team provides access to capital and investment solutions for both municipal and corporate institutions. Treasury Management teams help businesses manage their working capital programs and reduce... -

Page 18

... financial services company headquartered in Akron, Ohio, which reported assets of approximately $25.5 billion based on their December 31, 2015 unaudited balance sheet, and 366 banking offices and 400 ATM locations in Ohio, Michigan, Wisconsin, Illinois, and Pennsylvania. First Merit Corporation... -

Page 19

... as our 24-Hour Grace® account feature, which gives customers an additional business day to cover overdrafts to their consumer account without being charged overdraft fees. The table below shows our competitive ranking and market share based on deposits of FDIC-insured institutions as of June 30... -

Page 20

..., the Bank is subject to deposit insurance assessments payable to the Deposit Insurance Fund and various FDIC requirements. The National Bank Act and the OCC regulations primarily govern the Bank's permissible activities, capital requirements, branching, dividend limitations, investments, loans, and... -

Page 21

...The Huntington National Bank, conduct annual stress tests for submission beginning in January 2015. The results of the stress tests will provide the OCC with forward-looking information that will be used in bank supervision and will assist the agency in assessing a company's risk profile and capital... -

Page 22

... bank holding companies. Under the guidelines and related policies, bank holding companies must maintain capital sufficient to meet both a risk-based asset ratio test and a leverage ratio test on a consolidated basis. The risk-based ratio is determined by allocating assets and specified off-balance... -

Page 23

..., and the FDIC specify that evaluations by the banking agencies of a bank's capital adequacy will include an assessment of the exposure to declines in the economic value of a bank's capital due to changes in interest rates. These banking agencies issued a joint policy statement on interest rate risk... -

Page 24

... order, agreement, or directive to meet and maintain a specific capital level for any capital measure. At December 31, 2015 (dollar amounts in billions) Wellcapitalized minimums Actual Excess Capital (1) Ratios: Tier 1 leverage ratio Common equity tier 1 risk-based capital ratio Tier 1 risk-based... -

Page 25

... an orderly manner that enables prompt access of insured deposits; maximizes the return from the failed institution's assets; and minimizes losses realized by creditors and the Deposit Insurance Fund. We filed our resolution plans pursuant to each rule in December 2015. As a bank holding company, we... -

Page 26

... insured depository institutions, broker-dealers, and certain other financial institutions to have policies, procedures, and controls to detect, prevent, and report money laundering and terrorist financing. Federal banking regulators are required, when reviewing bank holding company acquisition... -

Page 27

... from the Company, a portion of net shares received upon exercise of stock options or release of restricted stock awards (50% for executive officers and 25% for other award recipients), equity deferrals, recoupment provisions, and the right to terminate compensation plans at any time. Management has... -

Page 28

... to access funding sources or manage fluctuations in funding levels. Liquidity risk also results from the failure to recognize or address changes in market conditions that affect the Bank's ability to liquidate assets quickly and with minimal loss in value; • Operational and legal risk, which... -

Page 29

... regulatory capital ratios. In a rising interest rate environment, pension and other post-retirement obligations somewhat mitigate negative OCI impacts from securities and financial instruments. For more information, refer to "Market Risk" of the MD&A. Certain investment securities, notably mortgage... -

Page 30

... repurchase agreements, noncore deposits, and long-term debt. The Bank is also a member of the Federal Home Loan Bank of Cincinnati, which provides members access to funding through advances collateralized with mortgage-related assets. We maintain a portfolio of highly-rated, marketable securities... -

Page 31

... operational risks could lead to financial loss, expensive litigation, and loss of confidence by our customers, regulators, and the capital markets. Moreover, negative public opinion can result from our actual or alleged conduct in any number of activities, including clients, products and business... -

Page 32

... estimating probable loan losses, measuring the fair value of financial instruments when reliable market prices are unavailable, estimating the effects of changing interest rates and other market measures on our financial condition and results of operations, managing risk, and for capital planning... -

Page 33

... basis and reviews the strength of a bank holding company's capital adequacy process. The Federal Reserve also makes a quantitative assessment of capital based on supervisory-run stress tests that assess the ability to maintain capital levels above each minimum regulatory capital ratio and above... -

Page 34

... rating on its most recent Community Reinvestment Act examination. Item 1B: Unresolved Staff Comments None. Item 2: Properties Our headquarters, as well as the Bank's, is located in the Huntington Center, a thirty seven story office building located in Columbus, Ohio. Of the building's total office... -

Page 35

..., Ohio Warren, Ohio Toledo, Ohio Pittsburgh, Pennsylvania Charleston, West Virginia Holland, Michigan Troy, Michigan Columbus, Ohio Columbus, Ohio Cleveland, Ohio Indianapolis, Indiana Information required by this item is set forth in Note 20 of the Notes to Consolidated Financial Statements under... -

Page 36

...compensation plans, see Part III, Item 12. The following table provides information regarding Huntington's purchases of its Common Stock during the three-month period ended December 31, 2015: Maximum Number of Shares (or Approximate Dollar Value) that May Yet Be Purchased Under the Plans or Programs... -

Page 37

... January 26, 2016, Huntington announced the signing of a definitive merger agreement under which Ohio-based FirstMerit Corporation, the parent company of FirstMerit Bank, will merge into Huntington in a stock and cash transaction. The transaction is expected to be completed in the 2016 third quarter... -

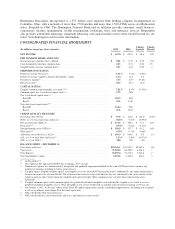

Page 38

... Net income per common share-diluted Cash dividends declared per common share Balance sheet highlights Total assets (period end) Total long-term debt (period end) Total shareholders' equity (period end) Average total assets Average total long-term debt Average total shareholders' equity Key ratios... -

Page 39

... companies may calculate these financial measures differently. (8) In accordance with applicable regulatory reporting guidance, we are not required to retrospectively update historical filings for newly adopted accounting principles. Therefore, tier 1 capital, tier 1 common equity, and risk-weighted... -

Page 40

... banking services, automobile financing, equipment leasing, investment management, trust services, brokerage services, insurance service programs, and other financial products and services. Our 777 branches and private client group offices are located in Ohio, Michigan, Pennsylvania, Indiana, West... -

Page 41

... securities portfolio to prepare for the LCR requirements, which resulted in securities gains. The decrease in trust services primarily related to our fiduciary trust businesses moving to a more open architecture platform and a decline in assets under management in proprietary mutual funds. During... -

