Epson 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 Epson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65SEIKO EPSON CORPORATION

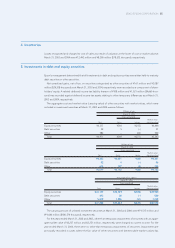

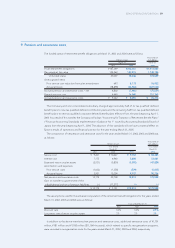

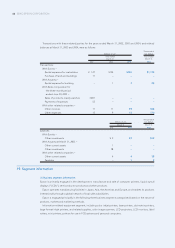

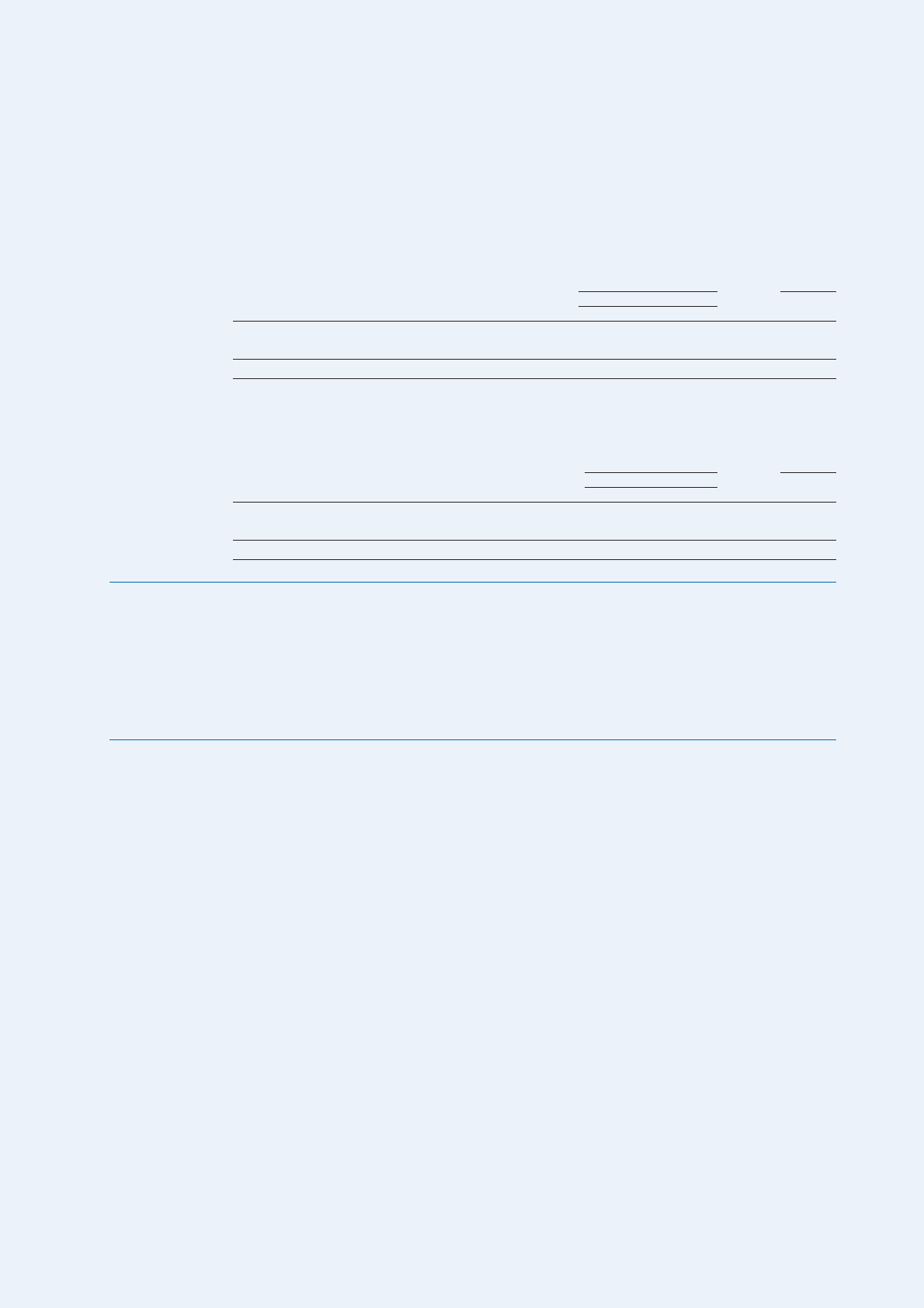

Future lease payments for non-cancelable operating leases as a lessee at March 31, 2003 and 2004 were

as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31,

Future lease payments 2003 2004 2004

Due within one year ¥ 2,983 ¥ 2,729 $ 25,821

Due after one year 10,071 8,511 80,528

Total ¥13,054 ¥11,240 $106,349

In addition, future lease receipts for non-cancelable operating leases as a lessor at March 31, 2003 and 2004

were as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31,

Future lease receipts 2003 2004 2004

Due within one year ¥ 338 ¥ 301 $ 2,848

Due after one year 2,589 2,008 18,999

Total ¥2,927 ¥2,309 $21,847

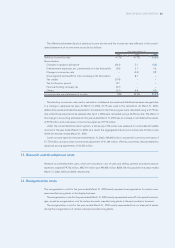

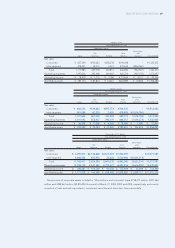

17. Commitments and contingent liabilities

Contingent liabilities for guarantee of employees’ housing loans from banks at March 31, 2003 and 2004 were

¥4,534 million and ¥3,744 million ($35,424 thousand), respectively. Furthermore, the amount of discounted notes,

which consisted of discounted letters of credit, at March 31, 2003 and 2004 were ¥160 million and ¥19 million

($180 thousand), respectively.

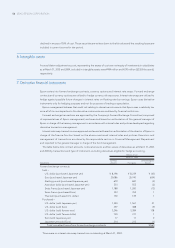

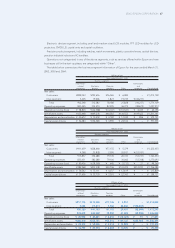

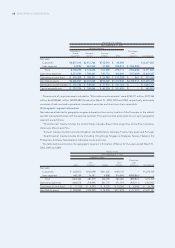

18. Related party transactions

