Dish Network 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

51

from lower non-subsidized sales of DBS accessories, a decline in charges for slow moving and obsolete inventory and

a decrease in services provided to EchoStar under our transitional services agreement with EchoStar.

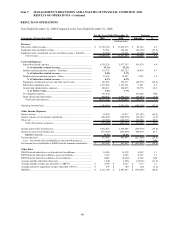

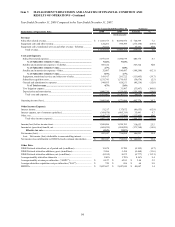

Subscriber acquisition costs. “Subscriber acquisition costs” totaled $1.540 billion for the year ended December 31,

2009, an increase of $8 million or 0.5% compared to the same period in 2008. This increase was primarily attributable

to the increase in gross new subscribers discussed previously, partially offset by lower SAC discussed below.

SAC. SAC was $697 during the year ended December 31, 2009 compared to $720 during the same period in 2008, a

decrease of $23, or 3.2%. This decrease was primarily attributable to a change in sales channel mix and a decrease in

hardware costs per activation, partially offset by an increase in advertising costs. The decrease in hardware cost per

activation was driven by a reduction in manufacturing costs for new receivers and due to more cost-effective

deployment of set-top boxes, requiring less equipment per subscriber. These decreases in hardware costs were partially

offset by an increase in deployment of more advanced set-top boxes, such as HD receivers and HD DVRs.

During the years ended December 31, 2009 and 2008, the amount of equipment capitalized under our lease program

for new subscribers totaled $634 million and $604 million, respectively. This increase in capital expenditures under

our lease program for new subscribers resulted primarily from the increase in gross new subscribers.

Capital expenditures resulting from our equipment lease program for new subscribers were partially mitigated by the

redeployment of equipment returned by disconnecting lease program subscribers. However, to remain competitive

we upgrade or replace subscriber equipment periodically as technology changes, and the costs associated with these

upgrades may be substantial. To the extent technological changes render a portion of our existing equipment

obsolete, we would be unable to redeploy all returned equipment and consequently would realize less benefit from

the SAC reduction associated with redeployment of that returned lease equipment.

Our SAC calculation does not reflect any benefit from payments we received in connection with equipment not

returned to us from disconnecting lease subscribers and returned equipment that is made available for sale or used in

our existing customer lease program rather than being redeployed through our new lease program. During the years

ended December 31, 2009 and 2008, these amounts totaled $94 million and $128 million, respectively.

Several years ago, we began deploying receivers that utilize 8PSK modulation technology and receivers that utilize

MPEG-4 compression technology. These technologies, when fully deployed, will allow more programming

channels to be carried over our existing satellites. A majority of our customers today, however, do not have

receivers that use MPEG-4 compression and a smaller but still significant percentage do not have receivers that use

8PSK modulation. We may choose to invest significant capital to accelerate the conversion of customers to MPEG-

4 and/or 8PSK to realize the bandwidth benefits sooner. In addition, given that all of our HD content is broadcast in

MPEG-4, any growth in HD penetration will naturally accelerate our transition to these newer technologies and may

increase our subscriber acquisition and retention costs. All new receivers that we purchase from EchoStar now have

MPEG-4 technology. Although we continue to refurbish and redeploy MPEG-2 receivers, as a result of our HD

initiatives and current promotions, we currently activate most new customers with higher priced MPEG-4

technology. This limits our ability to redeploy MPEG-2 receivers and, to the extent that our promotions are

successful, will accelerate the transition to MPEG-4 technology, resulting in an adverse effect on our SAC.

Our “Subscriber acquisition costs” and “SAC” may materially increase in the future to the extent that we transition to

newer technologies, introduce more aggressive promotions, or provide greater equipment subsidies. See further

discussion under “Liquidity and Capital Resources – Subscriber Acquisition and Retention Costs.”

General and administrative expenses. “General and administrative expenses” totaled $603 million during the year

ended December 31, 2009, an increase of $59 million or 10.8% compared to the same period in 2008. This increase

was primarily attributable to additional costs to support the DISH Network television service including personnel

costs and professional fees. “General and administrative expenses” represented 5.2% and 4.7% of “Total revenue”

during the years ended December 31, 2009 and 2008, respectively. The increase in the ratio of the expenses to “Total

revenue” was primarily attributable to the increase in expenses discussed above.