Hamilton Beach 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[29]

2007 Results

Kitchen Collection (“KC”) had a challenging year in 2007.

Higher gasoline prices and consumer concern over the economy

and the housing market adversely affected both customer

visits and spending in 2007, particularly during the important

fourth-quarter holiday gift-giving season. In addition, KC spent

much of the year integrating operations, replenishing product

inventory and restoring customer loyalty at its Le Gourmet

Chef® stores (“LGC stores”), a chain of kitchenware and gourmet

food stores acquired out of bankruptcy in August 2006.

Revenues increased 23 percent in 2007 primarily because

of the acquisition of the LGC stores. Sales gains were

partially offset by the effect of closures

of unprofitable stores as the number

of Kitchen Collection® stores (“KC

stores”) decreased to 198 in 2007 from

203 in 2006. The number of LGC stores

also decreased to 74 in 2007 from 77

in 2006, in line with expectations at

the time of the acquisition.

KC generated a net loss of

$0.9 million in 2007 compared with

net income of $3.7 million in 2006,

primarily because KC recognized an

additional eight months of seasonal

operating losses during 2007 for the Le Gourmet Chef (“LGC”)

business of approximately $7.0 million, or $4.3 million net of

taxes of $2.7 million, as a result of owning LGC for a full year in

2007 compared with only the four most profitable months in

2006. Lower-than-expected retail sales, as well as store inventory

fulfillment difficulties at LGC’s third-party warehouse

operations, also contributed to the current year net loss. As a

result, return on equity(1) declined to negative 6.0 percent in

2007 from 28.2 percent in 2006, and return on total capital

employed (“ROTCE”) declined to 0.6 percent in 2007 from

18.3 percent in 2006. (See reconciliations of non-GAAP

ROTCE on page 43.)

During 2007, KC generated a negative cash flow before

financing activities of $14.8 million compared with cash flow

before financing activities of $1.1 million for 2006. The change

in cash flow before financing resulted primarily from a decrease

in net income and a decrease in accounts payable between years

as a result of the timing of payments.

Vision and Goals

KC’s vision is to be the leading specialty retailer of

kitchen, home entertaining and gourmet food products in

outlet malls and other retail channels

for consumers seeking a large

selection of unique, high-quality

products at an exceptional value.

KC’s goals are to earn a minimum

operating profit margin of 5 percent

and to generate substantial cash flow

before financing activities.

Industry Trends

The retail environment continues

to be extremely competitive.

Widespread Chinese sourcing allows

many retailers to offer value-priced kitchen products. Labor

and rent costs are rising, and transportation costs are increasing

due to higher fuel prices. To succeed in kitchenware retailing,

costs must be kept to a minimum.

KC believes there is excellent growth potential in

kitchenware retailing, but only through offering unique, high-

quality products at prices affordable to most consumers. While

a number of very low-end and very high-end kitchenware

retailers participate in the marketplace, there is still an excellent

opportunity for stores offering mid-priced, high-quality

Nearly 300 Kitchen

Collection® and Le Gourmet

Chef® stores bring the best

products, at a great value,

to cooking and food

enthusiasts across the U.S.

(1) Return on Equity = The respective year’s net income divided by that year’s average equity (a five-point average of equity at December 31 of the previous year and each of the

respective year’s quarter ends).

Left: The Kitchen Collection® store in Ellenton, Florida, features higher-margin, brand-name kitchen gadgets, small electric appliances and a variety of other kitchen- and

housewares-related products.

