Electrolux 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Electrolux annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

2013

Table of contents

-

Page 1

2013 Annual Report -

Page 2

... the best appliance company as measured by our customers Customer value is based on the products and the services Electrolux provides. Innovative products, closely based on the Group's professional expertise, are launched at an increasing pace across the globe. Cover: In 2013, Electrolux launched... -

Page 3

-

Page 4

... vision is to be the best appliance company as measured by our employees Dedicated employees from diverse backgrounds play a crucial role in creating an innovative corporate culture. Growth, innovation and operational excellence always begin with people. The Electrolux CombiSteam Sous-vide oven is... -

Page 5

-

Page 6

... be the best appliance company as measured by our shareholders The combination of continuous growth, high profitability, a stable cashflow, and a small capital base generates a high total return for shareholders. Over the past five years, the average annual total return on the Electrolux share was... -

Page 7

-

Page 8

... and professionals. The focus is on innovative and energy-efficient products in the premium segments. Proffessional kitchen, 3% Proffessional laundry, 2% Share of Group sales 65% 35% Adjacent product categories 10% Electrolux growth markets Electrolux core markets 6 ANNUAL REPORT 2013 -

Page 9

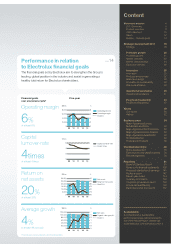

... People and leadership People and leadership Values Our values History Business areas Major Appliances Europe, Middle East and Africa Major Appliances North America Major Appliances Latin America Major Appliances Asia/Pacific Small Appliances Professional Products Capital turnover-rate Goal 4 times... -

Page 10

..., innovative solutions for households and businesses, with products such as refrigerators, dishwashers, washing machines, cookers, vacuum cleaners, air conditioners and small domestic appliances. Under esteemed brands including Electrolux, AEG, Zanussi, Frigidaire and Electrolux Grand Cuisine... -

Page 11

... machines and tumble-dryers are the core of the Electrolux product offering for washing and garment care. Demand is driven by innovations and a growing preference for capacity, user-friendliness and resource efficiency. page 30 Professional laundry, 2% 8% Share of Group sales Small appliances... -

Page 12

... growth path going forward in order to achieve our vision to be the best appliance company as measured by our customers, our employees and our shareholders. Short facts Electrolux Organic growth 2013 Sales growth, since 2011 Growth markets, of sales Operating margin 4.5% 10 ANNUAL REPORT 2013 15... -

Page 13

... three main brands AEG, Zanussi and Electrolux. The last one was the Electrolux Inspiration Range, which by the end of 2013 has been launched in all markets in Europe. In Major Appliances North America we had a number of product launches. New distribution channels were also successfully opened that... -

Page 14

... best appliance company in the world as measured by customers, employees, and shareholders. Customers - Customers' perception of Electrolux is based on the products the Group sells and the service it provides. The pace of innovation and the number of product launches have increased in recent years... -

Page 15

... 4% annually page 14-15 Strategy How we want to do it Profitable growth Innovation Products and services Brand and design Sustainability Operational excellence page 16-47 People and leadership Values The base for our work Core values Foundation Passion for Innovation Customer Obsession... -

Page 16

... in 2013, although Major Appliances North America and Professinal Products showed an operating margin well above 6%. Capital turnover-rate of at least 4 times Electrolux strives for an optimal capital structure in relation to the Group's goals for profitability and growth. In recent years, work on... -

Page 17

... annually In order to reach the growth goal, the Group continues to strengthen its positions in the premium segment, expand in profitable high-growth product categories, increase sales in growth regions and develop service and after-market operations. More rapid implementation of the growth strategy... -

Page 18

Electrolux Gourmet Range enables home cooks to enhance their skills and express their creativity with inspired dishes. The Gourmet range of kitchen appliances was launched in 2013 in partnership with Poggenpohl. -

Page 19

Strategic development 2013 Strategy Profitable growth Innovation Operational excellence People and leadership 18 20 28 40 44 -

Page 20

...high-growth product categories, developing service and after-market operations and reducing complexity and costs in manufacturing. Despite intense competition, Electrolux captured market shares in Latin America and in several key product segments in North America, Europe and Asia in 2013. Innovation... -

Page 21

... transforming the global market for household appliances. Electrolux has a number of competitive advantages, such as its global presence in over 150 countries, that make the Group well positioned to benefit from this trend. Electrolux aims to increase the emerging markets' share of Group sales to at... -

Page 22

Strategic development 2013 Profitable growth Electrolux focus is on increasing the share of sales in growth regions, strengthening the position in core markets and in the global premium segment, expanding in profitable high-growth product categories, developing service and after-market operations ... -

Page 23

.... New/adjacent product categories Adjacent product categories, such as air care, water heaters, accessories and small domestic appliances, have substantial growth potential. The Group's offerings in these product categories have increased substantially in recent years. ANNUAL REPORT 2013 21 -

Page 24

... is already as important as Europe or North America and is growing fast. As a key part of the Group's growth strategy, Electrolux made its biggest product launch in 2013 in China, with more than 60 new products for kitchen and laundry. Electrolux net sales in growth markets SEKm 35,000 28,000 21... -

Page 25

... 1,750 million  Electrolux core markets Western Europe North America Australia, New Zealand, Japan 600 million  Electrolux growth markets Africa, Middle East, Eastern Europe Latin America Southeast Asia, China 100 million people Increasing global demand for major appliances, million units... -

