Dell 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

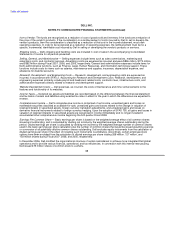

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Dell's interest rate swap agreements are designated as fair value hedges. See Note 3 of Notes to Consolidated Financial

Statements below for further discussion of hedging instruments.

Treasury Stock — Effective with the beginning of the second quarter of Fiscal 2002, Dell began holding repurchased shares

of its common stock as treasury stock. Prior to that date, Dell retired all such repurchased shares, which were recorded as a

reduction to retained earnings. Dell accounts for treasury stock under the cost method and includes treasury stock as a

component of stockholders' equity.

Revenue Recognition — Net revenue includes sales of hardware, software and peripherals, and services (including

extended service contracts and professional services). These products and services are sold either separately or as part of a

multiple-element arrangement. Dell allocates revenue from multiple-element arrangements to the elements based on the

relative fair value of each element, which is generally based on the relative sales price of each element when sold

separately. The allocation of fair value for a multiple-element arrangement involving software is based on vendor specific

objective evidence ("VSOE"), or in the absence of VSOE for delivered elements, the residual method. Under the residual

method, Dell allocates revenue to software licenses at the inception of the license term when VSOE for all undelivered

elements, such as Post Contract Customer Support ("PCS"), exists and all other revenue recognition criteria have been

satisfied. In the absence of VSOE for undelivered elements, revenue is deferred and subsequently recognized over the term

of the arrangement. For sales of extended warranties with a separate contract price, Dell defers revenue equal to the

separately stated price. Revenue associated with undelivered elements is deferred and recorded when delivery occurs.

Product revenue is recognized, net of an allowance for estimated returns, when both title and risk of loss transfer to the

customer, provided that no significant obligations remain. Revenue from extended warranty and service contracts, for which

Dell is obligated to perform, is recorded as deferred revenue and subsequently recognized over the term of the contract or

when the service is completed. Revenue from sales of third-party extended warranty and service contracts or software PCS,

for which Dell is not obligated to perform, and for which Dell does not meet the criteria for gross revenue recognition under

EITF 99-19 is recognized on a net basis. All other revenue is recognized on a gross basis.

Dell defers the cost of shipped products awaiting revenue recognition until the goods are delivered and revenue is

recognized. In-transit product shipments to customers totaled $424 million and $417 million as of February 2, 2007 and

February 3, 2006, respectively, and are included in other current assets on Dell's Consolidated Statement of Financial

Position.

Warranty — Dell records warranty liabilities at the time of sale for the estimated costs that may be incurred under its limited

warranty. The specific warranty terms and conditions vary depending upon the product sold and country in which Dell does

business, but generally includes technical support, parts, and labor over a period ranging from one to three years. Factors

that affect Dell's warranty liability include the number of installed units currently under warranty, historical and anticipated

rates of warranty claims on those units, and cost per claim to satisfy Dell's warranty obligation. The anticipated rate of

warranty claims is the primary factor impacting the estimated warranty obligation. The other factors are less significant due to

the fact that the average remaining aggregate warranty period of the covered installed base is approximately 20 months,

repair parts are generally already in stock or available at pre-determined prices, and labor rates are generally arranged at

pre-established amounts with service providers. Warranty claims are relatively predictable based on historical experience of

failure rates. If actual results differ from the estimates, Dell revises its estimated warranty liability. Each quarter, Dell

reevaluates its estimates to assess the adequacy of its recorded warranty liabilities and adjusts the amounts as necessary.

Vendor Rebates — Dell may receive consideration from vendors in the normal course of business. Certain of these funds are

rebates of purchase price paid and others are related to reimbursement of costs incurred by Dell to sell the vendor's

products. Dell's policy for accounting for these funds is in accordance with EITF 02-16, Accounting by a Customer (Including

a Reseller) for Certain Consideration Received

67