Page 42

... financial services company headquartered in Akron, Ohio, which reported assets of approximately $25.5 billion based on their December 31, 2015 unaudited balance sheet, and 366 banking offices and 400 ATM locations in Ohio, Michigan, Wisconsin, Illinois, and Pennsylvania. First Merit Corporation... -

Page 43

... credit losses Net interest income after provision for credit losses Service charges on deposit accounts Cards and payment processing income Mortgage banking income Trust services Insurance income Brokerage income Capital markets fees Bank owned life insurance income Gain on sale of loans Securities... -

Page 44

... to the sale of HAA, HASI, and Unified. This resulted in a negative impact of $0.01 per common share in 2015. • During 2014, $16 million of net noninterest expense was recorded related to the acquisition of 24 Bank of America branches and Camco Financial. This resulted in a net negative impact... -

Page 45

.../ Rate Total Volume 2014 Increase (Decrease) From Previous Year Due To Yield/ Rate Total Loans and leases $ Investment securities Other earning assets Total interest income from earning assets Deposits Short-term borrowings Long-term debt Total interest expense of interest-bearing liabilities Net... -

Page 46

Trading account securities Held-to-maturity securities-taxable Total securities Loans and leases: (2) Commercial: Commercial and industrial Commercial real estate: Construction Commercial Commercial real estate Total commercial Consumer: Automobile loans and leases Home equity Residential mortgage ... -

Page 47

... (1) 2015 2014 2013 2015 Average Rate (2) 2014 2013 Assets Interest-bearing deposits in banks $ 90 Loans held for sale 23,812 Securities: Available-for-sale and other securities: Taxable 202,104 Tax-exempt 64,637 Total available-for-sale and other securities 266,741 Trading account securities 493... -

Page 48

... are reflected in the average balances of loans. Yield/rates and amounts include the effects of hedge and risk management activities associated with the respective asset and liability categories. 2015 vs. 2014 Fully-taxable equivalent net interest income for 2015 increased $118 million, or 6%, from... -

Page 49

...in trade finance in support of our middle market and corporate customers. $0.4 billion, or 8%, increase in average Residential mortgage loans as a result of the Camco Financial acquisition and a decrease in the rate of payoffs due to lower levels of refinancing. Average noninterest bearing deposits... -

Page 50

... Percent 2013 Service charges on deposit accounts $ 280,349 Cards and payment processing income 142,715 Mortgage banking income 111,853 Trust services 105,833 Insurance income 65,264 Brokerage income 60,205 Capital markets fees 53,616 Bank owned life insurance income 52,400 Gain on sale of loans 33... -

Page 51

...) Year Ended December 31, Change from 2014 2015 Personnel costs Outside data processing and other services Equipment Net occupancy Marketing Professional services Deposit and other insurance expense Amortization of intangibles Other expense Total noninterest expense Number of employees (average... -

Page 52

... increase in salaries related to the 2015 second quarter implementation of annual merit increases, the addition of Huntington Technology Finance, and a 3% increase in the number of average full-time equivalent employees, largely related to the build-out of the in-store strategy. $26 million, or... -

Page 53

...have credit risk associated with our AFS and HTM securities portfolios (see Note 4 and Note 5 of the Notes to Consolidated Financial Statements). We engage with other financial counterparties for a variety of purposes including investing, asset and liability management, mortgage banking, and trading... -

Page 54

... loans to real estate companies with significant equity invested in each project. These loans are underwritten and managed by a specialized real estate lending group that actively monitors the construction phase and manages the loan disbursements according to the predetermined construction schedule... -

Page 55

... - Loan and Lease Portfolio Composition (dollar amounts in millions) At December 31, 2015 2014 2013 2012 2011 Commercial: (1) Commercial and industrial Commercial real estate: Construction Commercial Total commercial real estate Total commercial Consumer: Automobile Home equity Residential mortgage... -

Page 56

... of Huntington Technology Finance. The increase in the unsecured exposure is centered in high quality commercial credit customers. Table 9 - Loan and Lease Portfolio by Collateral Type (dollar amounts in millions) At December 31, 2015 2014 2013 2012 2011 Secured loans: Real estate-commercial Real... -

Page 57

...Financial Statements) are managed by our Special Assets Division. SAD is a specialized group of credit professionals that handle the day-to-day management of workouts, commercial recoveries, and problem loan sales. Its responsibilities include developing and implementing action plans, assessing risk... -

Page 58

... our high credit quality standards while expanding the portfolio. RESIDENTIAL REAL ESTATE SECURED PORTFOLIOS The properties securing our residential mortgage and home equity portfolios are primarily located within our geographic footprint. Huntington continues to support our local markets with... -

Page 59

...mortgage loans with underwriting criteria based on minimum credit scores, debt-to-income ratios, and LTV ratios. We offer closed-end home equity loans which are generally fixed-rate with principal and interest payments, and variable-rate interest-only home equity lines-of-credit which do not require... -

Page 60

... Assets (dollar amounts in thousands) At December 31, 2015 2014 2013 2012 2011 Nonaccrual loans and leases: Commercial and industrial Commercial real estate Automobile Residential mortgages Home equity Other Consumer Total nonaccrual loans and leases Other real estate owned, net Residential... -

Page 61

... for each of the last five years: Table 12 - Accruing Past Due Loans and Leases (dollar amounts in thousands) At December 31, 2015 2014 2013 2012 2011 Accruing loans and leases past due 90 days or more Commercial and industrial (1) Commercial real estate (2) Automobile $ 8,724 9,549 7,162 14,082... -

Page 62

... - Accruing and Nonaccruing Troubled Debt Restructured Loans (dollar amounts in thousands) At December 31, 2015 2014 2013 2012 2011 Troubled debt restructured loans-accruing: Commercial and industrial Commercial real estate Automobile Home equity Residential mortgage Other consumer Total troubled... -

Page 63

...million of home equity TDRs from loans to loans held for sale in anticipation of a sale. The following table reflects TDR activity for each of the past five years: Table 14 - Troubled Debt Restructured Loan Activity (dollar amounts in thousands) Year Ended December 31, 2015 2014 2013 2012 2011 TDRs... -

Page 64

... Commercial business verticals such as healthcare, ABL, and energy. A provision for credit losses is recorded to adjust the ACL to the level we have determined to be appropriate to absorb credit losses inherent in our loan and lease portfolio as of the balance sheet date. Our ACL evaluation process... -

Page 65

... 31, 2015 2014 2013 2012 2011 Allowance for loan and lease losses, beginning of year $ Loan and lease charge-offs Commercial: Commercial and industrial Commercial real estate: Construction Commercial Commercial real estate Total commercial Consumer: Automobile Home equity Residential mortgage Other... -

