Dell 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

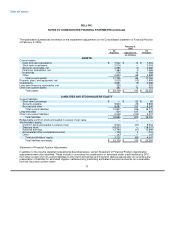

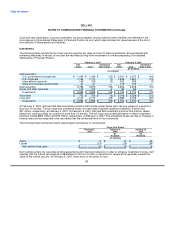

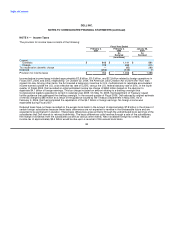

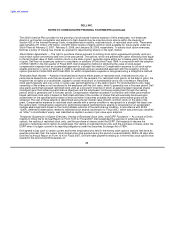

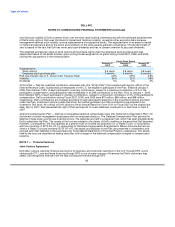

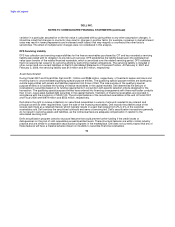

The effective tax rate differed from the statutory U.S. federal income tax rate as follows:

Fiscal Year Ended

February 2, February 3, January 28,

2007 2006 2005

As As

Restated Restated

Effective tax rate:

U.S. federal statutory rate 35.0% 35.0% 35.0%

Foreign income taxed at different rates (17.8) (13.9) (11.7)

Tax repatriation (benefit) charge — (1.9) 6.4

Foreign earnings subject to U.S. taxation 2.9 1.6 0.7

Imputed intercompany charges 2.0 1.2 —

Other 0.7 (0.2) 1.1

Effective tax rate 22.8% 21.8% 31.5%

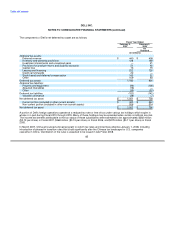

The increase in Dell's Fiscal 2007 effective tax rate, compared to Fiscal 2006, is due to the $85 million tax reduction in the

second quarter of Fiscal 2006 offset by a higher proportion of its operating profits being generated in lower foreign tax

jurisdictions during Fiscal 2007 as compared to a year ago. The decrease in Dell's Fiscal 2006 effective tax rate, compared

to Fiscal 2005, is due to the aforementioned tax repatriation charge and a higher proportion of operating profits attributable to

foreign jurisdictions which are taxed at lower rates.

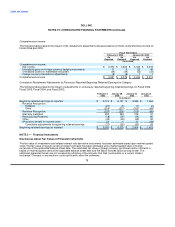

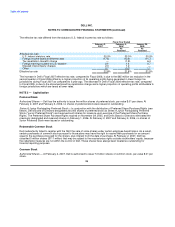

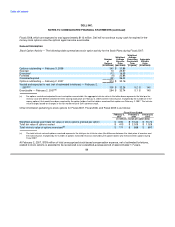

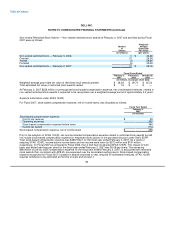

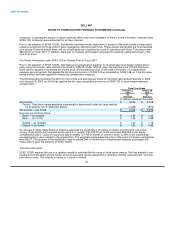

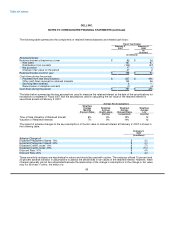

NOTE 5 — Capitalization

Preferred Stock

Authorized Shares — Dell has the authority to issue five million shares of preferred stock, par value $.01 per share. At

February 2, 2007 and February 3, 2006, no shares of preferred stock were issued or outstanding.

Series A Junior Participating Preferred Stock — In conjunction with the distribution of Preferred Share Purchase Rights (see

below), Dell's Board of Directors designated 200,000 shares of preferred stock as Series A Junior Participating Preferred

Stock ("Junior Preferred Stock") and reserved such shares for issuance upon exercise of the Preferred Share Purchase

Rights. The Preferred Share Purchase Rights expired on November 29, 2005, and Dell's Board of Directors eliminated the

previously designated and reserved shares on February 1, 2006. At February 2, 2007 and February 3, 2006, no shares of

Junior Preferred Stock were issued or outstanding.

Redeemable Common Stock

Dell inadvertently failed to register with the SEC the sale of some shares under certain employee benefit plans. As a result,

certain purchasers of common stock pursuant to those plans may have the right to rescind their purchases for an amount

equal to the purchase price paid for the shares, plus interest from the date of purchase. At February 2, 2007, Dell has

classified 5 million shares ($111 million) that may be subject to the rescissionary rights outside stockholders' equity, because

the redemption features are not within the control of Dell. These shares have always been treated as outstanding for

financial reporting purposes.

Common Stock

Authorized Shares — At February 2, 2007, Dell is authorized to issue 7.0 billion shares of common stock, par value $.01 per

share.

86