Dell 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

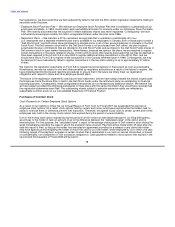

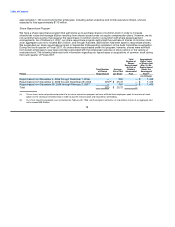

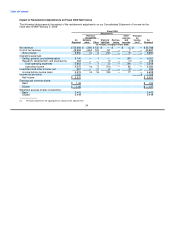

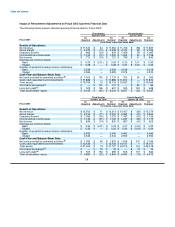

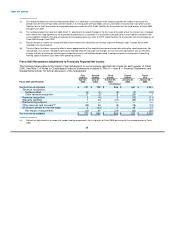

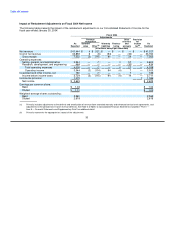

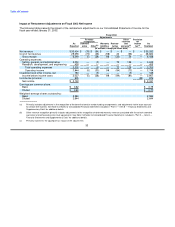

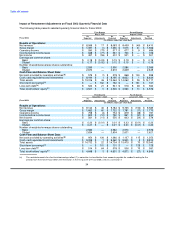

Impact of Restatement Adjustments on Fiscal 2006 Quarterly Financial Data

The following tables present selected quarterly financial data for Fiscal 2006:

First Quarter Second Quarter(c)

April 29, 2005 July 29, 2005

As As As As

Fiscal 2006 Reported Adjustments Restated Reported Adjustments Restated

(in millions, expect per share data)

Results of Operations:

Net revenue $ 13,386 $ (86) $ 13,300 $ 13,428 $ (46) $ 13,382

Gross margin $ 2,491 $ (39) $ 2,452 $ 2,499 $ (68) $ 2,431

Operating income $ 1,174 $ (37) $ 1,137 $ 1,173 $ (60) $ 1,113

Income before income taxes $ 1,233 $ (45) $ 1,188 $ 1,234 $ (47) $ 1,187

Net income $ 934 $ (26) $ 908 $ 1,020 $ (38) $ 982

Earnings per common share:

Basic $ 0.38 $ (0.01) $ 0.37 $ 0.42 $ (0.01) $ 0.41

Diluted $ 0.37 $ (0.01) $ 0.36 $ 0.41 $ (0.01) $ 0.40

Number of weighted-average shares outstanding:

Basic 2,456 — 2,456 2,418 — 2,418

Diluted 2,515 — 2,515 2,478 — 2,478

Cash Flow and Balance Sheet Data:

Net cash provided by operating activities(d) $ 1,190 $ 84 $ 1,274 $ 919 $ (58) $ 861

Cash, cash equivalents and investments $ 13,374 $ 4 $ 13,378 $ 12,624 $ 6 $ 12,630

Total assets $ 22,687 $ 82 $ 22,769 $ 22,611 $ 107 $ 22,718

Short-term borrowings(a) $ — $ 81 $ 81 $ — $ 77 $ 77

Long-term debt(b) $ 504 $ 140 $ 644 $ 504 $ 135 $ 639

Total stockholders' equity $ 5,624 $ (100) $ 5,524 $ 5,509 $ (144) $ 5,365

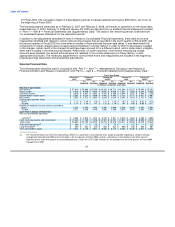

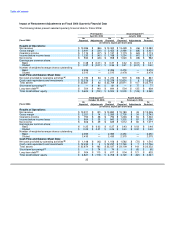

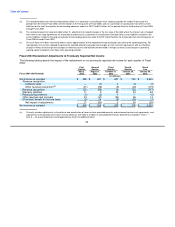

Third Quarter(c) Fourth Quarter

October 28, 2005 February 3, 2006

As As As As

Fiscal 2006 Reported Adjustments Restated Reported Adjustments Restated

(in millions, expect per share data)

Results of Operations:

Net revenue $ 13,911 $ (31) $ 13,880 $ 15,183 $ 43 $ 15,226

Gross margin $ 2,251 $ 14 $ 2,265 $ 2,709 $ 34 $ 2,743

Operating income $ 754 $ 38 $ 792 $ 1,246 $ 94 $ 1,340

Income before income taxes $ 804 $ 39 $ 843 $ 1,303 $ 87 $ 1,390

Net income $ 606 $ 29 $ 635 $ 1,012 $ 65 $ 1,077

Earnings per common share:

Basic $ 0.25 $ 0.02 $ 0.27 $ 0.43 $ 0.03 $ 0.46

Diluted $ 0.25 $ 0.01 $ 0.26 $ 0.43 $ 0.02 $ 0.45

Number of weighted-average shares outstanding:

Basic 2,395 — 2,395 2,350 — 2,350

Diluted 2,435 — 2,435 2,375 — 2,375

Cash Flow and Balance Sheet Data:

Net cash provided by operating activities(d) $ 1,148 $ (42) $ 1,106 $ 1,582 $ (72) $ 1,510

Cash, cash equivalents and investments $ 12,233 $ 4 $ 12,237 $ 11,749 $ 7 $ 11,756

Total assets $ 22,874 $ 163 $ 23,037 $ 23,109 $ 143 $ 23,252

Short-term borrowings(a) $ — $ 74 $ 74 $ — $ 65 $ 65

Long-term debt(b) $ 504 $ 113 $ 617 $ 504 $ 121 $ 625

Total stockholders' equity $ 4,821 $ (113) $ 4,708 $ 4,129 $ (82) $ 4,047

25