Page 26

Strategic development 2013 Profitable growth Market characteristics Core markets Western Europe North America Australia, New Zealand and Japan A mature, homogenous market with high penetration that is dominated by replacement products. Large homes allow space for many household appliances, ... -

Page 27

... Small appliances Professional products Market value SEKbn 500 400 300 200 100 0 Major appliances Floor care Professional products Product penetration % of households 100 80 60 40 20 0 s es er ns ers tor hin ok ash ove era ac Co hw ave frig gm Dis ow Re icr shin a M W rs ers ne Dry itio nd -co Air... -

Page 28

... ï® Small appliances ï® Professional food-service and laundry equipment ï® Major appliances ï® Small appliances ï® Professional food-service and laundry equipment Consumer brands Consumer brands Consumer brands Electrolux market shares 17% core appliances 12% floor care Leadership position... -

Page 29

... years due to a strong product offering, market growth and the acquisition of CTI in Chile in 2011. Electrolux sales in Southeast Asia and China are growing. The Group's market-leading position in front-load washing machines has been leveraged to expand the business to kitchen appliances. In 2013... -

Page 30

Strategic development 2013 Innovation In the Electrolux CombiSteam SousVide oven dishes are vacuum sealed before being steam-cooked at low temperatures. -

Page 31

... (refrigerators, freezers) Hot (cookers, hobs, ovens) Dish Professional food-service equipment Electrolux kitchen products account for almost two-thirds of the Group's sales and the company holds strong positions in all major categories of kitchen appliances and commands significant global market... -

Page 32

... as commercial laundries. The majority of sales in the professional market is generated in Europe, although the most rapid increase in sales is taking place in the US, Southeast Asia and Japan. Electrolux develops innovative solutions for washing machines and tumble-dryers for households based on... -

Page 33

...just a few percentage points. In 2013, a new product range was launched in Europe that included items such as baking trays, cleaning fluids for hobs and digital thermometers. Air-conditioning equipment and water heaters Although the global market for air-conditioners and water heaters is of the same... -

Page 34

...positions held by the Group include the market for frontload washing machines and dishwashers, which are segments with low penetration in most markets. Among adjacent product categories, Electrolux identifies major global potential for air-conditioning equipment and water heaters. 32 ANNUAL REPORT... -

Page 35

... of a product's sales value that comprises service, consumables and sales of accessories is to increase to a minimum of 10%. Innovation Triangle ⶠDevelop best-in-class products ⷠ70% Preference Rule ⸠Reduce Time to Market by 30% ⹠Continue investing in premium brands R&D costs compared... -

Page 36

... to the Group's professional expertise, new, innovative consumer products are being launched in the premium segment across the world. 8 Strategic brands Global and strategic brands in major appliances are to increase value. Investments will be made in premium brands in all markets. Electrolux aims... -

Page 37

...Frigidaire, Grand Cuisine, Molteni, Westinghouse and Zanussi. AEG holds a leading position in appliances in Germany, Austria and the Benelux countries built on a long history and a strong focus on design and quality. In North America, Frigidaire is the Group's brand for appliances in the mass-market... -

Page 38

... leading products against the total range. A key challenge is to meeting increasing demand for energy and cost-efficient appliances by transfering innovation rapidly from the premium to the mass-market segment. To build increased consumer awareness of the value of efficient appliances, Electrolux... -

Page 39

... to meet the increasing demand for energy and cost-efficient appliances. In 2013, the Green Range represented 12% of products sold and 24% of gross profit. A key challenge is to rapidly transfer innovation from the premium to the mass-market segment. Sustainability Awards 2013 ANNUAL REPORT 2013... -

Page 40

... improve management of limited water resources. Two years ahead of schedule, the Group achieved its 2014 goal of a 20 percent reduction in water consumption in operations. During 2013 and together with WWF, Electrolux mapped water-related risks associated with Group factories. As a result, new and... -

Page 41

... cycle Recycling Materials Manufacturing Transportation 1% 9% 1% 1% Product usage 88 % AEG Ã-koKombi, the world's first washer-dryer with heat pump technology. The AEG Ã-koKombi washer-dryer has an A-40% energy rating which is the best in the market. The product life-cycle approach guides the... -

Page 42

...of the Group's household appliances are currently manufactured in low-cost areas (LCA). Since 2004, about 35% of the Group's manufacturing in high-cost areas (HCA) has been discontinued or moved, primarily from Western Europe and the US to existing or new units in such countries as Thailand, Hungary... -

Page 43

... 2013, a new cooker plant was opened in Memphis, Tennessee in the US, and a refrigerator plant was opened in Rayong, Thailand. A decision was taken to close down the plant for refrigerators and freezers in Orange, Australia, and to concentrate production to the plant in Thailand. In Latin America... -

Page 44

... of the Group's products. Developing products based on global platforms leads to greater ef ficiency not only in product development and marketing, but also in production, since fewer product platforms are required. Capital efficiency For several years, Electrolux has been working intensively to... -

Page 45

...These new production centers have been established both to reduce costs and to support strategic growth markets in Asia, Mexico, Latin America, Eastern Europe and Northern Africa. % 66% Proportion of production in low-cost regions 28% 04 05 06 07 08 09 10 11 12 13 ANNUAL REPORT 2013 43 -

Page 46

... 2013 People and leadership An innovative corporate culture with dedicated employees from diverse backgrounds provides the right foundation to develop successful products for consumers across the globe. Employee passion for innovation, consumer insight and motivation to achieve results set... -

