Hamilton Beach 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[7]

Because new products drive growth and help sustain

margins, successful housewares companies must repeatedly

capture consumers’ attention, as well as their dollars. HBB is

aggressively focused on innovation through a unique product

development process designed to create new products that

meet consumers’ current needs, as well as improve profitability.

Utilizing a relatively low-risk, staged assessment and develop-

ment process, HBB regularly investigates promising concepts

both inside and outside its traditional product scope that have

the potential to substantially improve results in the longer term.

Strong relationships with leading retailers are vital for

success. Shelf placement, brand positioning and promotions

with all retailers and channels also are important to sustain and

improve sales volumes. HBB believes it has one of the most

professional sales and marketing organizations in the industry.

The company views this sales and

marketing strength as critical to

optimizing channel performance and

maintaining strong retailer relation-

ships. Efforts supporting this strategy

include specific retailer and channel

focus programs as well as a number of

strategic brand application initiatives.

To help manage ongoing margin

pressure in the industry, HBB places significant emphasis on

continuous cost reduction. Several key profitability programs

address cost reductions, continuous quality improvement and

supply chain optimization.

Housewares markets in the United States were relatively

weak in 2007, particularly in the important fourth-quarter

holiday season. Unfortunately, there are no indications these

markets will improve in 2008 and HBB expects reduced

results in 2008. As HBB works to maintain and improve sales

in this challenging environment, the company will continue

to concentrate on further improving margins and efficiencies

as part of its effort to meet its financial targets. The company’s

operating profit margin was 7.5 percent in 2007. Going

forward, more innovation, stronger assortments of new

products and higher sales volume will become more important

to realizing sustainable profit growth and driving the economies

of scale that are critical to attaining the long-term 10 percent

minimum operating profit margin target. Significant

generation of cash flow before financing activities is expected

in future years.

Kitchen Collection

KC’s position as the leading kitchenware retailer in the

outlet mall channel was maintained in 2007 as the company

worked to integrate the LGC business, which was acquired in

2006. LGC provides an additional successful format for outlet

malls, as well as a promising platform for expansion into

other channels.

Consumer visits to outlet malls declined in 2007, while, at

some outlet malls and in some parts of the country, store rent

and labor expenses continued to increase. These pressures,

combined with the challenges of integrating LGC’s distribution

facilities and the time required to implement key product and

merchandising programs, led to a net loss at KC in 2007. KC

has established programs aimed at achieving cost control

through general corporate expense management, highly

focused store expense management,

continuous product cost management

and an ongoing logistics efficiency

program. KC is still in the process of

applying these programs to the newly

acquired Le Gourmet Chef® stores

(“LGC stores”) and operations.

KC believes there is still significant

growth potential in kitchenware

retailing, particularly in the niche between the lowest-priced

discounters and the higher-end chains. One of the keys to

capturing that potential is the ability to offer customers unique,

high-quality products at affordable prices. To help accomplish

this goal, KC has established innovative product selection and

merchandising programs, a highly successful Hamilton Beach®

private label product program and an Economic Value Income

program designed to help evaluate SKU assortments by store

type to optimize profit performance.

With limited construction of new malls expected in the

outlet mall channel, KC has focused on optimizing Kitchen

Collection® store (“KC store”) performance and LGC store

presence at existing outlet malls as well as expanding this

presence into new, high-potential formats and distribution

channels. The company plans to expand LGC’s national presence

in outlet malls over time, although the company will be prudent

during this time of uncertain consumer spending. KC has a

number of other initiatives under way related to enhancing

the KC store outlet mall format, including a segmentation

effort designed to enhance performance based on different

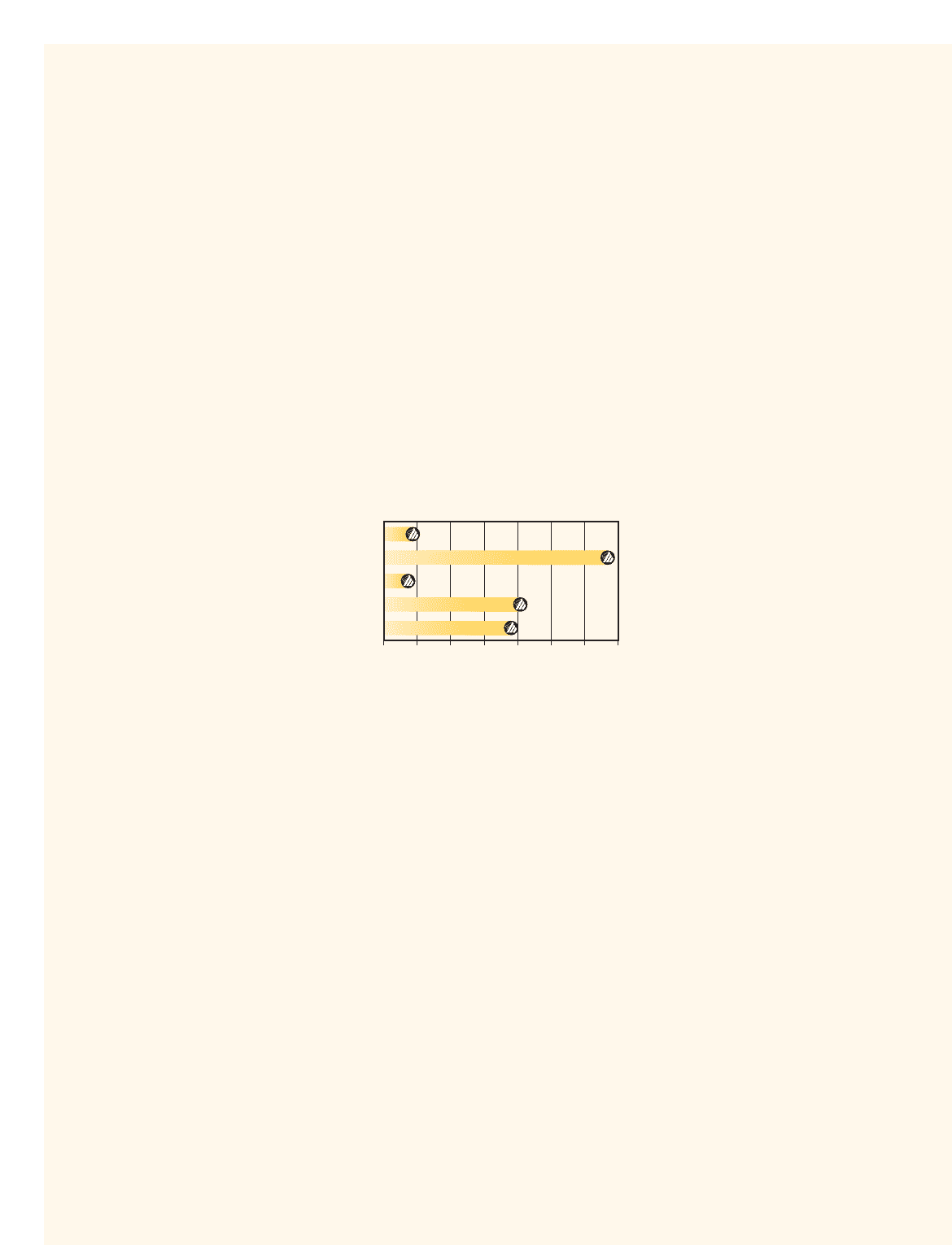

03

04

05

06

07

Consolidated Cash Flow

before Financing Activities

(In millions)

$0 $20 $40 $60 $80 $120$100 $140

$21.7

$138.2

$18.9

$85.9

$80.5