Epson 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Epson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

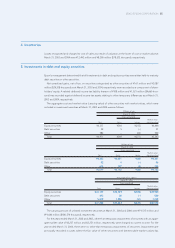

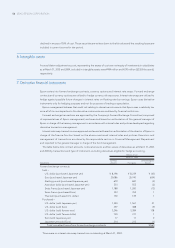

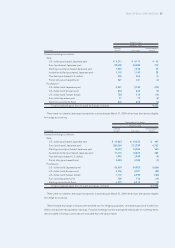

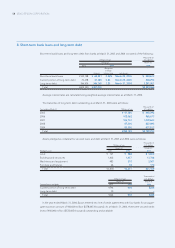

51SEIKO EPSON CORPORATION

Notes to Consolidated Financial Statements

SEIKO EPSON CORPORATION AND SUBSIDIARIES

1. Basis of presenting consolidated financial statements

(1) Background

Seiko Epson Corporation (the “Company”) was originally established as a manufacturer of watches but later

expanded its business to provide key devices and solutions for the digital color imaging markets through the

application of its proprietary technologies. The Company operates its manufacturing and sales business mainly

in Japan, the Americas, Europe and Asia/Oceania.

(2) Basis of presenting consolidated financial statements

The Company and its subsidiaries in Japan maintain their records and prepare their financial statements in

accordance with accounting principles generally accepted in Japan while its foreign subsidiaries maintain their

records and prepare their financial statements in conformity with accounting principles generally accepted in

their respective country of domicile.

The accompanying consolidated financial statements of the Company and its consolidated subsidiaries and

affiliates (collectively “Epson”) are prepared on the basis of accounting principles generally accepted in Japan,

which are different in certain respects as to application and disclosure requirements of International Financial

Reporting Standards, and are compiled from the consolidated financial statements prepared by the Company

as required by the Securities and Exchange Law of Japan.

The accompanying consolidated financial statements incorporate certain reclassifications and rearrangements

in order to present them in a form that is more familiar to readers outside Japan. In addition, the notes to the

consolidated financial statements include information that is not required under generally accepted accounting

principles in Japan, but which is provided herein as additional information. However, none of the reclassifica-

tions nor rearrangements have a material effect on the financial statements.

2. Summary of significant accounting policies

(1) Consolidation and investments in affiliates

The accompanying consolidated financial statements include the accounts of the Company and those of its

subsidiaries that are controlled by Epson. Under the effective control approach, all majority-owned companies

are to be consolidated. Additionally, companies in which share ownership equals 50% or less may be required to

be consolidated in cases where such companies are effectively controlled by other companies through the

interests held by a party who has a close relationship with the parent in accordance with Japanese accounting

standards. All significant inter-company transactions and accounts and unrealized inter-company profits are

eliminated upon consolidation.

Investments in affiliates in which Epson has significant influence are accounted for using the equity method.

Consolidated income includes Epson’s current equity in net income or loss of affiliates after elimination of unre-

alized inter-company profits.

The excess of the cost over the underlying net equity of investments in subsidiaries and affiliates accounted

for under the equity method is recognized as a “consolidation adjustment” included in the intangible assets

account and is amortized on a straight-line basis over a period of five years.

(2) Foreign currency translation and transactions

Foreign currency transactions are translated using foreign exchange rates prevailing at the respective transac-

tion dates. Receivables and payables in foreign currencies are translated at the foreign exchange rates prevail-

ing at the respective balance sheet dates.

All the assets and liabilities of foreign subsidiaries and affiliates are translated at the foreign exchange rates

prevailing at the respective balance sheet dates, and all the income and expense accounts are translated at the

average foreign exchange rates for the respective periods. Foreign currency financial statement translation

differences are recorded in the consolidated balance sheet as a separate component of shareholders’ equity.