Dell 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

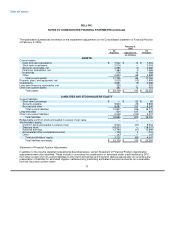

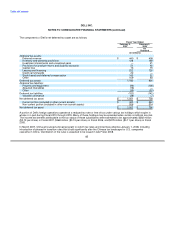

Warranty Liabilities

The issues related to Dell's warranty liabilities include situations where certain vendor reimbursement agreements were

incorrectly accounted for as a reduction in the estimate of the outstanding warranty liabilities. There were also instances

where warranty reserves in excess of the estimated warranty liability, as calculated by the warranty liability estimation

process, were retained and not released to the income statement as appropriate. Additionally, certain adjustments in the

warranty liability estimation process were identified where expected future costs or estimated failure rates were not accurate.

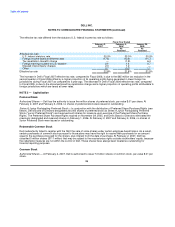

Other Reserves and Accruals

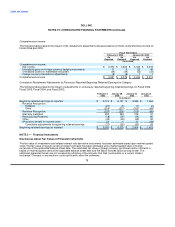

Many of the restatement adjustments relate to the estimates and reconciliation of various reserves and accrued liabilities,

including employee benefits, accounts payable, litigation, sales commissions, payroll, employee bonuses, and supplier

rebates. Dell extensively reviewed its accruals and underlying estimates, giving consideration to subsequent developments

after the date of the financial statements, to assess whether any of the previously recorded amounts required adjustment.

Dell conducted expanded account reviews and expanded balance sheet reconciliations to ensure that all accounts were fully

reconciled, supported, and appropriately documented. As a result of this review, Dell determined that a number of its

accruals required adjustment across various accounting periods. The largest of these adjustments are described in more

detail below:

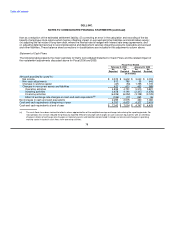

• Employee Bonuses — Certain employee bonuses were not accrued correctly, including the timing of the recording of the

accrual for the employee bonuses. Additionally, in certain cases when excess accruals resulted from differences in the

actual bonus payments, the excess accruals were not adjusted as appropriate.

• Vendor Funding Arrangements — In some instances vendor funding arrangements were not accounted for appropriately

under EITF Issue No. 02-16, Accounting by a Customer (Including a Reseller) for Certain Consideration Received from a

Vendor. Certain amounts received from vendors were recorded as a reduction in operating expenses instead of being

correctly recorded as a reduction of cost of goods sold. Additionally, certain amounts received were retained on the balance

sheet and released in future periods despite the earnings process having been complete in the earlier period. Finally, there

were instances where the benefit of certain vendor funding was recorded prior to the completion of the earnings process.

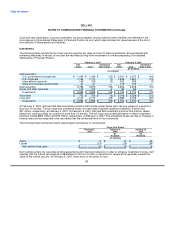

• Unsubstantiated Accruals and Inadequately Reconciled Accounts — In some instances accrual and reserve accounts

lacked justification or supporting documentation. In certain cases these accounts were used to accumulate excess amounts

from other reserve and accrual accounts. However, these excess reserves were not released to the income statement in

the appropriate reporting period or were released for other purposes. In some instances accounts had incorrect balances

because they had not been properly reconciled or because reconciling items had not been adjusted timely.

76