Page 47

... during their meetings with customers and colleagues around the globe. Employees by geographic area 2013 Western Europe, 22% North America, 16% Australia, New Zealand and Japan, 3% Africa, Middle East and Eastern Europe, 24% Latin America, 30% Southeast Asia and China, 5% ANNUAL REPORT 2013 45 -

Page 48

Strategic development 2013 People and leadership Ethics, integrity and human rights In 2013, Electrolux continued to intensify its efforts regarding human rights. A major part of this comprised adapting the operations of companies acquired in 2011 - Olympic Group in Egypt and CTI in Chile - in ... -

Page 49

The following awards are presented at The Electrolux Award Day Sustainability Award Digital Marketing Excellence Award 360 Marketing Excellence Award Industrial Design Award EMS Best Practice Award Product Award Invention Award Customer Care Award People Leadership Award Sales Excellence Award The ... -

Page 50

Three core values clearly distinguish Electrolux: Passion for Innovation, Customer Obsession and Drive for Results. -

Page 51

Our Values -

Page 52

... with the Electrolux code of business ethics. Safety and Sustainability • We seek and encourage actions that contribute to a safe and sustainable environment. • We are willing to compromise short-term results at individual units to achieve sustainable Group results. 50 ANNUAL REPORT 2013 -

Page 53

... is key to our success. We are constantly looking for new opportunities and new ways to go forward. We are always open to better ways of doing things. We are not afraid of taking risks. An innovation may be anything new and different that improves the customer experience or otherwise benefits the... -

Page 54

... is why we are going to cool with air, because we all have access to that." In 2013, Electrolux launched new refrigerators featuring the best professional technology to create optimal air humidity and preserve fresh food for longer. 1912 Lux I 2012 Ultra One Mini 1901 AB Lux was founded. 1912... -

Page 55

... 1994 Appliance manufacturer AEG is acquired. 2001 The household appliance division of Australian company Email is acquired. 2011 Appliance manufacturers Olympic Group in Egypt, and CTI in Chile, are acquired. The share of the Group's sales in growth markets increases rapidly. ANNUAL REPORT 2013... -

Page 56

Electrolux is continuing to launch intelligently designed and high-performing professional products. Competence from the professional operation is continually transferred to consumer appliances. -

Page 57

Business Areas Major Appliances Europe, Middle East and Africa North America Latin America Asia/Pacific Small Appliances Professional Products 56 58 60 62 64 66 -

Page 58

... across all markets in Europe. In 2013, a new product series, the Electrolux Gourmet Range, was launched. This range is positioned between the ultra-luxury Electrolux Grand Cuisine, professional cooking system for home use, and the Electrolux Inspiration Range in the premium segment. New steam ovens... -

Page 59

...launched in Europe under the Electrolux and AEG brands. Sous-vide is an example of Electrolux professional technology being introduced in a premium domestic product. It is aimed at foodies - people who are genuinely passionate about cooking. Air conditioners A range of air conditioners was launched... -

Page 60

... in the market by offering new innovative products across several price segments and brands. Jack Truong Head of Major Appliances North America Share of net sales 2013 Share of operating income Market position • Major Appliances 23% 29% Electrolux commands a strong position in the US and Canada... -

Page 61

...new products under the Frigidaire brands, such as kitchen appliances with the Smudge-Proof Stainless Steel Range and the 50/50 Symmetry Double Oven. Market demand for 2013 compared to 2012 Electrolux markets and average number of employees 2013 North America Egypt Appliances Major 12,597 ANNUAL... -

Page 62

... its innovative products and close collaboration with marketleading retail chains. Ruy Hirschheimer Head of Major Appliances Latin America Share of net sales 2013 Share of operating income Market position • Electrolux has a leading position in Brazil and Argentina, and the number one position in... -

Page 63

... a new option for urban consumers with a lack of space, that need a complete, compact, silent and high-performance product, which washes small loads and delicate clothes. Market demand for 2013 compared to 2012 Electrolux markets and average number of employees 2013 Brazil Egypt Major Appliances... -

Page 64

...-efficient products. Refrigerators from the newly opened factory in Thailand further strengthened Electrolux position in Southeast Asia in 2013. Efficient manufacturing Over the past number of years, Electrolux has worked to streamline manufacturing and, in early 2013, the Group's new production... -

Page 65

... market is already as important as Europe or North America and is growing fast. As a key part of the Group's growth strategy, Electrolux made its biggest product launch in 2013 in China, with more than 60 new products for kitchen and laundry. The new range includes refrigerators, washing machines... -

Page 66

...ever broader product portfolio. A large number of new products were launched in 2013. Henrik Bergström Head of Small Appliances Share of net sales 2013 Share of operating income Market position • Leading positions in Europe, North America and Latin America 8% The Group holds leading positions in... -

Page 67

... called 'Now You Are Cooking'. A third generation of Ergorapido was launched in Japan, which is the largest market for the product. Market demand for 2013 compared to 2012 Electrolux markets and average number of employees 2013 Europe North America Egypt Small Appliances 2,683 ANNUAL REPORT... -

Page 68

...fast-food chain market. Sales increases were especially noted in North America, China, Eastern Europe, the Middle East and in Southeast Asia. Electrolux continues to launch intelligently designed and high-performing products. The innovation driver for laundry equipment is strongly linked to the goal... -

Page 69

... competitive position in the market for professional cooking ranges. Hood type dishwasher Electrolux green&clean Market demand for 2013 compared to 2012 Electrolux markets and average number of employees 2013 Europe Emerging markets Egypt Professional Products 2,595 ANNUAL REPORT 2013 67 -

