Chesapeake Energy 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3

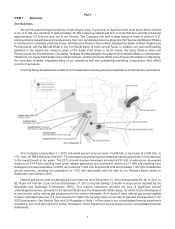

opportunities as we focus on developing the most promising of our plays. Our undeveloped leasehold acquisition phase

is now substantially complete. We spent approximately 50% less on new leasehold in 2012 than in 2011 and are

forecasting to spend approximately 75% less in 2013 than in 2012.

Focus our Operations in the "Core of the Core" of Our Leasehold. We have made significant acquisitions of

leasehold inventory and necessary investments in infrastructure, oilfield services, seismic data and human resources

that have allowed us to drill wells more successfully and at a lower cost. Recently, we have shifted our focus to the

development of the 10 plays in which we have a #1 or #2 ownership position. In an effort to optimize our portfolio

around our core natural gas and oil properties, during 2012 we completed sales of non-core natural gas and oil

properties, midstream and other assets for proceeds of approximately $12 billion (including $1.25 billion from the sale

of a preferred security in a subsidiary), and in 2013 we are planning to sell additional natural gas and oil properties as

well as midstream, certain oilfield services and other assets that do not fit our long-term plans for expected additional

proceeds of approximately $4 - $7 billion. We expect that a much higher percentage of our total expenditures in 2013

will be directed toward drilling and completion activities. By concentrating on the "core of the core" of our assets, we

believe we can leverage our past investments to prioritize our drilling program around our highest-return assets and

enhance returns on capital.

Improve Our Balance Sheet through Reduction of Debt. Our strategic and financial plan calls for reduced long-

term debt along with continued growth in production. We believe that reduced debt and continued growth in our asset

base will lead to investment grade metrics. We expect to reduce debt primarily with proceeds from asset sales. Among

the several benefits of lower debt are lower borrowing costs, and we believe improved credit metrics will lead to more

favorable debt ratings by the major ratings agencies over time.

Mitigate Natural Gas and Oil Price Risk. We have used and intend to continue using our hedging program to

mitigate the risks inherent in developing and producing natural gas and liquids-rich resources and to provide a level

of cash flow certainty. We intend to periodically use the volatility in natural gas and oil prices to our benefit by adjusting

our hedge position when market prices reach levels that management believes are either unsustainable for the long

term, have material risk in the short term or offer unusually high rates of return on our invested capital. We currently

have downside hedge protection on approximately 85% of our expected 2013 oil production and 50% of our expected

2013 natural gas production, which equates to approximately 72% of our expected 2013 natural gas, oil and NGL

revenue, after differentials. We have also hedged a significant portion of our projected 2014 oil production.

Focus on Low Costs and Vertical Integration. By minimizing lease operating expenses through focused activities,

vertical integration and increased scale, we strive to deliver attractive profit margins and financial returns through all

phases of the commodity price cycle. Our operational efficiencies are reflected in faster spud-to-spud cycle times,

overall decreases in production costs per unit and economies of scale from pad drilling. We believe our low cost

structure is the result of management's effective cost-control programs, a high-quality asset base and access to oilfield

services, especially those we own through our wholly and non-wholly owned subsidiaries, and natural gas processing

and transportation infrastructures that exist in our key operating areas. Our high level of drilling activity and production

volumes create considerable value for our oilfield services and compression businesses. As of December 31, 2012,

we operated approximately 27,200 of our 45,400 gross wells, which delivered approximately 85% of our daily production

volume. This large percentage of operated properties provides us with a high degree of operational flexibility and cost

control.

Maintain an Entrepreneurial Culture. As an employer of approximately 12,000 people and an indirect employer

of tens of thousands more, we take pride in our innovative and aggressive implementation of our business strategy

and strive to be as entrepreneurial today as we were when we were a much smaller company. We have maintained

an unusually flat organizational structure as we have grown to help ensure that important information travels rapidly

through the Company and decisions are made and implemented quickly. Our efforts in the development of our human

resources have been recognized by many, most recently Fortune Magazine, which in January 2013 named Chesapeake

the 26th best company to work for in the U.S., including the second highest ranked company within the U.S. oil and

gas industry. This was the sixth year in a row that we have been named by Fortune as one of the 100 Best Companies

to Work for in America.