Electrolux 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Electrolux annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 Summary

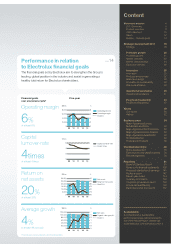

• Organic sales growth of 4.5%.

• Strong performance for Major Appliances North America.

• Weak market conditions in Europe and unfavourable currency

movements impacted earnings.

• A year of extensive product launches in several markets and

product mix improvements.

• The Board proposes an unchanged dividend of SEK6.50 per share.

page 54

page 28

page 22

Strong

organic sales

growth

Net sales

+4.5%

Sales growth in most regions except

for Europe. Growth was particularly

strong in North America, Asia/Pacific

and Latin America. Product launches

and price increases contributed to

the positive sales trend.

Operating margin

3.7%

Operating income, excluding items

affecting comparability, amounted to

SEK4,055m corresponding to a

margin of 3.7%. Increased sales in

most regions and product-mix

improvements positively contributed

to operating income, while continued

weak markets in Europe and

unfavourable currency development

had a negative impact. 2013 was a

year with extensive product launches

across most markets. The

significance of sales in growth

markets is increasing. Electrolux aims

to increase this share to 50% of sales.

35%65%

Our products

Electrolux is the only

appliance manufacturer

in the industry to offer

complete solutions for

both consumers and

professionals. The focus

is on innovative and

energy- efficient products

in the premium segments.

Share of

Group sales

Kitchen 60%

3%

2%

Laundry 17%

Small appliances 8%

Adjacent product categories 10%

Business areas

The Group’s products

are sold in more than

150 markets. The larg-

est of these are in

Europe and North

America. Electrolux is

expanding its presence

in growth markets, such

as Latin America,

Africa, the Middle East

and Asia.

Share of

Group sales

Major Appliances

Europe, Middle East and Africa 31%

Major Appliances

North America 29%

Major Appliances

Latin America 19%

Major Appliances

Asia/Pacific 8%

Small Appliances 8%

Professional Products 5%

Proffessional kitchen, 3%

Proffessional laundry, 2%

Electrolux growth markets

Electrolux core markets

Share of Group sales

6ANNUAL REPORT 2013

Vision and mission