Page 70

Electrolux mission is to create sustainable economic value and to increase return for all its stakeholders. Over the past 10 years, Electrolux shares have generated a compounded annual total return of 13%. -

Page 71

The Electrolux Share The Electrolux share Electrolux and the capital markets Managing risks 70 74 76 -

Page 72

... expenditures, divided by the average number of shares after buy-backs. 8) 9) Market capitalization excluding buy-backs, plus net borrowings and non-controlling interests, divided by operating income. Trading price in relation to earnings per share. Continuing operations. 70 ANNUAL REPORT 2013 -

Page 73

... goals and strategy • China launch started • Measures to consolidate selected operations in Small Appliances • Continued launch of the Inspiration Range across Europe • Intensive launch period and marketing spend in North America • Investments related to new range product launch in Asia... -

Page 74

....electrolux.com/ownership-structure Shareholders by country P/E ratio and dividend yield % Sweden, 58% UK, 15% USA, 13% Other, 14% 30 25 20 15 10 5 04 05 06 07 08 09 10 11 12 13 As of December 31, 2013, approximately 42% of the total share capital was owned by foreign investors. Source: Euroclear... -

Page 75

... Electrolux shares were traded daily on Nasdaq OMX Stockholm. DJSI World Index Electrolux - a leader in the consumer durables industry The Group's sustainability performance and strategy help attract and strengthen relations with investors. In 2013 and for the seventh consecutive year, Electrolux... -

Page 76

...'s head office in Stockholm, Sweden, as well as in the form of roadshows, primarily in major financial markets in Europe and the US. Electrolux also interacts daily with the capital markets. Furthermore, Electrolux arranges Capital Markets Days and the Annual General Meeting, providing shareholders... -

Page 77

... the Group is accelerating its product innovation and launches across all major markets. In North America, investments related to the new cooking plant in Memphis, Tennessee, and ramp-up costs for new channel expansion were continued. In Europe, the launch of the Electrolux branded Inspiration Range... -

Page 78

... and increase shareholder return is based on three elements: innovative products, strong brands and cost-efficient operations. Realizing this potential requires effective and controlled risk management. Fluctuation in demand In 2013, demand for appliances in the North American market showed... -

Page 79

...major increases in credit losses for Electrolux. Electrolux has a comprehensive process for evaluating credits and monitoring the financial situation of customers. Authority for approving and responsibility to manage credit limits are regulated by the Group's credit policy. A global credit insurance... -

Page 80

... USD/BRL Latin America The principal currency pair for the Latin American operations is the USD/BRL. Purchases of raw materials and components are to a large extent priced in USD. The products are then sold in BRL. A weak BRL compared with the USD is negative for the Group. 78 ANNUAL REPORT 2013 -

Page 81

Principal currency pairs Electrolux (transaction effects) Europe The principal currency in Europe is the EUR. A weak EUR has a positive net effect on Group income, because European operations have greater expenses in EUR than sales in EUR. A majority of the purchases of raw materials and components ... -

Page 82

The compact wall-mounted washer Mini Silent was launched in Latin America during 2013. With a 3-kg wash load, it is ideal for households with limited space. -

Page 83

... to repurchase own shares. Key data SEKm 2012 2013 Change, % Net sales Operating income Margin, % Income after financial items Income for the period Earnings per share, SEK1) Dividend per share, SEK Net debt/equity ratio Return on equity, % Average number of employees Excluding items affecting... -

Page 84

... Electrolux Group in 2013 was 4.5%. All business areas showed sales growth except for Major Appliances Europe, Middle East and Africa. Sales growth were particularly strong for major appliances in Asia/Pacific, North America and Latin America. The negative trend in market conditions in core markets... -

Page 85

... range of appliances for the premium segment. In North America, a number of products were launched under the Electrolux, Frigidaire and Eureka brands. A wide range of new products within small domestic appliances and vacuum cleaners were launched across most markets. Capital turnover-rate times... -

Page 86

... seen in Asia/Pacific, North America and Latin America. 2013 was a year with extensive launches of new products across most markets. Net sales and operating margin SEKm 125,000 100,000 75,000 50,000 25,000 0 09 10 11 12 13 % 7.5 6.0 4.5 3.0 1.5 0.0 1) Effects of changes in exchange rates Changes in... -

Page 87

..., 29 11 11 23 34 -1,532 -2 -1,477 -2,343 22 2,362 3 671 1 26 -4 20 8.26 8.24 20 285.9 286.6 374 -4 2.35 2.34 286.2 287.3 Amounts for 2012 have been restated where applicable as a consequence of the amended standard for pension accounting, IAS 19 Employee Benefits. ANNUAL REPORT 2013 85 -

Page 88

... as professional users. Products for consumers comprise major appliances, i.e., refrigerators, freezers, cookers, dryers, washing machines, dishwashers, room air-conditioners and microwave ovens, floor-care products and small domestic appliances. Professional products comprise food-service equipment... -

Page 89

... number of employees Major Appliances North America Market demand in North America for core appliances increased by 9% in 2013 compared with 2012. Market demand for major appliances including microwave ovens and home-comfort products, such as room air-conditioners increased by 5% in 2013 year... -

Page 90

... appliances. The organic sales growth in Latin America was mainly driven by price increases and an improved customer mix. The fire in September 2013 at Electrolux warehouse for refrigerators and freezers in Curitiba, Brazil, impacted sales volumes negatively in the latter part of the year. Operating... -

