Fannie Mae 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

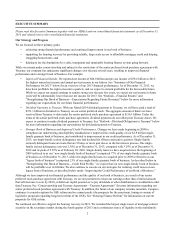

Table 2: Credit Statistics, Single-Family Guaranty Book of Business(1)

2013 2012 2011

(Dollars in millions)

As of the end of each period:

Serious delinquency rate(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.38 % 3.29 % 3.91 %

Seriously delinquent loan count . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 418,837 576,591 690,911

Troubled debt restructurings on accrual status(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 140,512 $ 135,196 $ 107,991

Nonaccrual loans(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 81,397 $ 112,627 $ 140,388

Foreclosed property inventory:

Number of properties(5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 103,229 105,666 118,528

Carrying value. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10,334 $ 9,505 $ 9,692

Combined loss reserves(6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 44,705 $ 58,809 $ 71,512

Total loss reserves(7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 46,689 $ 61,396 $ 75,264

During the period:

Foreclosed property (number of properties):

Acquisitions(5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 144,384 174,479 199,696

Dispositions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (146,821) (187,341) (243,657)

Credit-related income (expense)(8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 11,205 $ 919 $ (27,218)

Credit losses(9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,452 $ 14,392 $ 18,346

REO net sales prices to unpaid principal balance(10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67 % 59 % 54 %

Short sales net sales price to unpaid principal balance(11) . . . . . . . . . . . . . . . . . . . . . . . . . 67 % 61 % 59 %

Loan workout activity (number of loans):

Home retention loan workouts(12). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 172,029 186,741 248,658

Short sales and deeds-in-lieu of foreclosure. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61,949 88,732 79,833

Total loan workouts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 233,978 275,473 328,491

Loan workouts as a percentage of delinquent loans in our guaranty book of business(13) . 29.20 % 26.38 % 27.05 %

__________

(1) Our single-family guaranty book of business consists of (a) single-family mortgage loans of Fannie Mae, (b) single-family mortgage

loans underlying Fannie Mae MBS, and (c) other credit enhancements that we provide on single-family mortgage assets, such as long-

term standby commitments. It excludes non-Fannie Mae mortgage-related securities held in our retained mortgage portfolio for which

we do not provide a guaranty.

(2) Calculated based on the number of single-family conventional loans that are 90 days or more past due and loans that have been referred

to foreclosure but not yet foreclosed upon, divided by the number of loans in our single-family conventional guaranty book of business.

We include all of the single-family conventional loans that we own and those that back Fannie Mae MBS in the calculation of the

single-family serious delinquency rate.

(3) A troubled debt restructuring (“TDR”) is a restructuring of a mortgage loan in which a concession is granted to a borrower experiencing

financial difficulty.

(4) We generally classify single-family loans as nonaccrual when the payment of principal or interest on the loan is 60 days or more past

due. Includes off-balance sheet loans in unconsolidated Fannie Mae MBS trusts that would meet our criteria for nonaccrual status if the

loans had been on-balance sheet.

(5) Includes held-for-use properties (properties that we do not intend to sell or that are not ready for immediate sale in their current

condition), which are reported in our consolidated balance sheets as a component of “Other assets,” and acquisitions through deeds-in-

lieu of foreclosure.

(6) Consists of the allowance for loan losses for single-family loans recognized in our consolidated balance sheets and the reserve for

guaranty losses related to both loans backing Fannie Mae MBS that we do not consolidate in our consolidated balance sheets and loans

that we have guaranteed under long-term standby commitments. For additional information on the change in our loss reserves see

“Consolidated Results of Operations—Credit-Related (Income) Expense—(Benefit) Provision for Credit Losses.”

(7) Consists of (a) the combined loss reserves, (b) allowance for accrued interest receivable, and (c) allowance for preforeclosure property

taxes and insurance receivables.

(8) Consists of (a) the benefit (provision) for credit losses and (b) foreclosed property income (expense).