Dish Network 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-20

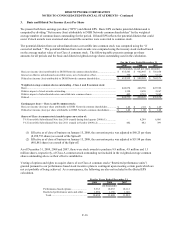

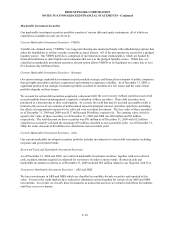

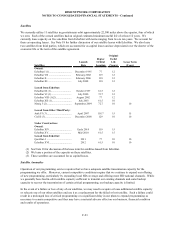

Marketable Investment Securities in a Loss Position

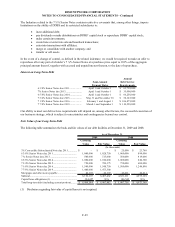

The following table reflects the length of time that the individual securities, accounted for as available-for-sale, have

been in an unrealized loss position, aggregated by investment category. As of December 31, 2009 and 2008, the

unrealized losses on our investments in debt securities primarily represent investments in auction rate, mortgage and

asset-backed securities. We do not intend to sell our investments in these debt securities before they recover or

mature, and it is more likely than not that we will hold these investments until that time. In addition, we are not

aware of any specific factors indicating that the underlying issuers of these debt securities would not be able to pay

interest as it becomes due or repay the principal at maturity. Therefore, we believe that these changes in the

estimated fair values of these marketable investment securities are related to temporary market fluctuations.

Pri mary

Reason for Total

Investment Unrealized Fair Fair Unrealized Fair Unrealized Fair Unrealized

Category Loss Value Value Loss Value Loss Value Loss

Debt securities......

Temporary market

fluctuations 348,995$ 180,359$ (306)$ 7,535$ (45)$ 161,101$ (70,464)$

Total..................... 348,995$ 180,359$ (306)$ 7,535$ (45)$ 161,101$ (70,464)$

Debt securities......

Temporary market

fluctuations 295,676$ 2,070$ (540)$ 8,114$ (24)$ 285,492$ (115,821)$

Total..................... 295,676$ 2,070$ (540)$ 8,114$ (24)$ 285,492$ (115,821)$

As of December 31, 2009

(In thousands)

Nine Months or MoreLess than Six Months Six to Nine Months

(In thousands)

As of December 31, 2008

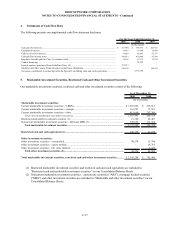

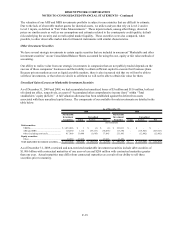

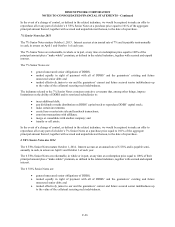

Fair Value Measurements

We determine fair value based on the exchange price that would be received for an asset or paid to transfer a

liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly

transaction between market participants. Market or observable inputs are the preferred source of values, followed

by unobservable inputs or assumptions based on hypothetical transactions in the absence of market inputs. We

apply the following hierarchy in determining fair value:

x Level 1, defined as observable inputs being quoted prices in active markets for identical assets;

x Level 2, defined as observable inputs including quoted prices for similar assets in active markets; quoted

prices for identical or similar instruments in markets that are not active; and model-derived valuations in

which significant inputs and significant value drivers are observable in active markets; and

x Level 3, defined as unobservable inputs in which little or no market data exists, therefore requiring

assumptions based on the best information available.

Our assets measured at fair value on a recurring basis were as follows:

Assets Total Level 1 Level 2 Le vel 3

Marketable investment securities........ 2,175,502$ 105,988$ 1,956,503$ 113,011$

(In thousands)

Total Fair Value as of De cember 31, 2009