Page 66

... of Allowance for Credit Losses (1) (dollar amounts in thousands) At December 31, 2015 Commercial: Commercial and industrial Commercial real estate Total commercial Consumer: Automobile Home equity Residential mortgage Other loans Total consumer Total allowance for loan and lease losses Allowance... -

Page 67

..., collateral dependent non-reaffirmed debt in Chapter 7 bankruptcy filings will result in a charge-off to estimated collateral value, less anticipated selling costs at the time of discharge. C&I and CRE loans are either charged-off or written down to net realizable value at 90-days past due with the... -

Page 68

...thousands) 2015 2014 Year Ended December 31, 2013 2012 2011 Net charge-offs by loan and lease type Commercial: Commercial and industrial Commercial real estate: Construction Commercial Total commercial real estate Total commercial Consumer: Automobile Home equity Residential mortgage Other consumer... -

Page 69

... mortgage backed securities prepayments, and changes in funding mix. INCOME SIMULATION AND ECONOMIC VALUE ANALYSIS Interest rate risk measurement is calculated and reported to the ALCO monthly and ROC at least quarterly. The information reported includes period-end results and identifies any policy... -

Page 70

... Consumer and Commercial deposit balances. MSRs (This section should be read in conjunction with Note 6 of Notes to the Consolidated Financial Statements.) At December 31, 2015, we had a total of $161 million of capitalized MSRs representing the right to service $16.2 billion in mortgage loans. Of... -

Page 71

... funding plans. Available-for-sale and other securities portfolio (This section should be read in conjunction with Note 4 of the Notes to Consolidated Financial Statements.) Our investment securities portfolio is evaluated under established asset/liability management objectives. Changing market... -

Page 72

... restricted stock holding carried at par. For 2016, the Federal Reserve reduced the dividend rate on FRB stock from 6% to the current 10-year Treasury rate for banks with more than $10 billion in assets. Consists of certain mutual fund and equity security holdings. Investment securities portfolio... -

Page 73

... of the securities with an average life of 5 years to 10 years is 5.43 years Bank Liquidity and Sources of Funding Our primary sources of funding for the Bank are retail and commercial core deposits. At December 31, 2015, these core deposits funded 73% of total assets (102% of total loans). Other... -

Page 74

...bearing Money market deposits Savings and other domestic deposits Core certificates of deposit Total core deposits: Other domestic deposits of $250,000 or more Brokered deposits and negotiable CDs Deposits in foreign offices Total deposits Total core deposits: Commercial Consumer Total core deposits... -

Page 75

... to shareholders, debt service, income taxes, operating expenses, funding of nonbank subsidiaries, repurchases of our stock, and acquisitions. The parent company obtains funding to meet obligations from dividends and interest received from the Bank, interest and dividends received from direct... -

Page 76

... filed and effective with the SEC, which permits the parent company to issue an unspecified amount of debt or equity securities. On January 26, 2016, Huntington announced the signing of a definitive merger agreement under which Ohio-based FirstMerit Corporation, the parent company of FirstMerit Bank... -

Page 77

...-party services to test the effectiveness of our cyber security risk management framework, and any such third parties are required to comply with our policies regarding information security and confidentiality. To mitigate operational risks, we have a senior management Operational Risk Committee... -

Page 78

... the Notes to Consolidated Financial Statements.) Both regulatory capital and shareholders' equity are managed at the Bank and on a consolidated basis. We have an active program for managing capital and maintain a comprehensive process for assessing the Company's overall capital adequacy. We believe... -

Page 79

... 30 - Capital Adequacy-Non-Regulatory (dollar amounts in millions) At December 31, 2015 2014 2013 2012 2011 Consolidated capital calculations: Common shareholders' equity Preferred shareholders' equity Total shareholders' equity Goodwill Other intangible assets Other intangible asset deferred tax... -

Page 80

...(dollar amounts in millions) At December 31, Basel III 2015 2014 2013 Basel I 2012 2011 Total risk-weighted assets Common equity tier 1 risk-based capital Tier 1 risk-based capital Tier 2 risk-based capital Total risk-based capital Tier 1 leverage ratio Common equity tier 1 risk-based capital ratio... -

Page 81

... Finance and Commercial Real Estate (AFCRE), Regional Banking and The Huntington Private Client Group (RBHPCG), and Home Lending. A Treasury / Other function includes technology and operations, other unallocated assets, liabilities, revenue, and expense. Business segment results are determined based... -

Page 82

... rate risk in the Treasury / Other function where it can be centrally monitored and managed. The Treasury / Other function charges (credits) an internal cost of funds for assets held in (or pays for funding provided by) each business segment. The FTP rate is based on prevailing market interest rates... -

Page 83

... revenue in 2015 was $1.1 billion, up $106 million, or 10%, from 2014. COMMERCIAL OCR PERFORMANCE For commercial OCR performance, there are three key performance metrics: (1) the number of checking account commercial relationships, (2) product penetration by number of services, and (3) the revenue... -

Page 84

... share of wallet. The percent of commercial relationships with 4 or more product services at the end of 2015 was 44.3%, up from 41.9% at the end of last year. Total commercial relationship revenue in 2015 was $890 million, up $39 million, or 5%, from 2014. Retail and Business Banking Table 35 - Key... -

Page 85

... branch and the Camco acquisitions. $7 million, or 16%, increase in outside data processing and other services expense, mainly the result of transaction volumes associated with debit and credit card activity. $4 million, or 8%, increase in marketing, primarily due to direct mail campaigns in 2015... -

Page 86

...equipment and technology finance related fee income, primarily reflecting the 2015 first quarter acquisition of Huntington Technology Finance. $6 million, or 11%, increase in service charges on deposit accounts and other treasury management related revenue, primarily due to growth in commercial card... -

Page 87

Automobile Finance and Commercial Real Estate Table 37 - Key Performance Indicators for Automobile Finance and Commercial Real Estate (dollar amounts in thousands unless otherwise noted) Year ended December 31, 2015 2014 Change from 2014 Amount Percent 2013 Net interest income Provision (reduction ... -

Page 88

..., or 15%, increase in personnel costs, primarily due to a higher number of employees, resulting from higher production and business development activities, including community development. 2014 vs. 2013 AFCRE reported net income of $196 million in 2014, compared with a net income of $220 million in... -

Page 89

... to corporate operations and reduced incentives related to the reduction in trust and brokerage income. $2 million, or 9%, decrease in outside data processing and other services, primarily due to movement of trust system expenses to corporate operations. 2014 vs. 2013 RBHPCG reported net income... -

