Chesapeake Energy 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2

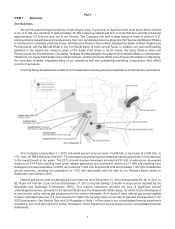

Our daily production for 2012 averaged 3.886 bcfe, an increase of 614 mmcfe, or 19%, over the 3.272 bcfe of

daily production for 2011, and consisted of 3.084 bcf (80% on a natural gas equivalent basis), approximately 85,420

bbls of oil (13% on a natural gas equivalent basis) and approximately 48,130 bbls of NGL (7% on a natural gas equivalent

basis). Our natural gas production in 2012 grew by 12%, or 333 mmcf per day; our oil production increased by 84%,

or approximately 38,950 bbls per day; and our NGL production increased by 19%, or approximately 7,820 bbls per

day.

Information About Us

Our principal executive offices are located at 6100 North Western Avenue, Oklahoma City, Oklahoma 73118 and

our main telephone number at that location is (405) 848-8000. We make available free of charge on our website at

www.chk.com our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and

amendments to those reports as soon as reasonably practicable after we electronically file such material with, or furnish

it to, the SEC. From time to time, we also post announcements, updates, events, investor information and presentations

on our website in addition to copies of all recent news releases. References to "Chesapeake", the "Company", "us",

"we" and "our" in this report are to Chesapeake Energy Corporation together with its subsidiaries, unless the context

otherwise requires.

Business Strategy

Since our inception in 1989, Chesapeake's primary goal has been to create value for investors by building and

developing one of the largest onshore natural gas and liquids-rich resource bases in the U.S. Key elements of this

business strategy are further explained below.

Grow Through the Drillbit. We believe that our most distinctive characteristic is our commitment and ability to

grow production and proved reserves organically through the drillbit at a low cost in areas with large unconventional

accumulations of natural gas and liquids. We are currently utilizing 83 operated drilling rigs and 31 non-operated drilling

rigs to conduct the most active drilling program in the U.S. We are active in most of the nation's major unconventional

plays, where we drill more horizontal wells than any other company in the industry. For many years, we have invested

large amounts of capital in undeveloped leasehold, three dimensional (3-D) seismic information and human resources

to take full advantage of our capacity to grow through the drillbit. As a result of those investments, we have been able

to increase production for 23 consecutive years. We believe the success of our drilling program is largely due to our

recognition, earlier than most of our competitors, that advanced horizontal drilling and completion techniques would

enable development of previously uneconomic natural gas and liquids-rich reservoirs and that, as a consequence,

various unconventional formations could be recognized and developed as potentially prolific reservoirs. For 2013 and

beyond, we anticipate spending significantly less than in previous years on undeveloped leasehold, oilfield service

assets and other fixed assets, and at the same time benefiting from our past investment in non-drilling assets that

facilitate our ability to drill the best wells in the most efficient manner.

Increase Liquids Production. In recognition of the value gap between liquids and natural gas prices that has

widened to historic levels in the last five years, we have directed a significant portion of our technological and leasehold

acquisition expertise to identify, secure and commercialize new unconventional liquids-rich plays. This planned

transition will result in a more balanced and likely more profitable portfolio between natural gas and liquids. To date,

we have established production in multiple liquids-rich plays on approximately 6.4 million net acres. Our production of

liquids averaged approximately 133,550 bbls per day during 2012, a 54% increase over the average during 2011, as

a result of the increased development of our unconventional liquids-rich plays. In 2012, approximately 85% of our

drilling and completion expenditures were allocated to liquids-rich plays, compared to 50% in 2011 and 30% in 2010.

We are projecting that 85% of our operated drilling and completion expenditures will be allocated to liquids development

in 2013 as well, and we expect to increase our liquids production through our drilling activities by approximately 27%

in 2013 compared to 2012, net of expected asset sales. We project that liquids will account for more than 25% of our

2013 production and approximately 60% of our natural gas, oil and NGL revenue, after differentials and realized

hedging.

Control Substantial Land and Drilling Location Inventories. Recognizing that better horizontal drilling and

completion technologies, when applied to various new unconventional reservoirs, would likely create a unique

opportunity to capture many years worth of drilling opportunities, we aggressively acquired leases in natural gas shale

plays from 2006 through 2008 and unconventional oil plays from 2009 through 2011. We believe our lease acquisition

program has given us competitive advantages in some of the best unconventional resource plays in the U.S. As of

December 31, 2012, we held approximately 15 million net acres of onshore leasehold in the U.S. We believe this

extensive leasehold position provides substantial opportunities for future growth and offers valuable divestiture