Hamilton Beach 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

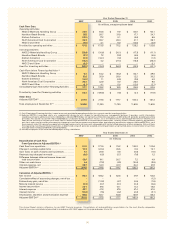

In addition, in 2007, Consolidated NMHG delivered return

on equity(1) (“ROE”) of 7.9 percent compared with 7.7 percent

in 2006, and a return on total capital employed (“ROTCE”)

of 6.8 percent in 2007 compared with 6.9 percent in 2006 –

levels still well below NMHG’s longer-term objectives. (See

reconciliations of non-GAAP ROTCE on page 43.)

Vision and Goals

NMHG’s vision is to be a leading globally integrated

designer, manufacturer and marketer of a complete range of

high-quality, application-tailored lift trucks, offering the lowest

cost of ownership, outstanding parts and service support and

the best overall value. NMHG Wholesale’s established financial

objectives are to achieve an operating profit margin of 9 percent

and to generate substantial cash flow before financing activities.

NMHG also remains focused on reaching break-even results

in its owned retail operations while developing strengthened

market positions.

Industry Trends

Lift truck customers increasingly require more dependable

lift trucks and greater levels of service and expect manufacturers

and dealers to deliver both at competitive prices. Therefore,

maintaining low costs as well as outstanding quality, timeliness

and reliability are critical for competitiveness. Because greater

economies of scale produce lower product costs, the industry is

led by large, global manufacturers with an increasingly global

supply base. While China and other low-cost countries are

emerging as more reliable sources for low-cost components,

costs for commodities, such as steel, oil, lead, rubber and copper,

continue to rise globally and place pressure on profit margins for

all manufacturers. Lift truck companies also face uncertainties

in the U.S. economy, which could affect key customers’ capital

equipment purchasing levels and timing. In this environment,

continual improvements in manufacturing and supply chain

efficiencies are vital to improve financial performance.

In most regions around the world, customers desire

specialized solutions for their materials handling needs.

Manufacturers must strike the right balance between the number

of models and options offered and the volume required to

maintain efficiencies and economies of scale. In addition, newer

lift trucks must address evolving end-user needs, which have

led, for example, to more environmentally friendly products,

such as lift trucks using fuel cell technology, and increased

demand for electric-powered lift trucks, especially those for

use in warehousing operations. Since sophisticated customers

increasingly look beyond the initial purchase price of a lift

truck to consider the total cost of operation of the equipment,

manufacturers must design and build products that deliver a

low cost of ownership over the life of the product.

Successful lift truck companies and dealers foster strong,

lasting customer relationships by utilizing highly professional

personnel and business processes. As logistics efficiency grows

in importance to end users, the overall product and service

needs of these customers have become more sophisticated.

Manufacturers face increasing demand for enhanced service

[12]

(1) ROE = The respective year’s net income divided by that year’s average equity (a five-point average of equity at December 31 of the previous year and each of the respective

year’s quarter ends).

Below left to right: The Yale® Veracitor® GP 60VX pneumatic tire internal combustion lift truck, with a lifting capacity of up to 6,000 pounds, provides excellent performance

for standard and medium-duty applications. The Yale® MPW 60E Walkie Motorized Hand Pallet Truck, with a carrying capacity up to 6,000 pounds, has ergonomically

designed handles to put full control at the operator’s fingertips and has a tapered fork design that provides excellent pallet entry and exit for low-level warehouse operation.

The Yale® ERC-HH cushion tire electric rider lift truck, for demanding applications in warehouse environments, has lifting capacities from 7,000 to 12,000 pounds and is

extremely maneuverable with high stacking ability.