Page 90

... Performance Comparison (dollar amounts in millions, except per share amounts) Impact(1) Three Months Ended: Amount EPS(2) December 31, 2015-GAAP net income Franchise repositioning related expense Mergers and acquisitions, net gains(3) December 31, 2014-GAAP net income Net additions to litigation... -

Page 91

Table 41 - Average Earning Assets - 2015 Fourth Quarter vs. 2014 Fourth Quarter (dollar amounts in millions) Fourth Quarter 2015 2014 Amount Change Percent Loans/Leases Commercial and industrial Commercial real estate Total commercial Automobile Home equity Residential mortgage Other consumer Total... -

Page 92

...) Fourth Quarter 2015 2014 Amount Change Percent Service charges on deposit accounts Cards and payment processing income Mortgage banking income Trust services Insurance income Brokerage income Capital markets fees Bank owned life insurance income Gain on sale of loans Securities gains (losses... -

Page 93

... related to Huntington Technology Finance and the $3 million net gain on the sale of HAA, HASI, and Unified. $5 million, or 8%, increase in service charges on deposit accounts, reflecting the benefit of continued new customer acquisition including a 2% increase in commercial checking relationships... -

Page 94

... Noninterest Expense (Non-GAAP): (dollar amounts in thousands) 2015 Fourth Quarter 2014 Amount Change Percent Personnel costs Outside data processing and other services Equipment Net occupancy Marketing Professional services Deposit and other insurance expense Amortization of intangibles Other... -

Page 95

... loans and leases decreased to 1.33% from 1.40% a year ago, while the ACL as a percentage of period-end total NALs decreased to 180% from 222%. Management believes the level of the ACL is appropriate given the credit quality metrics and the current composition of the overall loan and lease portfolio... -

Page 96

... Book value per common share Tangible book value per common share(3) Per common share Net income-basic Net income-diluted Cash dividends declared Common stock price, per share High(4) Low(4) Close Average closing price Return on average total assets Return on average common shareholders' equity... -

Page 97

... Quarterly Income Statement, Capital, and Other Data (1) 2015 Capital adequacy December 31, September 30, June 30, March 31, Total risk-weighted assets (in millions)(10) Tier 1 leverage ratio (period end)(10) Common equity tier 1 risk-based capital ratio(10) Tier 1 risk-based capital ratio (period... -

Page 98

... Ending Book value per share Tangible book value per share(3) Per common share Net income-basic Net income -diluted Cash dividends declared Common stock price, per share High(4) Low(4) Close Average closing price Return on average total assets Return on average common shareholders' equity Return on... -

Page 99

... intangible assets is calculated assuming a 35% tax rate. High and low stock prices are intra-day quotes obtained from Bloomberg. Net income applicable to common shares excluding expense for amortization of intangibles for the period divided by average tangible common shareholders' equity. Average... -

Page 100

... to consider the consolidated financial statements and other financial information contained in this Form 10-K in their entirety, and not to rely on any single financial measure. Non-Regulatory Capital Ratios In addition to capital ratios defined by banking regulators, the Company considers various... -

Page 101

... Financial Statements. Estimates are made under facts and circumstances at a point in time, and changes in those facts and circumstances could produce results substantially different from those estimates. The most significant accounting policies and estimates and their related application... -

Page 102

... debt securities issued by banks, bank holding companies, and insurance companies. A full cash flow analysis is used to estimate fair values and assess impairment for each security within this portfolio. We engage a third-party pricing specialist with direct industry experience in pooled-trust... -

Page 103

...risk in that their fair value will fluctuate as a result of changes in the interest rate environment. Fair value is determined based upon the application of an income approach valuation model. We use an independent third-party valuation model, which incorporates assumptions in estimating future cash... -

Page 104

... of "Market Risk" in Item 7 (MD&A), which is incorporated by reference into this item. Item 8: Financial Statements and Supplementary Data Information required by this item is set forth in the Reports of Independent Registered Public Accounting Firm, Consolidated Financial Statements and Notes... -

Page 105

... and 15d-15(f) of the Securities Exchange Act of 1934, as amended. Huntington's Management assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2015. In making this assessment, Management used the criteria set forth by the Committee of Sponsoring... -

Page 106

... accompanying consolidated balance sheet as of December 31, 2015 and the related consolidated statements of income, comprehensive income, changes in shareholders' equity and cash flows for the year then ended present fairly, in all material respects, the financial position of Huntington Bancshares... -

Page 107

... Incorporated Columbus, Ohio We have audited the accompanying consolidated balance sheet of Huntington Bancshares Incorporated and subsidiaries (the "Company") as of December 31, 2014, and the related consolidated statements of income, comprehensive income, changes in shareholders' equity, and cash... -

Page 108

...Consolidated Balance Sheets December 31, (dollar amounts in thousands, except number of shares) Assets Cash and due from banks Interest-bearing deposits in banks Trading account securities Loans held for sale (includes $337,577 and $354,888 respectively, measured at fair value)(1) Available-for-sale... -

Page 109

... provision for credit losses Service charges on deposit accounts Cards and payment processing income Mortgage banking income Trust services Insurance income Brokerage income Capital markets fees Bank owned life insurance income Gain on sale of loans Net gains on sales of securities Impairment losses... -

Page 110

... The following OTTI losses are included in securities losses for the periods presented: Total OTTI losses Noncredit-related portion of loss recognized in OCI Net impairment credit losses recognized in earnings See Notes to Consolidated Financial Statements $ $ (3,144) $ 704 (2,440 1,870) 68 (1,802... -

Page 111

...Consolidated Statements of Comprehensive Income Year Ended December 31, (dollar amounts in thousands) 2015 2014 2013 Net income $ Other comprehensive income, net of tax: Unrealized gains on available-for-sale and other securities: Non-credit-related impairment recoveries (losses) on debt securities... -

Page 112

...Incorporated Consolidated Statements of Changes in Shareholders' Equity Accumulated Preferred Stock (all amounts in thousands, except for per share amounts) Year Ended December 31, 2015 Balance, beginning of year Net income Other comprehensive income (loss) Repurchases of common stock Cash dividends... -

Page 113

... Incorporated Consolidated Statements of Changes in Shareholders' Equity Accumulated Preferred Stock (all amounts in thousands, except for per share amounts) Year Ended December 31, 2014 Balance, beginning of year Net income Other comprehensive income (loss) Repurchase of common stock Cash dividends... -