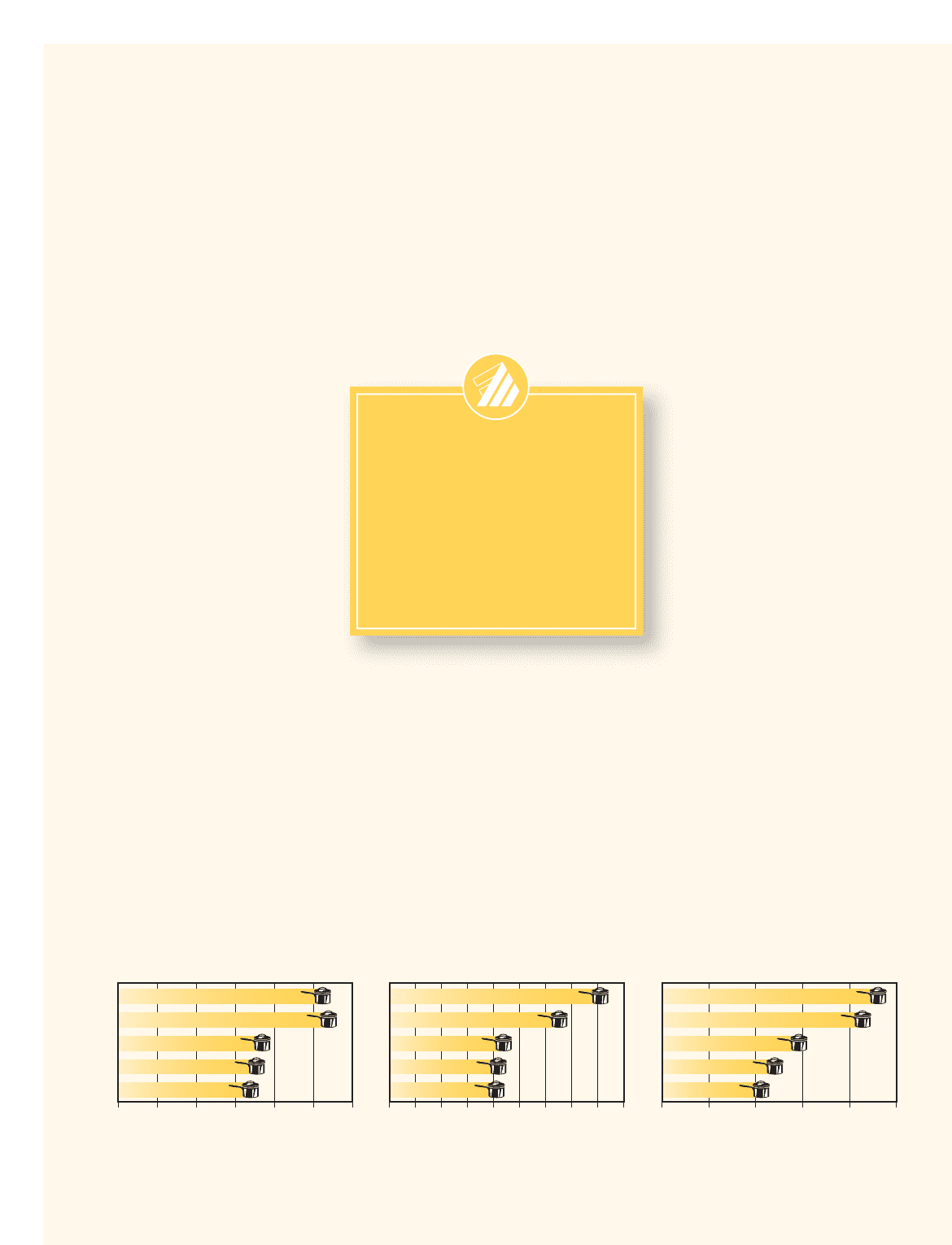

03

04

05

06

07

0 50 100 150 200 250 300

Number of Stores

180

188

195

280*

03

04

05

06

07

Revenues

(In millions)

$0 $25 $50 $75 $125$100 $150 $175 $200 $225

03

04

05

06

07

Average Sales Transaction

$18.29

$18.58

$19.10

$20.46*

$16 $17 $18 $19 $20 $21

272*$20.78*

$110.2

$112.3

$116.9

$170.7*

$210.0*

*Includes acquisition of the Le Gourmet Chef®stores in August 2006.