Page 91

...impacted results negatively in 2013, while price increases and mix improvements made a positive contribution. The market introduction of the ultra-luxury product range, Electrolux Grand Cuisine, continued throughout the year. Key figures SEKm 2012 2013 Net sales and operating margin 5,571 -3.9 588... -

Page 92

... and working capital, etc. December 31, 2013 25,890 -843 -1,967 -1,467 3,535 -3,356 2,964 24,961 SEKm Inventories Trade receivables Accounts payable Provisions Prepaid and accrued income and expenses Taxes and other assets and liabilities Working capital Property, plant and equipment Goodwill... -

Page 93

...,194 78 1,610 20,607 1,331 12,886 2,733 194 3,034 40,785 61,693 76,001 69 1,458 19 25 94 1,276 Amounts for 2012 have been restated where applicable as a consequence of the amended standard for pension accounting, IAS 19 Employee Benefits. ANNUAL REPORT 2013 91 -

Page 94

board of directors' report Cont. Financial position Net debt Net debt SEKm Dec. 31, 2012 Dec. 31, 2013 Borrowings Liquid funds Financial net debt Net provisions for post-employment benefits Net debt Net debt/equity ratio Equity Equity per share, SEK Return on equity, % Equity/assets ratio, % 13,... -

Page 95

...transactions with equity holders Closing balance, December 31, 2012 Income for the period Available for sale instruments Cash flow hedges Exchange-rate differences on translation of foreign operations Remeasurement of provisions for post-employment benefits Income tax relating to other comprehensive... -

Page 96

... business area SEKm 2012 2013 1,000 0 09 10 11 12 13 Major Appliances Europe, Middle East and Africa % of net sales North America % of net sales Latin America % of net sales Asia/Pacific % of net sales Small Appliances % of net sales Professional Products % of net sales Other Total % of net sales... -

Page 97

... 206 -325 18 18 2,569 -3,063 -1,868 212 -2,269 109 6,966 -240 6,835 -25 1,151 3,039 -1,851 -1,860 - 454 175 6,835 -403 6,607 Amounts for 2012 have been restated where applicable as a consequence of the amended standard for pension accounting, IAS 19 Employee Benefits. ANNUAL REPORT 2013 95 -

Page 98

... products in Asia/Pacific resulted in the decision to close the factory in Orange, Australia, and to concentrate production to the plant in Rayong, Thailand. Execution started in the fourth quarter of 2013. Overhead-cost reduction In order to adapt the overhead-cost structure to the current market... -

Page 99

.... Investor AB Alecta Pension Insurance Swedbank Robur Funds AMF Insurance & Funds Government of Norway Didner & Gerge Funds SHB funds Second Swedish National Pension Fund Unionen SEB funds Total, ten largest shareholders Board of Directors and Group Management, collectively Source: Euroclear Sweden... -

Page 100

... adapt the Group's capital structure, thus contributing to increased shareholder value and to use these shares to finance potential company acquisitions and as a hedge for the company's share-related incentive programs. In accordance with the proposal by the Board of Directors, the AGM 2013 decided... -

Page 101

... factor in terms of the development in the future. Price competition Most of the markets in which Electrolux operates features strong price competition. Some of Electrolux markets experienced strong price pressure during 2013. The Group's strategy is based on innovative products and brand-building... -

Page 102

...the Talent Management program, succession planning, the internal Open Labor Market, and the web-based Employee Engagement Survey. Code of Conduct The Group has a Code of Conduct that defines high employment standards for all Electrolux employees in all countries and business sectors. It incorporates... -

Page 103

... for the Group established by the Board for (i) earnings per share, (ii) return on net assets and (iii) organic sales growth, for the 2014 financial year. The proposed program will include up to 225 senior managers and key employees. Allocation of performance-based shares, if any, will take place in... -

Page 104

...with reference to both acquisitions of new plants and continuous operations. Potential non-compliance, disputes or items that pose a material financial risk are reported to Group level in accordance with Group policy. No such significant item was reported in 2013. Electrolux products are affected by... -

Page 105

... of the Group's head office, as well as five companies operating on a commission basis for AB Electrolux. As from 2013, the main financial flows for the business area Major Appliances Europe, Middle East and Africa are included in the parent company reporting, which affects the financial statements... -

Page 106

board of directors' report Parent Company balance sheet SEKm Note December 31, 2012 December 31, 2013 ASSETS Non-current assets Intangible assets Property, plant and equipment Deferred tax assets Financial assets Total non-current assets Current assets Inventories Receivables from subsidiaries ... -

Page 107

Parent Company change in equity Restricted equity SEKm Share capital Statutory reserve Non-restricted equity Fair value reserve Retained earnings Total equity Opening balance, January 1, 2012 Income for the period Available for sale instruments Cash flow hedges Income tax relating to other ... -

Page 108

board of directors' report Parent Company cash ï¬,ow statement SEKm 2012 2013 Operations Income after financial items Depreciation and amortization Capital gain/loss included in operating income Share-based compensation Group contributions Taxes paid Cash ï¬,ow from operations, excluding change in... -

Page 109

... valuation principles Financial risk management Segment information Net sales and operating income Other operating income Other operating expenses Items affecting comparability Leasing Financial income and financial expenses Taxes Other comprehensive income Property, plant and equipment Goodwill and... -

Page 110

... financial statements were authorized for issue by the Board of Directors on January 30, 2014. The balance sheets and income statements are subject to approval by the Annual General Meeting of shareholders on March 26, 2014. Principles applied for consolidation The acquisition method of accounting... -

