Dish Network 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-30

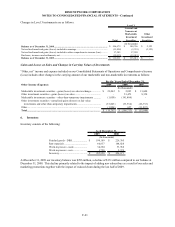

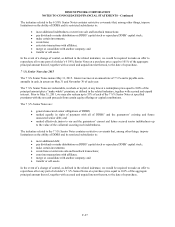

Other Long-Term Debt and Capital Lease Obligations

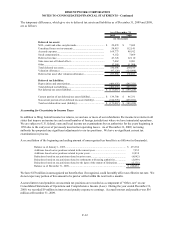

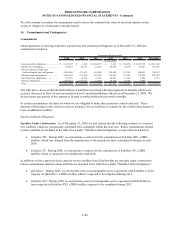

Other long-term debt and capital lease obligations consist of the following:

2009 2008

Satellites and other capital lease obligations............................................................................................. 304,457$ 186,545$

8% note payable for EchoStar VII satellite vendor financing, payable over 13 years from launch........... 8,773 9,881

6% note payable for EchoStar X satellite vendor financing, payable over 15 years from launch............. 11,704 12,498

6% note payable for EchoStar XI satellite vendor financing, payable over 15 years from launch............ 16,748 17,500

Mortgages and other unsecured notes payable due in installments through 2017

with interest rates ranging from approximately 2% to 13% ................................................................ 4,8 8 2 6,332

Total ......................................................................................................................................................... 346,564 232,756

Less current portion ............................................................................................................................. (26,518) (13,333)

Other long-term debt and capital lease obligations, net of current portion ............................................... $ 320,046 $ 219,423

As of December 31,

(In thousands)

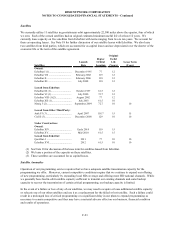

Capital Lease Obligations

Anik F3. Anik F3, an FSS satellite, was launched and commenced commercial operation during April 2007. This

satellite is accounted for as a capital lease and depreciated over the term of the satellite service agreement. We have

leased 100% of the Ku-band capacity on Anik F3 for a period of 15 years.

Ciel II. Ciel II, a Canadian DBS satellite, was launched in December 2008 and commenced commercial operation

during February 2009. This satellite is accounted for as a capital lease and depreciated over the term of the satellite

service agreement. We have leased 100% of the capacity on Ciel II for an initial ten-year term.

As of December 31, 2009 and 2008, we had $500 million and $223 million capitalized for the estimated fair value

of satellites acquired under capital leases included in “Property and equipment, net,” with related accumulated

depreciation of $66 million and $26 million, respectively. In our Consolidated Statements of Operations and

Comprehensive Income (Loss), we recognized $40 million, $15 million and $66 million in depreciation expense on

satellites acquired under capital lease agreements during the years ended December 31, 2009, 2008 and 2007,

respectively.

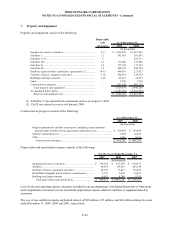

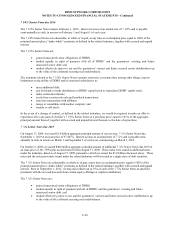

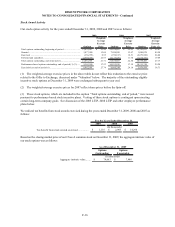

Future minimum lease payments under the capital lease obligation, together with the present value of the net

minimum lease payments as of December 31, 2009 are as follows (in thousands):

For the Years Ended December 31,

2010.............................................................................................................................................................. 81,263$

2011.............................................................................................................................................................. 78,353

2012.............................................................................................................................................................. 75,970

2013.............................................................................................................................................................. 75,970

2014.............................................................................................................................................................. 75,970

Thereafter...................................................................................................................................................... 466,209

Total minimum lease payments..................................................................................................................... 853,735

Less: Amount representing lease of the orbital location and estimated executory costs (primarily

insurance and maintenance) including profit thereon, included in total minimum lease payments............. (392,544)

Net minimum lease payments....................................................................................................................... 461,191

Less: Amount representing interest.............................................................................................................. (156,734)

Present value of net minimum lease payments.............................................................................................. 304,457

Less: Current portion................................................................................................................................... (22,375)

Long-term portion of capital lease obligations.............................................................................................. 282,082$

The summary of future maturities of our outstanding long-term debt as of December 31, 2009 is included in the

commitments table in Note 14.