Dish Network 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-34

401(k) Employee Savings Plan

We sponsor a 401(k) Employee Savings Plan (the “401(k) Plan”) for eligible employees. Voluntary employee

contributions to the 401(k) Plan may be matched 50% by us, subject to a maximum annual contribution of $1,500

per employee. Forfeitures of unvested participant balances which are retained by the 401(k) Plan may be used to

fund matching and discretionary contributions. We also may make an annual discretionary contribution to the plan

with approval by our Board of Directors, subject to the maximum deductible limit provided by the Internal Revenue

Code of 1986, as amended. These contributions may be made in cash or in our stock.

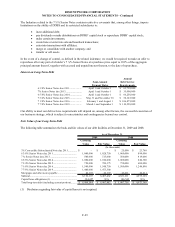

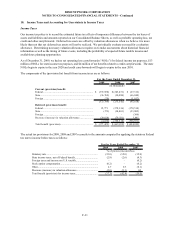

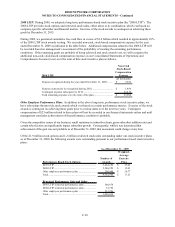

The following table summarizes the expense associated with our matching contributions and discretionary

contributions:

Expense Recognized Related to the 401(k) Plan 2009 2008 2007

Matching contributions, net of forfeitures....................... $ 6,116 $ 4,641 $ 2,444

Discretionary stock contributions, net of forfeitures....... $ 29,004 $ 12,436 $ 19,594

(In thous ands)

For the Years Ended December 31,

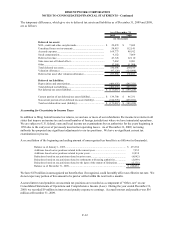

13. Stock-Based Compensation

Stock Incentive Plans

In connection with the Spin-off, as permitted by our existing stock incentive plans and consistent with the Spin-off

exchange ratio, each DISH Network stock option was converted into two stock options as follows:

x an adjusted DISH Network stock option for the same number of shares that were exercisable under the

original DISH Network stock option, with an exercise price equal to the exercise price of the original

DISH Network stock option multiplied by 0.831219.

x a new EchoStar stock option for one-fifth of the number of shares that were exercisable under the

original DISH Network stock option, with an exercise price equal to the exercise price of the original

DISH Network stock option multiplied by 0.843907.

Similarly, each holder of DISH Network restricted stock units retained his or her DISH Network restricted stock

units and received one EchoStar restricted stock unit for every five DISH Network restricted stock units that they

held.

Consequently, the fair value of the DISH Network stock award and the new EchoStar stock award immediately

following the Spin-off was equivalent to the fair value of such stock award immediately prior to the Spin-off.

We maintain stock incentive plans to attract and retain officers, directors and key employees. Stock awards under

these plans include both performance and non-performance based stock incentives. As of December 31, 2009, we

had outstanding under these plans stock options to acquire 21.9 million shares of our Class A common stock and 1.2

million restricted stock units. Stock options granted through December 31, 2009 were granted with exercise prices

equal to or greater than the market value of our Class A common stock at the date of grant and with a maximum

term of ten years. While historically we have issued stock awards subject to vesting, typically at the rate of 20% per

year, some stock awards have been granted with immediate vesting and other stock awards vest only upon the

achievement of certain company-wide objectives. As of December 31, 2009, we had 79.2 million shares of our

Class A common stock available for future grant under our stock incentive plans. The 2009 Stock Incentive Plan,

which was approved at the annual meeting of shareholders on May 11, 2009, allows us to grant new stock awards

following the expiration of our 1999 Stock Incentive Plan on April 16, 2009.