Page 111

... the Group's key strategies is to develop Electrolux into the leading global brand within the Group's product categories. This acquisition has given Electrolux the right to use the Electrolux brand worldwide, whereas it previously could be used only outside of North America. All other trade- marks... -

Page 112

... course of business less the estimated costs of completion and the estimated costs necessary to make the sale at market value. The cost of finished goods and work in progress comprises development costs, raw materials, direct labor, tooling costs, other direct costs and related production overheads... -

Page 113

...the grants will be received. Government grants are included in the balance sheet as deferred income and recognized as income matching the associated costs the grant is intended to compensate. New or amended accounting standards in 2013 IAS 1 Financial Statement Presentation: Presentation of Items of... -

Page 114

... standards The International Financial Reporting Interpretation Committee (IFRIC) has not issued any new interpretations that are applicable to Electrolux. Critical accounting policies and key sources of estimation uncertainty Use of estimates Management of the Group has made a number of estimates... -

Page 115

...on page 123. Note 2 Financial risk management Financial risk management The Group is exposed to a number of risks coming from liquid funds, trade receivables, customer-financing receivables, payables, borrowings, commodities and foreign exchange. The risks are primarily: ANNUAL REPORT 2013 113 -

Page 116

...weighted cost of capital and sufficient credit worthiness where operating needs and the needs for potential acquisitions are considered. To achieve and keep an efficient capital structure, the Financial Policy states that the Group's long-term ambition is to maintain a long-term rating within a safe... -

Page 117

... include vacuum cleaners and other small appliances. Professional products have one reportable segment. Net sales 2012 2013 Operating income 20121) 2013 Major Appliances Europe, Middle East and Africa Major Appliances North America Major Appliances Asia/Pacific Small Appliances Common Group costs... -

Page 118

..., 20121) 2013 Major Appliances Europe, Middle East and Africa Major Appliances North America Major Appliances Latin America Major Appliances Asia/Pacific Small Appliances Professional Products Other2) Liquid funds Interest-bearing liabilities Pension assets/liablities Equity Total 1) 2) 22,800 12... -

Page 119

... the production system in Major Appliances Europe, Middle East and Africa and additional costs for pensions related to the closure of the plant in L'Assomption in Canada. Other operating expenses Group 2012 2013 Parent Company 2012 2013 Loss on sale of: Property, plant and equipment Operations and... -

Page 120

... Amounts for 2012 have been restated where applicable as a consequence of the amended standard for pension accounting, IAS 19 Employee Benefits. Interest income from others, for the Group and the Parent Company, includes gains and losses on financial instruments held for trading. Interest expense... -

Page 121

... where applicable as a consequence of the amended standard for pension accounting, IAS 19 Employee Benefits. Other deferred tax assets include tax credits related to the production of energy-efficient appliances amounting to SEK 573m (241). Note 11 Other comprehensive income Group 20121) 2013... -

Page 122

... equipment Plants under construction Total Acquisition costs Opening balance, January 1, 2012 Acquired during the year Acquisition of operations Transfer of work in progress and advances Sales, scrapping, etc. Exchange-rate differences Closing balance, December 31, 2012 Acquired during the year... -

Page 123

... intangible assets Parent company Trademarks, program software, etc. Other Acquisition costs Opening balance, January 1, 2012 Acquired during the year Acquisition of operations Internally developed Reclassification Fully amortized Write-off Exchange-rate differences Closing balance, December 31... -

Page 124

... have been restated where applicable as a consequence of the amended standard for pension accounting, IAS 19 Employee Benefits. Note 15 Inventories Group December 31, 2012 2013 Parent Company December 31, 2012 2013 Raw materials Products in progress Finished products Advances to suppliers Total... -

Page 125

..., 2012 2013 Additional and complementary information is presented in the following notes to the Annual Report: Note 1, Accounting and valuation principles, discloses the accounting and valuation policies adopted. Note 2, Financial risk management, describes the Group's risk policies in general and... -

Page 126

... in the Group's balance sheet. Short-term borrowings pertain mainly to countries with capital restrictions. The average maturity of the Group's long-term borrowings including longterm borrowings with maturities within 12 months was 3.3 years (3.1), at the end of 2013. The table below presents the... -

Page 127

... 76m (95) are included in the item Trade receivables in the consolidated balance sheet. The Group's customer-financing activities are performed in order to provide sales support and are directed mainly to independent retailers in Scandinavia. The majority of the financing is shorter than 12 months... -

Page 128

... provision of trade receivables and payables are assumed to approximate their fair values. The fair value of financial liabilities is estimated by discounting the future contractual cash flows at the current market-interest rate that is available to the Group for similar financial instruments. The... -

Page 129

... Note 19 Assets pledged for liabilities to credit institutions Group December 31, 2012 2013 Parent Company December 31, 2012 2013 Real-estate mortgages Other Total 73 5 78 63 6 69 - - - - - - The major part of real-estate mortgages is related to Brazil. In the process of finalizing the tax... -

Page 130

... Parent Company December 31, 2012 Appropriations December 31, 2013 Accumulated depreciation in excess of plan Brands Licenses Machinery and equipment Buildings Other Total Group contributions Total Appropriations 349 122 85 2 23 581 -28 - 1 -1 5 -23 -164 -187 321 122 86 1 28 558 128 ANNUAL REPORT... -

Page 131

...Norway. The pension plans in France and Italy are mainly unfunded. The Norwegian pension plans are funded and in Canada there are both funded and unfunded pension plans. A mix of final salary and career average exists in these countries. Some plans are open for new entrants. ANNUAL REPORT 2013 129 -

