Hamilton Beach 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[5]

2008. This decline could delay the timeframe for reaching those

targets. Nevertheless, HBB is expected to continue to drive

innovation in current and new markets while KC is expected to

focus on improving Le Gourmet Chef (“LGC”) logistics and

profitability in order to meet KC’s LGC acquisition-related targets.

NACoal has also been approaching its financial targets.

This subsidiary has strong operations, although the company

expects to be affected in 2008 by temporarily reduced customer

requirements in both coal and limerock operations. NACoal’s

focus is on continually improving current operations while

aggressively pursuing a variety of new business opportunities.

As profit improvement and growth programs are pursued,

NACCO maintains high expectations for returns on equity and

returns on total capital employed. These financial measures,

which were strong in 2007 at HBB and NACoal but well short

of targets at KC and NMHG, are expected to improve at all

NACCO subsidiaries over time to meet the specific financial

targets established several years ago.

This letter provides a short summary of each subsidiary’s

market situation, strategies, key performance improvement

programs and outlook, and concludes with an overall outlook

for NACCO Industries. The subsidiary letters found later in this

Annual Report provide greater detail on the objectives and

timing of key programs, which typically remain consistent

from year to year, and on progress being made toward reaching

each company’s specific financial and growth objectives.

Certainly the recent developments in the U.S. economy

have the potential to affect all of NACCO’s subsidiaries to some

extent in 2008. While each subsidiary’s programs tend to address

key areas of cost reduction and revenue growth, each company

will be closely monitoring market conditions, developing

special contingency plans and taking more aggressive actions

to preserve profitability if required.

NACCO Materials Handling Group

NMHG is a leader in the global lift truck industry and is

committed to building on that success in coming years.

Companies in the global lift truck industry are faced with

increased material costs and unpredictable currency exchange

rates. As a result, NMHG believes it is highly beneficial to execute

more fully its core manufacturing strategy of assembling lift

trucks in the market of sale, and to consider a variety of low-cost

component sourcing options, particularly as new opportunities

arise in lower-cost regions. NMHG is also focused on increasing

manufacturing efficiency and reducing its fixed-cost and overall

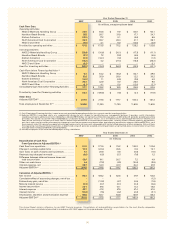

In 2007, NACCO’s revenue increased, but net income

decreased compared with 2006. The Company reported net

income of $89.3 million in 2007, or $10.80 per diluted share,

compared with net income of $106.2 million, or $12.89 per

diluted share, in 2006. However, net income for 2006 included

an after-tax extraordinary gain of $12.8 million, which did

not recur in 2007. Revenues for 2007 were $3.6 billion

compared with $3.3 billion for 2006.

NACCO earned income before extraordinary gain in

2007 of $89.3 million, or $10.80 per diluted share, compared

with $93.4 million, or $11.33 per diluted share, in 2006.

Included in the 2007 results were restructuring charges totaling

$8.0 million, or $4.9 million net of taxes of $3.1 million, for

manufacturing restructuring programs implemented at

NMHG. Excluding these restructuring charges, the Company

was able to maintain a consistent level of profitability compared

with the prior year, despite current economic conditions.

Improvements achieved in 2007 were the result of the

continued implementation of key programs, which helped

propel new products into the marketplace, increase production

and supply chain efficiency and, in some cases, lower selling

and administrative costs. However, these improvements

could not offset the effects of a slowing U.S. economy, very

weak markets for housewares products, increases in material

costs and a weak U.S. dollar.

In 2007, NACCO generated $21.7 million in consolidated

cash flow before financing activities, compared with $138.2

million in 2006. Cash flow before financing activities in

2007 was significantly lower than 2006 as a result of higher

working capital requirements and a lack of proceeds on

asset sales, which occurred in 2006.

In 2007, NACCO planned to spin off its Hamilton Beach

Brands (“HBB”) subsidiary to form a new public company,

Hamilton Beach, Inc. However, due to extreme volatility

and uncertainty in U.S. equity markets, in August 2007 the

Company’s Board of Directors decided not to pursue the

spin-off.

Discussion of Results