Chrysler 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

28

0

1

2

3

34

35

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

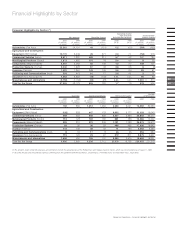

Report on Operations – Analysis of the Financial Position and Operating Results of the Fiat Group and Fiat S.p.A.

❚Itedi’s operating income, which totaled 10 million euros

compared with 17 million euros in 1999, suffered from the

loss of revenues from the technical publishing operations

of Satiz, which were sold at the end of 1999.

Result for the fiscal year

Income before taxes for the whole year totaled 1,050 million

euros, slightly more than in 1999 (1,024 million euros).

Important capital gains realized in 2000, thanks to dynamic

portfolio management and the finalization of the agreement

with General Motors, had a significant impact on the non-

operating items of the statement of operations and compensated

for higher financial expenses resulting from the debt assumed

to carry out important acquisitions over the last several years.

In 2000, the balance of financial and investment income

and expenses totaled 719 million euros in net expenses,

compared with a balance of 97 million euros in net expenses

for 1999.

A total of 914 million euros in net extraordinary income was

earned in 2000, significantly higher than that realized in 1999

(333 million euros).

Extraordinary income in 2000 totaled 2,757 million euros,

due in large measure to the capital gain of 1,779 million

euros generated during the third quarter by General Motors’

purchase of a 20% interest in Fiat Auto at a price higher

than the corresponding stockholders’ equity value.

The other extraordinary gains of approximately 900 million

euros came largely from the capital gains realized from the

disposal of Group assets, which were sold as part of its

portfolio streamlining program and generated net gains of

approximately 700 million euros. The most significant of these

gains stemmed from the sale of the Lubricants (347 million

euros) and Rearview Mirror (46 million euros) Divisions of

Magneti Marelli and from the sale of Fiat Ferroviaria (106

million euros) and Telexis/Atlanet (133 million euros), the latter

pursuant to agreements with Acea Telefonica for the creation

of the telecommunications company Atlanet.

Extraordinary expenses totaled 1,843 million euros, about

1.5 billion euros of which were for industrial reorganization

and streamlining, as well as other measures to strengthen

the asset base of certain Group Sectors. These measures

largely applied to activities located abroad, especially those

of Fiat Auto and CNH.

Consolidated net income before minority interest rose

to 578 million euros (506 million euros in 1999), partially as

a result of lower taxes, which decreased from 518 million

euros in 1999 to 472 million euros in 2000.

Income taxes for the 2000 fiscal year included 269 million

euros in current and deferred taxes (317 million euros in 1999)

and 203 million euros for IRAP, the regional tax on production

activity in Italy (201 million euros in 1999).

The Group’s interest in net income, which amounted to 664

million euros was almost double the 353 million euros realized

in the previous year, due to changes in the interest held by

minority stockholders in certain Group Sectors.

As a result of the increase in the Group's interest in net

income, net income per share has increased considerably

from 0.62 euros in 1999 to 1.19 euros in 2000.

Balance sheet

As required under Legislative Decree No. 127/91, a detailed

analysis of the Group’s balance sheet, which is presented in

accordance with the statutory format for consolidated financial

statements, is provided in the Notes to the Consolidated

Financial Statements.

In the following table, the Group’s consolidated balance sheet

has been reclassified and presented in a condensed format,

showing its main components according to their destination

and breaking them down between Industrial and Insurance

Activities.

Working capital

At the end of 2000, the Group’s consolidated working capital

totaled 1,630 million euros, up from 898 million euros at the

end of 1999. On a comparable consolidation and exchange

Net Income

(in millions of euros)

200019991998

Minority

Group

916

295

506

153

353

506

664

578

(86)

621