The Company has entered into real estate lease agreements and certain other agreements with K.K. Sunritz

(“Sunritz”) in which Mr. Yasuo Hattori, a Vice Chairman and Director of the Company, and their relatives own

9.5% and 71.3% of the outstanding shares of Sunritz, respectively. The Company has also purchased land and

buildings from Sunritz.

Mr. Yasuo Hattori, a Vice Chairman and Director of the Company, is a representative director of Aoyama Kigyo

K.K. (“Aoyama”). Mr. Yasuo Hattori owns 3.6% of the outstanding shares of the Company. Aoyama owns 10.3%

of the outstanding shares of the Company. Mr. Yasuo Hattori and their relatives own 26.7% and 38.5% of the

outstanding shares of Aoyama, respectively. The Company has entered into lease agreements and certain other

agreements with Aoyama effective from March 1, 2003.

Mr. Koichi Murano, a Statutory Auditor of the Company until June 26, 2001, is also a representative director of

Seiko Corporation. Until June 26, 2001, Seiko Corporation was regarded as a related party of the Company. The

Company sells its products, mainly watches, and pays certain expenses to Seiko Corporation under terms and

conditions stipulated in sales agreements. The Company and Seiko Corporation have also entered into other

various types of agreements. All the transactions and balances stated in the table below are up to June 30, 2001.

The Company’s management believes that all transactions with related parties as described in the

preceding paragraphs and in the table below were in accordance with terms and conditions decided on a

market-determined basis.