Page 132

... person in number of years. General inflation impacting salary and pensions increase. For USA Medical, the number refers to the inflation of health-care benefits. Includes settlement gains of SEK 143m in the USA and special events amounting to SEK 19m in various countries. 130 ANNUAL REPORT 2013 -

Page 133

... 3,170 The inflation change feeds through to other inflation-dependant assumptions, i.e., pension increases and salary growth. In 2014, the Group expects to pay a total of SEK 308m in contributions to the pension funds and as payments of benefits directly to the employees. ANNUAL REPORT 2013 131 -

Page 134

... company to offset pension costs. Change in the present value of deï¬ned beneï¬t pension obligation for funded and unfunded obligations Funded Unfunded Total Opening balance, January 1, 2012 Current service cost Interest cost Benefits paid Closing balance, December 31, 2012 Current service cost... -

Page 135

...(59). 2012 2013 Current service cost Interest cost Total expenses for deï¬ned beneï¬t pension plans Insurance premiums Total expenses for deï¬ned contribution plans Special employer's contribution tax Cost for credit insurance FPG Total pension expenses Compensation from the pension fund Total... -

Page 136

... AB, Sweden Total cash paid for acquisitions - 164 200 205 161 3 3 2 2012 2013 Note 26 Acquired and divested operations In the first quarter of 2013 The Group acquired and subsequently partly divested the real estate company owning the Corporate head office to the Swedish pension foundation... -

Page 137

... number of employees by country has been submitted to the Swedish Companies Registration Office and is available on request from AB Electrolux, Investor Relations and Financial Information. See also Electrolux website www.electrolux.com/ employees-by-country. Europe North America Latin America... -

Page 138

... receive a pension entitlement where the aggregated contribution is 35% of annual base salary. The retirement age is 65 years. For members of Group Management employed outside of Sweden, varying pension terms and conditions apply, depending upon the country of employment. 136 ANNUAL REPORT 2013 -

Page 139

... managers by providing long-term incentives through benefits linked to the company's share price. They have been designed to align management incentives with shareholder interests. All programs are equity-settled. Performance-share programs 2011, 2012 and 2013 The Annual General Meeting in 2013... -

Page 140

... concerning financial accounting and reporting standards; internal control reviews; and employee benefit plan audits. Audit-related fees also include review of interim report. Tax fees include fees for tax-compliance services, including the preparation of original and amended tax returns and... -

Page 141

...from AB Electrolux, Investor Relations and Financial Information. Associated companies Participation in associated companies amounted in total to SEK 221m (16). In the first quarter of 2013 The Group acquired and subsequently partly divested the real estate company owning the Corporate head office... -

Page 142

... of key ratios where capital is related to net sales, the latter are annualized and converted at year-end exchange rates and adjusted for acquired and divested operations. Net assets Total assets exclusive of liquid funds, pension plan assets and interest-bearing financial receivables less operating... -

Page 143

...Board of Directors has proposed that the Annual General Meeting 2014 resolves on a dividend to the shareholders of SEK 6.50 per share. On account hereof, the Board of Directors hereby makes the following statement according to Chapter 18 Section 4 of the Swedish Companies Act. The Board of Directors... -

Page 144

... Act. The statutory administration report is consistent with the other parts of the annual accounts and consolidated accounts. We therefore recommend that the annual meeting of shareholders adopt the income statement and balance sheet for the Parent Company and the Group. 142 ANNUAL REPORT 2013 -

Page 145

... that the members of the Board of Directors and the President be discharged from liability for the financial year. Stockholm, February 21, 2014 PricewaterhouseCoopers AB Anders Lundin Authorized Public Accountant Partner in Charge Björn Irle Authorized Public Accountant ANNUAL REPORT 2013 143 -

Page 146

...,612 52,700 281.0 281.6 Including outdoor products, Husqvarna, which was distributed to the Electrolux shareholders in June 2006. Amounts for 2012 have been restated where applicable as a consequence of the amended standard for pension accounting, IAS 19 Employee Benefits. 144 ANNUAL REPORT 2013 -

Page 147

... 58,800 284.7 284.7 59,478 13,785 51,800 285.9 286.1 5) 6) 60,754 13,521 51,500 286.2 286.2 1.9 1.3 -0.4 -2.4 -2.4 -1.6 Items affecting comparability are excluded. Cash flow from acquisitions and divestments excluded. 2013: Proposed by the Board. Net sales are annualized. ANNUAL REPORT 2013... -

Page 148

...4.2 -1,322 1,071 -987 -3.44 3.80 -2,393 286.2 286.2 109,151 1,580 1.4 4,055 3.7 904 3,379 672 2.35 9.81 -2,475 286.2 286.2 Basic, based on average number of shares, excluding shares owned by Electrolux. Restructuring provisions, write-downs and capital loss on divestments. 146 ANNUAL REPORT 2013 -

Page 149

...year 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Full year 2013 Major Appliances Europe, Middle East and Africa Net sales Operating income Margin, % Major Appliances North America Net sales Operating income Margin, % Major Appliances Latin America Net sales Operating income Margin, % Major Appliances Asia... -

Page 150

...control and risk management. Electrolux Code of Ethics, Policy on Corruption and Bribery and Workplace Code of Conduct. AB Electrolux (publ) is registered under number 556009-4178 with the Swedish Companies Registration Office. The registered office of the Board of Directors is in Stockholm, Sweden... -

