Dish Network 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

59

LIQUIDITY AND CAPITAL RESOURCES

Cash, Cash Equivalents and Current Marketable Investment Securities

We consider all liquid investments purchased within 90 days of their maturity to be cash equivalents. See “Item 7A.

– Quantitative and Qualitative Disclosures About Market Risk” for further discussion regarding our marketable

investment securities. As of December 31, 2009, our cash, cash equivalents and current marketable investment

securities totaled $2.139 billion compared to $559 million as of December 31, 2008, an increase of $1.580 billion.

This increase in cash, cash equivalents and current marketable investment securities was primarily related to cash

generated from operations of $2.195 billion and the net proceeds of $1.377 billion related to our 7 % Senior Notes

due 2019 issued in 2009, partially offset by capital expenditures of $1.037 billion and the $894 million dividend paid

on our Class A and Class B common stock.

We have investments in various debt and equity instruments including corporate bonds, corporate equity securities,

government bonds, and variable rate demand notes (“VRDNs”). VRDNs are long-term floating rate municipal

bonds with embedded put options that allow the bondholder to sell the security at par plus accrued interest. All of

the put options are secured by a pledged liquidity source. Our VRDN portfolio is comprised of investments in many

municipalities, which are backed by financial institutions or other highly rated companies that serve as the pledged

liquidity source. While they are classified as marketable investment securities, the put option allows VRDNs to be

liquidated on a same day or on a five business day settlement basis. As of December 31, 2009 and 2008, we held

VRDNs with fair values of $1.054 billion and $240 million, respectively.

The following discussion highlights our cash flow activities during the years ended December 31, 2009, 2008 and

2007.

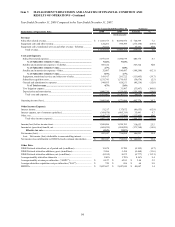

Free Cash Flow

We define free cash flow as “Net cash flows from operating activities” less “Purchases of property and equipment,”

as shown on our Consolidated Statements of Cash Flows. We believe free cash flow is an important liquidity metric

because it measures, during a given period, the amount of cash generated that is available to repay debt obligations,

make investments, fund acquisitions and for certain other activities. Free cash flow is not a measure determined in

accordance with GAAP and should not be considered a substitute for “Operating income,” “Net income,” “Net cash

flows from operating activities” or any other measure determined in accordance with GAAP. Since free cash flow

includes investments in operating assets, we believe this non-GAAP liquidity measure is useful in addition to the

most directly comparable GAAP measure “Net cash flows from operating activities.”

During the years ended December 31, 2009, 2008 and 2007, free cash flow was significantly impacted by changes in

operating assets and liabilities as shown in the “Net cash flows from operating activities” section of our Consolidated

Statements of Cash Flows included herein. Operating asset and liability balances can fluctuate significantly from

period to period and there can be no assurance that free cash flow will not be negatively impacted by material changes

in operating assets and liabilities in future periods, since these changes depend upon, among other things,

management’s timing of payments and control of inventory levels, and cash receipts. In addition to fluctuations

resulting from changes in operating assets and liabilities, free cash flow can vary significantly from period to period

depending upon, among other things, subscriber growth, subscriber revenue, subscriber churn, subscriber acquisition

costs including amounts capitalized under our equipment lease programs, operating efficiencies, increases or decreases

in purchases of property and equipment and other factors.