Page 114

... Incorporated Consolidated Statements of Changes in Shareholders' Equity Accumulated Preferred Stock (all amounts in thousands, except for per share amounts) Year Ended December 31, 2013 Balance, beginning of year Net income Other comprehensive income (loss) Repurchase of common stock Cash dividends... -

Page 115

... from sale of operating lease assets Purchases of premises and equipment Proceeds from sales of other real estate Purchases of loans and leases Purchases of customer lists Other, net Net cash provided by (used for) investing activities Financing activities Increase (decrease) in deposits Increase... -

Page 116

... paid Income taxes paid (refunded) Non-cash activities: Loans transferred to available-for-sale securities Loans transferred to held-for-sale from portfolio Loans transferred to portfolio from held-for-sale Transfer of loans to OREO Transfer of securities to held-to-maturity from available-forsale... -

Page 117

...financing, equipment leasing, investment management, trust services, brokerage services, customized insurance programs, and other financial products and services. Huntington's banking offices are located in Ohio, Michigan, Pennsylvania, Indiana, West Virginia, and Kentucky. Select financial services... -

Page 118

...as the direct costs of those activities. Huntington also acquires loans at a premium and at a discount to their contractual values. Huntington amortizes loan discounts, premiums, and net loan origination fees and costs on a level-yield basis over the estimated lives of the related loans, which would... -

Page 119

... changes in loss mitigation or credit origination strategies, and adjustments to the reserve factors are made as required. The general reserve consists of various risk-profile reserve components. The risk-profile component considers items unique to our structure, policies, processes, and portfolio... -

Page 120

...less anticipated selling costs, at 150-days past due and 120-days past due, respectively. Residential mortgages are charged-off to the estimated fair value of the collateral at 150-days past due. Impaired Loans - For all classes within the C&I and CRE portfolios, all loans with an obligor balance of... -

Page 121

... and significant changes in the cash flow estimates over the life of the loan can result. Transfers of Financial Assets and Securitizations - Transfers of financial assets in which we have surrendered control over the transferred assets are accounted for as sales. In assessing whether control... -

Page 122

... to meet its contractual obligations. Notional values of interest rate swaps and other off-balance sheet financial instruments significantly exceed the credit risk associated with these instruments and represent contractual balances on which calculations of amounts to be exchanged are based. Credit... -

Page 123

... asset is recorded on the day of the sale at fair value for the right to service the loans sold. To determine the fair value of a MSR, Huntington uses an option adjusted spread cash flow analysis incorporating market implied forward interest rates to estimate the future direction of mortgage... -

Page 124

... management to establish methodologies to allocate funding costs and benefits, expenses, and other financial elements to each business segment. 2. ACCOUNTING STANDARDS UPDATE ASU 2014-04-Receivables (Topic 310): Reclassification of Residential Real Estate Collateralized Consumer Mortgage Loans... -

Page 125

... impact on Huntington's Consolidated Financial Statements. ASU 2014-12-Compensation-Stock Compensation (Topic 718): Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period. The amendments require that... -

Page 126

...'s Consolidated Financial Statements. 3. LOANS AND LEASES AND ALLOWANCE FOR CREDIT LOSSES Except for loans which are accounted for at fair value, loans are carried at the principal amount outstanding, net of unamortized premiums and discounts and deferred loan fees and costs, which resulted in a net... -

Page 127

... of direct financing leases on equipment, which are included in C&I loans. Net investments in lease financing receivables by category at December 31, 2015 and 2014 were as follows: At December 31, (dollar amounts in thousands) 2015 2014 Commercial and industrial: Lease payments receivable Estimated... -

Page 128

...summarizes significant portfolio loan purchase and sale activity for the years ended December 31, 2015 and 2014. The table below excludes mortgage loans originated for sale. Commercial and Industrial (dollar amounts in thousands) Commercial Real Estate Home Equity Residential Mortgage Other Consumer... -

Page 129

... Commercial real estate: Retail properties Multi family Office Industrial and warehouse Other commercial real estate Total commercial real estate Automobile Home equity: Secured by first-lien Secured by junior-lien Total home equity Residential mortgage Other consumer Total nonaccrual loans... -

Page 130

... Total Loans and Leases 90 or more days past due and accruing Commercial and industrial: Owner occupied $ 11,947 Purchased credit-impaired 292 Other commercial and industrial 32,476 Total commercial and industrial 44,715 Commercial real estate: Retail properties 1,823 Multi family 961 Office 5,022... -

Page 131

... Accounting Policies and is reduced by charge-offs, net of recoveries, and the ACL associated with securitized or sold loans. During the 2015 first quarter, we reviewed our existing commercial and consumer credit models and enhanced certain processes and methods of ACL estimation. During this review... -

Page 132

... home equity and residential mortgage portfolios based on more recently observed portfolio experience. The net ACL impact of these enhancements was immaterial. The following table presents ALLL and AULC activity by portfolio segment for the years ended December 31, 2015, 2014, and 2013: (dollar... -

Page 133

...credit quality. Huntington assesses the risk in the loan portfolio by utilizing numerous risk characteristics. The classifications described above, and also presented in the table below, represent one of those characteristics that are closely monitored in the overall credit risk management processes... -

Page 134

... Risk Profile by UCS Classification (dollar amounts in thousands) Pass OLEM Substandard Doubtful Total Commercial and industrial: Owner occupied Purchased credit-impaired Other commercial and industrial Total commercial and industrial Commercial real estate: Retail properties Multi family Office... -

Page 135

... Risk Profile by UCS Classification (dollar amounts in thousands) Pass OLEM Substandard Doubtful Total Commercial and industrial: Owner occupied Purchased credit-impaired Other commercial and industrial Total commercial and industrial Commercial real estate: Retail properties Multi family Office... -

Page 136

..., 2015: Portion of ALLL balance: Commercial and Industrial Commercial Real Estate Automobile Home Equity Residential Mortgage Other Consumer Total Attributable to purchased credit-impaired loans $ Attributable to loans individually evaluated for impairment Attributable to loans collectively... -

Page 137

... and industrial Commercial real estate: (4) Retail properties Multi family Office Industrial and warehouse Purchased credit-impaired Other commercial real estate Total commercial real estate Automobile Home equity: Secured by first-lien Secured by junior-lien Total home equity Residential mortgage... -

Page 138

...Commercial real estate: Retail properties Multi family Office Industrial and warehouse Purchased credit-impaired Other commercial real estate Total commercial real estate Automobile Home equity: Secured by first-lien Secured by junior-lien Total home equity Residential mortgage: Residential mortgage... -

