Chrysler 2000 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2000 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

million euros over the previous year. The return on sales

(R.O.S.) of Industrial Activities (excluding Insurance Activities

which are characterized by a structurally negative operating

performance), was equivalent to 1.7%, down slightly from

the 1.9% recorded for 1999.

The improved return on sales resulting from reduced

manufacturing costs and overhead was offset by the

increased research and development and advertising outlays

mentioned above, as well as by a considerable rise

in the cost of some raw materials.

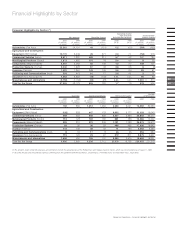

The operating performance of the individual Sectors

is reviewed below:

❚Fiat Auto closed the year with operating income of 44

million euros, compared with a loss of 121 million euros

posted in 1999. The return on sales was a positive 0.2%,

versus a negative 0.5% the previous year.

In spite of strong sales of the new Fiat Punto and Lancia

Lybra models, outlays borne by Fiat Auto to fend off

competitive pressures in Europe held back the Sector’s

profitability. On the other hand, the operating results

for activities in Brazil improved, thanks to a recovery

in demand.

Industrial streamlining in Argentina led to significantly

reduced losses from 1999 levels.

❚CNH Global ended the year with operating income of

45 million euros (0.4% of sales), compared with income

of 371 million euros realized in 1999 for New Holland alone

and 95 million euros (equal to 1% of sales) when Case

income for all 1999 is included on a pro forma basis.

From an industrial and commercial point of view, the

performance of CNH suffered from the previously noted

contraction in volumes, especially in the more profitable

segment of heavy agricultural equipment. The lower

volumes and a shift in demand to lower end of the market,

which were partially compensated for by improved prices,

pulled down the year’s earnings. The operating result

reported by CNH also reflects increased costs for the

amortization of goodwill and other intangible assets

connected with the acquisition of Case.

❚Iveco posted operating income of 489 million euros in 2000

(311 million euros in 1999), which amounted to 5.7% of net

revenues (+1.5 points over 1999). Aside from positive sales

trends and the effects of efficiency measures, this result

reflects a non-recurring real estate gain of 88 million euros

in the fourth quarter of 2000 from the disposal of industrial

areas no longer needed for Sector operations.

Operating income in the Other Industrial Sectors was

positive growing to 386 million euros (+15% over the 336

million euros reported in 1999), and yielding an aggregate

return on sales of approximately 3.8%, in line with the

previous year’s figure.

In particular:

❚Teksid posted operating income of 101 million euros (5.4%

of sales) for the year as a whole, compared with 76 million

euros in the previous year (4.5% of sales). This increase is

partially attributable to currency exchange rates and partially

to considerable cost savings and the favorable impact of

volumes and product mix, which compensated for the

unfavorable relationship between product costs and prices.

❚Magneti Marelli reported operating income of 55 million

euros for the year as a whole (1.2% of sales) compared

with 108 million euros in the previous year. The decrease

is largely the result of changes in the scope of consolidation

following the deconsolidation of businesses that were sold

off, particularly the Lubricants and Rearview Mirror Divisions.

On a comparable basis, the operating result in 2000 would

have been approximately 19 million euros higher than in

1999.

❚Comau reported operating income of 87 million euros

in 2000, equal to 3.6% of revenues, up from the previous

year both in absolute terms and in terms of profitability (43

million euros in 1999, equal to 2.5% of revenues), thanks to

higher volumes on orders in Europe, growth in the Comau

Service Division and the consolidation of Pico Group

activities for the entire year.

❚FiatAvio posted operating income of 143 million euros

(9.6% of sales) in 2000, compared with 109 million euros in

1999 (8% of sales). The improvement in FiatAvio operating

margin was due both to favorable exchange rates and to

the completion of industrial streamlining programs carried

out by the Sector, confirming the company’s strong strategic

position in its field.

The performance of the Other Sectors is reviewed below:

❚Toro Assicurazioni reported a negative operating result

of 56 million euros, which represents an improvement over

1999, when a loss of 103 million euros was reported. Income

before taxes, which is the most representative measure of

profitability for companies operating in the insurance

business, amounted to 163 million euros in 2000, 15 million

euros less than in 1999. It includes a provision of 24 million

euros set aside as a conservative measure in connection

with an administrative penalty levied for alleged violations

of antitrust laws. The Company is appealing the penalty.