Epson 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Epson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEIKO EPSON CORPORATION 45

Net cash used in financing activities was ¥40,918 million. In the prior fiscal year, net cash provided by financing

activities was ¥9,111 million. In the year under review, ¥109,915 million was procured through our initial public

offering and the issuance of common stock through the exercise of a greenshoe option. Furthermore, cash

provided by operating activities was far higher than cash used in investing activities. A large share of these funds

was used for repayment of short-term borrowings and long-term debt. As a result, total short- and long-term

loans fell from ¥609,390 million at the end of the previous fiscal year to ¥457,000 million.

Due to these factors, there was a net increase of ¥72,895 million in cash and cash equivalents.

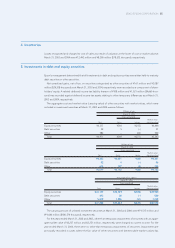

Long-term debt accounts for the majority of Epson’s long-term liabilities. As of March 31, 2004, long-term

debt, excluding the current portion, amounted to ¥346,769 million. Almost all of these loans are unsecured bank

loans with a weighted average interest rate of 1.25% with maturities up to March 2009. Epson also relies on

short-term bank loans and accounts payable as additional sources of liquidity. Epson is party to a line of credit

with four banks to secure an efficient source of working capital in the total maximum amount of ¥40,000 million,

all of which was unused as at March 31, 2004.

Financial Condition

Total assets as at March 31, 2004 were ¥1,206,491 million compared with ¥1,196,080 million as at March 31,

2003. Current assets increased ¥63,859 million while fixed assets decreased ¥53,448 million, mainly the result of

an increase in accumulated depreciation. The increase in current assets was mainly due to a large increase in

cash and cash equivalents, offset in part by a decrease in inventories and notes and accounts receivable, trade.

Total liabilities as at March 31, 2004 decreased to ¥789,582 million from ¥912,156 million as at March 31, 2003.

Current liabilities decreased ¥75,514 million and long-term liabilities decreased by ¥47,060 million. The decrease

in current liabilities was due mainly to decrease in short-term bank loans and the current portion of long-term

debt. A decline in long-term debt was primarily responsible for the decrease in long-term liabilities.

Working capital, defined as current assets less current liabilities, increased from ¥152,223 million as at March

31, 2003 to ¥291,596 million as at March 31, 2004. There were decreases in inventories and notes and accounts

receivable, trade, but increases in cash and cash equivalents, and decreases in short-term bank loans and the

current portion of long-term debt.

The ratio of debt to total assets was 37.9% as at March 31, 2004, well below the 50.9% as at March 31, 2003.