Page 139

... for 2015, 2014, and 2013, respectively. TDR Concession Types The Company's standards relating to loan modifications consider, among other factors, minimum verified income requirements, cash flow analyses, and collateral valuations. Each potential loan modification is reviewed individually and... -

Page 140

... Other Consumer loan TDRs - The Company may make similar interest rate, term, and principal concessions as with residential mortgage loan TDRs. TDR Impact on Credit Quality Huntington's ALLL is largely determined by updated risk ratings assigned to commercial loans, updated borrower credit scores on... -

Page 141

...principal payments received on that note are applied to first reduce the bank's outstanding book balance and then to recoveries of charged-off principal, unpaid interest, and/or fee expenses while the TDR is in nonaccrual status. Residential Mortgage, Automobile, Home Equity, and Other Consumer loan... -

Page 142

...commercial real estate Automobile: (3) Interest rate reduction Amortization or maturity date change Chapter 7 bankruptcy Other Total Automobile Residential mortgage: (3) Interest rate reduction Amortization or maturity date change Chapter 7 bankruptcy Other Total Residential mortgage First-lien home... -

Page 143

... The Year Ended December 31, 2015 (1) (dollar amounts in thousands) Number of Contracts Ending Balance December 31, 2014 (1) Number of Contracts Ending Balance C&I-Owner occupied: Interest rate reduction Amortization or maturity date change Other Total C&I-Owner occupied C&I-Other commercial and... -

Page 144

.... As of December 31, 2015, these borrowings and advances are secured by $17.5 billion of loans and securities. On March 31, 2015, Huntington completed its acquisition of Macquarie Equipment Finance, which we have re-branded Huntington Technology Finance. Huntington assumed debt associated with two... -

Page 145

...) Amortized Cost Gross Gains Gross Losses Fair Value December 31, 2015 U.S. Treasury Federal agencies: Mortgage-backed securities Other agencies Total U.S. Treasury, Federal agency securities Municipal securities Asset-backed securities Corporate debt Other securities Total available-for-sale and... -

Page 146

...Cost Gross Gains Gross Losses Fair Value December 31, 2014 U.S. Treasury Federal agencies: Mortgage-backed securities Other agencies Total U.S. Treasury, Federal agency securities Municipal securities Private-label CMO Asset-backed securities Corporate debt Other securities Total available-for-sale... -

Page 147

... of trust-preferred securities and subordinated debt securities issued by banks, bank holding companies, and insurance companies. Many collateral issuers have the option of deferring interest payments on their debt for up to five years. A full cash flow analysis is used to estimate fair values and... -

Page 148

... that we will be able to hold the ICONS security to recovery under the final Volcker Rule regulations. The following table summarizes the relevant characteristics of our CDO securities portfolio, which are included in asset-backed securities, at December 31, 2015 and 2014. Each security is part of... -

Page 149

... reduce asset risk weighting and credit risk in the investment portfolio, the remainder of the private-label CMO portfolio was sold in the 2015 third quarter. Huntington recognized OTTI on this portfolio in prior periods. 5. HELD-TO-MATURITY SECURITIES These are debt securities that Huntington has... -

Page 150

... unrealized gains and losses, and fair value by investment category at December 31, 2015 and 2014: Unrealized (dollar amounts in thousands) Amortized Cost Gross Gains Gross Losses Fair Value December 31, 2015 Federal Agencies: Mortgage-backed securities Other agencies Total U.S. Government backed... -

Page 151

... activity relating to residential mortgage loans sold with servicing retained for the years ended December 31, 2015, 2014, and 2013: Year Ended December 31, (dollar amounts in thousands) 2015 2014 2013 Residential mortgage loans sold with servicing retained Pretax gains resulting from above loan... -

Page 152

... in value associated with loans that paid off during the period. (3) Represents change in value resulting primarily from market-driven changes in interest rates and prepayment speeds. Amortization Method (dollar amounts in thousands) 2015 2014 Carrying value, beginning of year New servicing assets... -

Page 153

... and impairment of capitalized servicing assets included in mortgage banking income was $27 million, $24 million, and $29 million for the years ended December 31, 2015, 2014, and 2013, respectively. The unpaid principal balance of residential mortgage loans serviced for third parties was $16... -

Page 154

... principal balance of automobile loans serviced for third parties was $0.9 billion, $0.8 billion, and $1.6 billion at December 31, 2015, 2014, and 2013, respectively. Small Business Association (SBA) Portfolio The following table summarizes activity relating to SBA loans sold with servicing retained... -

Page 155

...Business Banking, Commercial Banking, Automobile Finance and Commercial Real Estate (AFCRE), Regional Banking and The Huntington Private Client Group (RBHPCG), and Home Lending. A Treasury / Other function includes, along with technology and operations, other unallocated assets, liabilities, revenue... -

Page 156

(dollar amounts in thousands) Gross Carrying Amount Accumulated Amortization Net Carrying Value December 31, 2015 Core deposit intangible Customer relationship Other Total other intangible assets December 31, 2014 Core deposit intangible Customer relationship Other Total other intangible assets... -

Page 157

... of the following at December 31, 2015 and 2014: At December 31, (dollar amounts in thousands) 2015 2014 Federal funds purchased and securities sold under agreements to repurchase Federal Home Loan Bank advances Other borrowings Total short-term borrowings Other borrowings consist of borrowings... -

Page 158

... in thousands) 2015 2014 The Parent Company: Senior Notes: 2.64% Huntington Bancshares Incorporated senior note due 2018 Subordinated Notes: Fixed 7.00% subordinated notes due 2020 Huntington Capital I Trust Preferred 1.03% junior subordinated debentures due 2027 (1) Sky Financial Capital Trust IV... -

Page 159

... 31, 2015, based on three-month LIBOR +0.425%. Amounts above are net of unamortized discounts and adjustments related to hedging with derivative financial instruments. The derivative instruments, principally interest rate swaps, are used to hedge the fair values of certain fixed-rate debt by... -

Page 160

... net gains (losses) included in net income Net change in unrealized holding gains (losses) on available-for-sale debt securities Net change in unrealized holding gains (losses) on available-for-sale equity securities Unrealized gains and losses on derivatives used in cash flow hedging relationships... -

Page 161

... the impacted line items as listed on the Consolidated Statements of Income for the years ended December 31, 2015 and 2014: Reclassifications out of accumulated OCI Accumulated OCI components (dollar amounts in thousands) Amounts reclassed from accumulated OCI 2015 2014 Location of net gain (loss... -

