Dell 2006 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• Stock Options — Stock options are designed to reward executive officers for the increase in Dell's stock price over time.

Options represent the high-risk and potential high-return component of our total long-term incentive program, as the

realizable value of each option can fall to zero if the stock price is lower than the exercise price established on the date of

grant.

The size of stock option grants for executive officers is based primarily on the target dollar value of the award translated into

a number of option shares based on the estimated economic value on the date of grant, as determined using the Black-

Scholes option pricing formula. As a result, the number of shares underlying stock option awards will typically vary from

year to year, as it is dependent on the price of Dell common stock on the date of grant. In addition, the size of the award will

vary based on the target mix of options and PBUs, which varies for each executive officer.

In March 2006, the Leadership Development and Compensation Committee approved grants of stock options to each of the

executive officers (other than Mr. Dell) as part of our annual stock option grants. These options had an exercise price equal

to the fair market value of Dell common stock on the date of grant (determined as the average of the high and low stock

price on The NASDAQ Stock Market on the date of grant) and vest ratably over five years (20% per year) beginning on the

first anniversary of the date of grant. Because the exercise price of these options is equal to the fair market value of Dell's

common stock on the date of grant, these stock options will deliver a reward only if the stock price appreciates from the

price on the date the stock options were granted. This design is intended to focus the executive officers on the long-term

enhancement of stockholder value.

After we delayed the filing of our Annual Report on Form 10-K for Fiscal 2007, we suspended the exercise of employee

stock options. As a result, some stock options expired while the holders had no ability to exercise them or otherwise prevent

their expiration. The Leadership Development and Compensation Committee determined that we should nevertheless

provide certain of the affected individuals with the value that they would have received had they been permitted to exercise

the options. Therefore, we agreed to pay those individuals cash payments generally equal to the in-the-money value of the

options at expiration. We will make those payments within 45 days after we file our Annual Report on Form 10-K for Fiscal

2007. The group of affected individuals included current and former executive officers. Because these payments are

intended to compensate the affected individuals for the value they would have received had their options been exercisable,

the payments were not considered in making other compensation decisions.

• RSUs — Like stock options, RSUs are designed to reward executives for increases in our stock price over time. RSUs also

provide a deferral of vesting and payout to help retain executive officers. RSUs are denominated in full shares of the

company's common stock and, therefore, have a more stable value over time as the stock price goes up or down (as

compared to options, which only have value if the stock price increases).

• PBUs — PBUs are designed to reward participants for the achievement of near-term financial objectives, while also

providing a deferral of vesting and payout to help retain executive officers. Like RSUs, PBUs are denominated in full shares

of the company's common stock and, therefore, have a more stable value over time as the stock price goes up or down.

The size of PBU grants is based on a target dollar value of the award divided by the stock price on the date of grant. The

actual number of shares earned is determined based on company performance measured over a one-year period against

predetermined performance goals. Shares granted in Fiscal 2007 vest ratably over a five-year period beginning on the date

of grant.

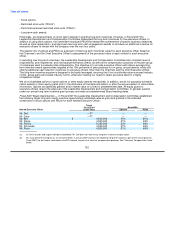

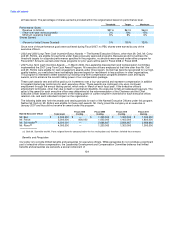

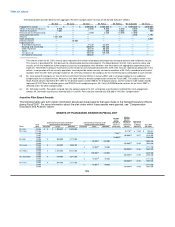

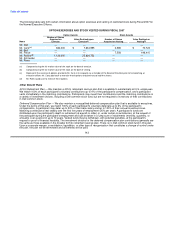

For Fiscal 2007, the following revenue growth and minimum operating margin goals were used as performance measures.

Even if the revenue growth goal is achieved, the minimum operating margin goal must also be achieved at or above the

threshold for any shares to be earned. The table below provides the threshold, target, and maximum performance levels

and the percentage of shares earned

133