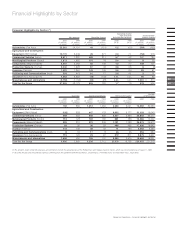

Chrysler 2000 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2000 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A breakdown of the changes affecting the net financial

position in 2000 is provided below:

(in millions of euros)

Net financial position at December 31, 1999 (4,031)

Increase in working capital (732)

Investments in fixed assets (3,236)

Cash flow 3,630

Dividends paid by Fiat S.p.A. (352)

Dividends paid by other companies (60)

Acquisitions and capital contributions (4,347)

Disposals (net of capital gains) 1,040

Other changes 1,621

Total change (2,436)

Net financial position at December 31, 2000 (6,467)

Cash flow, which is equal to net income before minority

interest plus depreciation and amortization, climbed sharply

to 3,630 million euros from 2,860 million euros in 1999 as

a result of higher depreciation and amortization charges.

Depreciation and amortization rose to 3,052 million euros

(up from 2,354 million euros in 1999), due largely to higher

amortization for goodwill, particularly as a result of the Case

acquisition and the widening of the scope of consolidation.

Disposals included the sale of a 20% interest in Fiat Auto

to General Motors. This value does not reflect realized capital

gains since they were already included in cash flow.

The other changes consist mainly of changes in the scope

of consolidation, the impact of exchange rates and increased

allowances made for industrial reorganization and the

strengthening of the asset base of several Group Sectors.

A breakdown of the net financial position is provided below:

(in millions of euros) 12/31/00 12/31/99

Cash 1,997 1,906

Marketable securities 1,643 1,613

Financial receivables and leased assets 24,059 19,103

Accrued financial income 620 295

Deferred financial income (1,778) (1,892)

Total financial assets (A)26,541 21,025

Short-term debt (17,217) (14,073)

Long-term debt (15,272) (10,756)

Accrued financial expenses (649) (309)

Deferred financial expenses 130 82

Total financial liabilities (B)(33,008) (25,056)

Group's net financial position (A-B)(6,467) (4,031)

Stockholders’ equity

Stockholders’ equity totaled 15,209 million euros at

December 31, 2000, compared with 14,767 million euros at

the end of 1999. The Group's interest in stockholders’ equity

amounted to 13,320 million euros versus 12,874 million euros

in the previous fiscal year. The debt to equity ratio rose from

0.27 at the end of 1999 to 0.43 at the end of 2000.

A breakdown of the changes in stockholders’ equity is

provided in the Notes to the Consolidated Financial

Statements.

Stockholders’ Equity

(in millions of euros)

2000

15,209

19991998

14,767

15,120

Minority

Group

1,889

13,320

1,893

12,874

2,122

12,998