Page 162

... through the second quarter of 2016. On January 26, 2016, Huntington announced the signing of a definitive merger agreement under which Ohio-based FirstMerit Corporation, the parent company of FirstMerit Bank, will merge into Huntington in a stock and cash transaction. The transaction is expected... -

Page 163

... incentive share based compensation plans. These plans provide for the granting of stock options and other awards to officers, directors, and other employees. Compensation costs are included in personnel costs on the Consolidated Statements of Income. Stock options are granted at the closing market... -

Page 164

...thousands) 2015 2014 2013 Share-based compensation expense Tax benefit $ 51,415 17,618 $ 43,666 14,779 $ 37,007 12,472 Huntington's stock option activity and related information for the year ended December 31, 2015, was as follows: WeightedAverage Remaining Contractual Life (Years) (amounts... -

Page 165

.... The Plan, which was modified in 2013 and no longer accrues service benefits to participants, provides benefits based upon length of service and compensation levels. The funding policy of Huntington is to contribute an annual amount that is at least equal to the minimum funding requirements but not... -

Page 166

...2014 Post-Retirement Benefits 2015 2014 Weighted-average assumptions used to determine benefit obligations Discount rate Rate of compensation increase Weighted-average assumptions used to determine net periodic benefit cost Discount rate (1)(2)(3) Expected return on plan assets Rate of compensation... -

Page 167

... fair value of Huntington's plan assets by $160 million. The following table shows the components of net periodic benefit costs recognized in the three years ended December 31, 2015: Pension Benefits (dollar amounts in thousands) 2015 2014 2013 2015 Post-Retirement Benefits 2014 2013 Service cost... -

Page 168

...) 2015 2014 Cash equivalents: Federated-money market Huntington funds-money market Fixed income: Corporate obligations U.S. Government Obligations Mutual funds-fixed income U.S. Government Agencies Equities: Mutual funds-equities Other common stock Huntington funds Exchange Traded Funds Limited... -

Page 169

..., 2014, and 2013: (dollar amounts in thousands) 2015 2014 2013 Net actuarial loss Prior service cost Defined benefit pension plans $ $ (243,984) $ 13,237 (230,747) $ (240,197) $ 14,517 (225,680) $ (166,078) 9,855 (156,223) 2015 (dollar amounts in thousands) Pretax Benefit After-tax Balance... -

Page 170

... annual base pay was awarded. The following table shows the costs of providing the defined contribution plan: Year ended December 31, (dollar amounts in thousands) 2015 2014 2013 Defined contribution plan $ 31,896 $ 31,110 $ 18,238 The following table shows the number of shares, market value... -

Page 171

... thousands) 2015 2014 2013 Provision for income taxes computed at the statutory rate Increases (decreases): Tax-exempt income Tax-exempt bank owned life insurance income General business credits State deferred tax asset valuation allowance adjustment, net Capital loss Affordable housing investment... -

Page 172

... Purchase accounting adjustments Partnership investments Market discount Pension and other employee benefits Tax credit carryforward Other Total deferred tax assets Deferred tax liabilities: Lease financing Loan origination costs Mortgage servicing rights Operating assets Securities adjustments... -

Page 173

... of trust-preferred securities and subordinated debt securities issued by banks, bank holding companies, and insurance companies. A cash flow analysis is used to estimate fair values and assess impairment for each security within this portfolio. We engage a third-party pricing specialist with direct... -

Page 174

... other interest rates are developed internally based on similar asset-backed security transactions in the market. During the first quarter of 2014, Huntington canceled the 2009 and 2006 Automobile Trusts. Huntington continues to report the associated automobile loan receivables at fair value due to... -

Page 175

...Value Measurements at Reporting Date Using (dollar amounts in thousands) Level 1 Level 2 Level 3 Netting Adjustments (1) December 31, 2015 Assets Loans held for sale Loans held for investment Trading account securities: Municipal securities Other securities Available-for-sale and other securities... -

Page 176

Fair Value Measurements at Reporting Date Using (dollar amounts in thousands) Level 1 Level 2 Level 3 Netting Adjustments (1) December 31, 2014 Assets Loans held for sale Loans held for investment Trading account securities: Federal agencies: Other agencies Municipal securities Other securities ... -

Page 177

...Level 2. Level 3 Fair Value Measurements Year ended December 31, 2014 Available-for-sale securities Derivative instruments Municipal securities Privatelabel CMO Assetbacked securities Automobile loans (dollar amounts in thousands) MSRs Opening balance Transfers into Level 3 Transfers out of Level... -

Page 178

... Level 3 assets and liabilities for the years ended December 31, 2015, 2014, and 2013: Level 3 Fair Value Measurements Year ended December 31, 2015 Available-for-sale securities Derivative instruments Municipal securities Privatelabel CMO Assetbacked securities Automobile loans (dollar amounts in... -

Page 179

... value changes, including net gains (losses) associated with instrument specific credit risk for the years ended December 31, 2015, 2014, and 2013: Net gains (losses) from fair value changes Year ended December 31, 2014 (dollar amounts in thousands) 2015 2013 Assets Mortgage loans held for sale... -

Page 180

... cash flow Asset-backed securities 100,337 Discounted cash flow Automobile loans 1,748 Discounted cash flow Impaired loans Other real estate owned 62,029 27,342 Appraisal value Appraisal value Constant prepayment rate Spread over forward interest rate swap rates Net market price Estimated... -

Page 181

...Value December 31, 2014 Carrying Amount Fair Value Financial Assets: Cash and short-term assets Trading account securities Loans held for sale Available-for-sale and other securities Held-to-maturity securities Net loans and direct financing leases Derivatives Financial Liabilities: Deposits Short... -

Page 182

... values of fixed-rate time deposits are estimated by discounting cash flows using interest rates currently being offered on certificates with similar maturities. Debt Long-term debt is based upon quoted market prices, which are inclusive of Huntington's credit risk. In the absence of quoted market... -

Page 183

... in Huntington's asset and liability management activities at December 31, 2015, identified by the underlying interest rate-sensitive instruments: (dollar amounts in thousands) Fair Value Hedges Cash Flow Hedges Total Instruments associated with: Loans Deposits Subordinated notes Long-term debt... -

Page 184

... as effective cash flow hedges: Derivatives in cash flow hedging relationships (dollar amounts in thousands) Interest rate contracts Loans Loans Total $ $ Amount of gain or (loss) recognized in OCI on derivatives (effective portion) 2015 8,428 - 8,428 $ $ 2014 9,192 - 9,192 2013 Location of gain... -