Page 151

...of Bert Nordberg as new Board member at the Annual General Meeting 2013. • Stefano Marzano left his position as Chief Design Officer in Group Management at year-end 2013. • Performance-based, long-term incentive program for top management. • Continued focus on roll-out of global ethics program... -

Page 152

... guidelines for Electrolux Group Management. • Performance-based, long-term incentive program for 2013 covering up to 225 managers and key employees. • Authorization to acquire own shares and to transfer own shares on account of company acquisitions. Annual General Meeting 2014 The next... -

Page 153

...website; www.electrolux.com/board-of-directors. The Board's tasks The main task of the Board is to manage the Group's operations in such a manner as to assure the owners that their interests, in terms of a long-term good return on capital, are being met in the best possible manner. The Board's work... -

Page 154

... usually last for half a day or one entire day in order to allow time for presentations and discussions. Cecilia Vieweg, Electrolux General Counsel, serves as secretary at the Board meetings. Each scheduled Board meeting includes a review of the Group's results and financial position, as well as the... -

Page 155

... Management for 2014. The Head of Human Resources and Organizational Development participated in the meetings and was responsible for meeting preparations. Audit Committee The main task of the Audit Committee is to oversee the processes of Electrolux financial reporting and internal control in order... -

Page 156

... of internal control and risk management has been developed to provide reasonable assurance that the Group's goals are met in terms of efficient operations, compliance with relevant laws and regulations and reliable financial reporting. Internal Audit For additional information on internal control... -

Page 157

...increase shareholder return is based on three elements: innovative products, strong brands and cost-efficient operations. Realizing this potential requires effective and controlled risk management. The Group's development is strongly affected by external factors, of which the most important in terms... -

Page 158

... CFO, the four Major Appliances business sector heads, the Chief Marketing Officer, the Chief Design Officer, the Chief Technology Officer and the heads of the Product Boards, Purchasing and Manufacturing, the General Counsel and the Head of Human Resources and Organizational Development. The MALT... -

Page 159

Major issues addressed by the President and Group Management in 2013 • Electrolux growth strategy. • Optimizing of the manufacturing footprint. • Accelerating efforts to capitalize on the Group's global strength and scope. • Launch of a full range of kitchen and laundry appliances ... -

Page 160

... goods in Australia and South Africa. Executive Vice President and Head of R&D of Scania CV AB, 2001- 2009. Founder of Mecel AB (part of Delphi Corporation). Senior management positions within Delphi Corporation, 1990-2001. Senior positions within Electrolux: Head of Major Appliances North America... -

Page 161

...and Chief Financial Officer of Axel Johnson AB, 2000- 2007. Head of Research of Aros Securities AB, 1998-2000. Various positions within ABB Financial Services AB, 1992-1998. President and CEO of Bonnier Growth Media since 2012. Member of Bonnier AB Executive Management Team since 2009. Board member... -

Page 162

... America, 2002. Executive Vice President of AB Electrolux, 2008. Senior management positions within DuPont in North America, Europe, Middle East and Africa, and globally, 1991-2003. Vice President Brand Marketing, Electrolux Major Appliances North America, 2003. Group Chief Marketing Officer, 2011... -

Page 163

... Communications AB, 2005-2007. Head of Electrolux Major Appliances Asia/ Pacific and Executive Vice President of AB Electrolux, 2007. Research & Development and Business Management positions within 3M in USA, 1989-1997. Managing Director, 3M Home Care Business, Europe, Middle East and North Africa... -

Page 164

...The Electrolux Control System (ECS) has been developed to ensure accurate and reliable financial reporting and preparation of financial statements in accordance with applicable laws and regulations, generally accepted accounting principles and other requirements for listed companies. ECS adds value... -

Page 165

... key applications. Examples of important IT general controls are ones over change management, user administration, production environment and back-up procedures. Control activities Risk assessment - Example trade receivables Internal Control and Risk Management - Risks assessed 2013 Annual Report... -

Page 166

... the year. The status of ECS activities is followed up continuously through status calls between the ECS Office and sector internal control coordinators. Information about the status of the ECS is provided periodically to relevant parties such as Sector and Group Management, the Audit Board and... -

Page 167

... has been formed. Electrolux has a communications policy meeting the requirements for a listed company. Financial information is issued regularly in the form of: • Full-year reports and interim reports, published as press releases. • The Annual Report. • Press releases on all matters which... -

Page 168

... the Group's website; www.electrolux.com/agm2014 • by telephone +46 8 402 92 79, on weekdays between 9 am and 4 pm • by mail to AB Electrolux c/o Euroclear Sweden AB Box 191 SE-101 23 Stockholm Sweden Notice should include the shareholder's name, personal identity or registration number, address... -

Page 169

....com/sustainability Electrolux interim reports www.electrolux.com/ir Financial reports and major events in 2014 Consolidated report, January 31 Interim report January-June, July 18 Interim report January-September, October 20 Interim report January-March, April 25 2014 Annual General Meeting... -

Page 170

-

Page 171

...the best appliance company as measured by customers employees shareholders Investor Relations Tel. +46 8 738 60 03 | E-mail: [email protected] | www.electrolux.com/ir Electrolux, AEG and Zanussi are the registered trademarks of AB Electrolux. For further information about trademarks, please contact... -

Page 172

599 14 14-34/2 AB Electrolux (publ) Mailing address SE-105 45 Stockholm, Sweden Visiting address S:t Göransgatan 143, Stockholm Telephone: +46 8 738 60 00 Website: http://group.electrolux.com On the web: www.electrolux.com/annualreport2013