Chrysler 2000 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2000 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Report on Operations – Stock Option Plans

29

28

0

1

2

3

4

5

6

7

8

9

10

11

12

13

74

75

16

17

18

19

20

21

22

23

24

25

26

27

In keeping with what has become an established international

practice, the Board of Directors agreed that stock options

provide the best means of strengthening management’s

loyalty, because they give executives a stake in the Company’s

operating success and in its ability to create growing value for

the stockholders. Consequently, as allowed under a resolution

adopted by the Extraordinary Stockholders’ Meeting on June

22, 1998, the Board approved three Stock Option Plans

offered to about 900 managers of the Group’s Italian and

foreign companies who are qualified as “Direttore” or have

been included in the Management Development Program

for high-potential managers. These Plans share the following

common features:

❚Options are awarded to individual managers on the basis

of objective parameters that take into account the level

of responsibility assigned to each person and his or her

performance.

❚If employment is terminated or an employee’s relationship

with the Group is otherwise severed, options that are not

exercisable shall become null and void. However, vested

options may be exercised within 30 days from the date

of termination, with certain exceptions.

❚The option exercise price, which is determined based on

the average stock market price for the month preceding the

option award, can vary as a result of transactions affecting

the Company’s capital stock and shall be paid in cash upon

the purchase of the underlying shares.

A total of 1,248,000 options, giving the holder the right to

purchase ordinary Fiat shares at a price of 28.45 euros per

share, were awarded in March 1999. Half of these options

may be exercised on or after April 1, 2001, with the remaining

50% exercisable on or after April 1, 2002. All options expire

on March 31, 2007.

A total of 5,158,000 options, giving the holder the right to

purchase ordinary Fiat shares at a price of 30.63 euros per

share, were awarded in February 2000. These options may

be exercised between February 18, 2001 and February 18,

2008. However, during the first four years, the options may

only be exercised in cumulative annual tranches not exceeding

25% of the total number awarded.

A total of 755,000 options, giving the holder the right to

purchase ordinary Fiat shares at a price of 27.07 euros per

share, were awarded in February 2001. These options, which

were reserved for the Group’s top management, may be

exercised between February 27, 2002 and February 27, 2009.

However, during the first four years, the options may only be

exercised in cumulative annual tranches not exceeding 25%

of the total number awarded.

Pursuant to these plans, a total of 5,506,000 shares,

equivalent to 1% of the Company’s total capital stock and

about 1.5% of its ordinary shares, will be issued through

a special dedicated capital increase, which the Board has

already approved, while 1,655,000 treasury shares will be

sold to option holders in accordance with the provisions

of the applicable Regulations.

On several occasion, the Board of Directors further awarded

the Chairman and the Chief Executive Officer options to

purchase ordinary Fiat shares. Detailed information on these

transactions is provided in the Notes to the Financial

Statements.

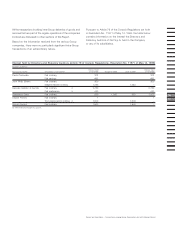

The table below summarizes the data for the options

outstanding at December 31, 2000:

Stock Option Plans

1999 2000

Number Average Market Number Average Market

of shares exercise price (*) price of shares exercise price (*) price

Options outstanding on 1/1 – – – 1,248,000 28.45 30.09

Options awarded during the year 1,248,000 28.45 28.45 5,158,000 30.63 30.63

Options outstanding on 12/31 1,248,000 28.45 30.09 6,406,000 30.20 26.34

Of which exercisable on 12/31 – – – –––

(*) Average exercise price of options.