Page 185

... 2015, 2014, and 2013: December 31, 2014 (dollar amounts in thousands) 2015 2013 Derivatives in cash flow hedging relationships Interest rate contracts: Loans Derivatives used in mortgage banking activities Mortgage loan origination hedging activity $ (763) $ 74 $ 878 Huntington's mortgage... -

Page 186

... collateral and master netting agreements with these counterparties, and routinely exchange cash and high quality securities collateral with these counterparties. Huntington enters into transactions with customers to meet their financing, investing, payment and risk management needs. These types... -

Page 187

... balance sheets (dollar amounts in thousands) Gross amounts of recognized assets Gross amounts offset in the consolidated balance sheets Financial instruments Cash collateral received Net amount Offsetting of Financial Assets and Derivative Assets December 31, 2015 December 31, 2014... -

Page 188

... 31, 2014 Other Consolidated Trusts (dollar amounts in thousands) Total Assets: Cash Net loans and leases Accrued income and other assets Total assets Liabilities: Other long-term debt Accrued interest and other liabilities Total liabilities Equity: Beneficial Interest owned by third party Total... -

Page 189

... of municipal securities, $86 million in Huntington Preferred Capital, Inc. (Real Estate Investment Trust) Class E Preferred Stock and cash of $6 million to Tower Hill Securities, Inc. in exchange for $184 million of Common and Preferred Stock of Tower Hill Securities, Inc. In 2015, the mandatorily... -

Page 190

... accounting accretion) at December 31, 2015, based on three month LIBOR + 1.33. Each issue of the junior subordinated debentures has an interest rate equal to the corresponding trust securities distribution rate. Huntington has the right to defer payment of interest on the debentures at any time... -

Page 191

... Statements. The contract amounts of these financial agreements at December 31, 2015, and December 31, 2014 were as follows: At December 31, (dollar amounts in thousands) 2015 2014 Contract amount represents credit risk Commitments to extend credit: Commercial Consumer Commercial real estate... -

Page 192

... by customers and remarketed by The Huntington Investment Company, the Company's broker-dealer subsidiary. Huntington uses an internal grading system to assess an estimate of loss on its loan and lease portfolio. This same loan grading system is used to monitor credit risk associated with standby... -

Page 193

... v. Huntington National Bank. The Bank is a defendant in a putative class action filed on October 15, 2013. The plaintiffs filed the action in West Virginia state court on behalf of themselves and other West Virginia mortgage loan borrowers who allege they were charged late fees in violation of West... -

Page 194

... qualifying subordinated debt and qualifying ALLL. We are also subject to CCAR and must submit annual capital plans to our banking regulators. We may pay dividends and repurchase stock up to the levels submitted in our capital plan to which the FRB did not object. As of December 31, 2015, Huntington... -

Page 195

... 2015 December 31, 2014 Assets Cash and cash equivalents Due from The Huntington National Bank Due from non-bank subsidiaries Investment in The Huntington National Bank Investment in non-bank subsidiaries Accrued interest receivable and other assets Total assets Liabilities and shareholders' equity... -

Page 196

... of Income (dollar amounts in thousands) 2015 Year Ended December 31, 2014 2013 Income Dividends from The Huntington National Bank Non-bank subsidiaries Interest from The Huntington National Bank Non-bank subsidiaries Other Total income Expense Personnel costs Interest on borrowings Other... -

Page 197

... losses and the credit risk associated with leased assets. The fair values of debt, securitizations, and other liabilities were estimated by discounting cash flows using interest rates currently being offered with similar maturities (Level 3). As part of the acquisition, Huntington recorded $156... -

Page 198

... limited to checking accounts, savings accounts, money market accounts, certificates of deposit, consumer loans, and small business loans. Other financial services available to consumer and small business customers include investments, insurance, interest rate risk protection, foreign exchange, and... -

Page 199

Income Statements (dollar amounts in thousands) Retail & Business Banking Commercial Banking AFCRE RBHPCG Home Lending Treasury / Other Huntington Consolidated 2015 Net interest income $ 1,030,238 Provision for credit losses 42,828 Noninterest income 440,261 Noninterest expense 1,029,727 ... -

Page 200

... financial services company headquartered in Akron, Ohio, which reported assets of approximately $25.5 billion based on their December 31, 2015 unaudited balance sheet. Under the terms of the agreement, shareholders of FirstMerit Corporation will receive 1.72 shares of Huntington common stock... -

Page 201

... 9B: Other Information Not applicable. PART III We refer in Part III of this report to relevant sections of our 2016 Proxy Statement for the 2016 annual meeting of shareholders, which will be filed with the SEC pursuant to Regulation 14A within 120 days of the close of our 2015 fiscal year. Portions... -

Page 202

... are no longer active and for which Huntington has not reserved the right to make subsequent grants or awards: employee and director stock plans of Unizan Financial Corp., Sky Financial Group, Inc. and Camco Financial Corporation assumed in the acquisitions of these companies. The weighted-average... -

Page 203

... Executive Vice President, Controller (Principal Accounting Officer) By: Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacities indicated on the 17th day of February, 2016... -

Page 204

... this Annual Report on Form 10-K, information on those web sites is not part of this report. You also should be able to inspect reports, proxy statements, and other information about us at the offices of the NASDAQ National Market at 33 Whitehall Street, New York, New York. SEC File or Registration... -

Page 205

...for Executive Officers Version II *Form of 2014 Performance Stock Unit Grant Agreement for Executive Officers Version II *Huntington Bancshares Incorporated 2012 Long-Term Incentive Plan. Definitive Proxy Statement for the 2012 Annual Meeting of Shareholders. *Huntington Bancshares Incorporated 2015... -

Page 206

... Private Investor Joined Board: 2012 Jonathan A. Levy(4)(6) Managing Partner, Redstone Investments Joined Board: 2007 COMMITTEES (1) Audit (2) Community Development (3) Compensation (4) Executive (5) Nominating and Corporate Governance (6) Risk Oversight (7) Technology Eddie R. Munson(1) Retired... -

Page 207

... 41 South High Street Columbus, OH 43287 [email protected] (614) 480-5676 CUSTOMER CONTACTS Corporate Headquarters (614) 480-8300 Customer Service Center (800) 480-BANK (2265) Business Direct (800) 480-2001 Auto Loan (800) 445-8460 The Huntington Investment Company (800... -

Page 208

... Passion Service Teamwo Huntington Center South High Street lusion 41 Passion Service Teamwork Accountability Do the Right Thing Acc Columbus, Ohio 43287 ssion Service Do the Right Thing Teamwork k Do the Right Thing Communic 800-480-BANK (2265) amworkhuntington.com Do the Right Thing Accountability...