Chrysler 2000 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2000 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

28

0

1

2

3

4

5

36

37

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

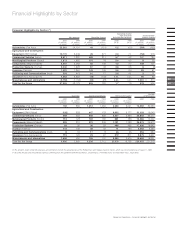

Report on Operations – Analysis of the Financial Position and Operating Results of the Fiat Group and Fiat S.p.A.

❚an increase in net intangible fixed assets (4,648 million euros),

due mainly to the consolidation of Case (approximately four

billion euros) and the goodwill resulting from the completion

of the tender offers for Toro Assicurazioni and Magneti Marelli

shares and the acquisition of the residual shares of Fraikin

and the Flexi-Coil Group (for a total of approximately 650

million euros).

Net deferred tax assets

At December 31, 2000, net deferred tax assets rose

to 1,007 million euros, from 574 million euros in 1999,

due mainly to provisions for risk reserves not deductible

for tax purposes in the period under examination.

The amount of net deferred tax assets includes prepaid

and deferred taxes set aside for the following temporary

differences: accelerated depreciation, capital gains reinvested

under a deferred tax treatment, inventories, taxed reserves

for risks and charges, and allowances for doubtful accounts

in excess of the percentage deductible for tax purposes.

A more detailed analysis of net deferred tax assets is provided

in the Notes to the Consolidated Financial Statements.

Reserves and allowances

At December 31, 2000, reserves and allowances totaled

20,891 million euros. They included the technical reserves of

the insurance companies (12,616 million euros), the reserve

for severance indemnities for employees in Italy (2,017 million

euros), the reserve for pensions and similar obligations (1,515

million euros), the warranty and technical support reserve

(1,008 million euros), and other reserves (3,735 million euros).

The increase of 4,692 million euros over the 16,199 million

euros reported at the end of 1999 is due to the higher

technical reserves of the insurance companies, which rose

by 2,323 million euros, reflecting a significant increase in

premium income; changes in the scope of consolidation

(by approximately 1 billion euros), largely due to the inclusion

of Case; and the extraordinary allowance for industrial

reorganization as well as other measures to strengthen

the asset base of several Group Sectors.

Net invested capital

The Group’s net invested capital at December 31, 2000 was

21,676 million euros, an increase of 2,878 million euros over

the end of 1999 (18,798 million euros).

Changes in the scope of consolidation, due largely to the

consolidation of Case and Flexi-Coil; the acquisition of the

equity interest in General Motors; and the increase in goodwill

resulting from the completion of the tender offers for Toro

Assicurazioni and Magneti Marelli produced an increase of

approximately 4,500 million euros in invested capital. If the

scope of consolidation had remained the same and the

greater volume of discounted trade receivables were excluded,

net invested capital would be approximately 470 million euros

lower than at the end of 1999.

On a comparable basis, the asset turnover rate declined from

3.3 in 1999 to 2.7 at the end of 2000.

The annualized return on invested capital, which is the ratio

of operating income plus investment income to average net

invested capital, was about 6%, which fell short of the 10%

value that was set in 2000 as the average cost of capital for

the Group, used for the calculation of value creation.

Net financial position of the Group

At December 31, 2000, the consolidated net financial

position of the Group showed net indebtedness of 6,467

million euros, 2,436 million euros more than at the beginning

of the fiscal year (net borrowings of 4,031 million euros).

The increase was due primarily to changes in the scope of

consolidation and to the tender offers for Toro Assicurazioni

and Magneti Marelli, which led to a total increase in net

debt of about 3.3 billion euros.

Net Invested Capital

(in millions of euros)

2000

21,676

19991998

18,798

13,700

consolidation scope

Comparable basis

4,498

17,178