Cathay Pacific 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Cathay Pacific annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capacity – cargo and mail ATK

HK$ million

0

4,000

2,000

6,000

8,000

10,000

12,000

14,000

2003 2004 2005 2006 2007

Turnover

Million tonne

kilometres

0

4,000

6,000

2,000

8,000

10,000

12,000

14,000

2003 2004 2005 2006 2007

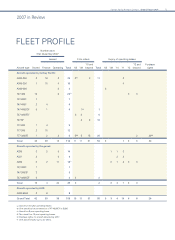

Review of Operations

Cargo Services

CATHAY PACIFIC

Cargo demand was weaker than expected throughout 2007, though with a capacity increase

of 20.3% we did see a new tonnage record set. Yield fell by 7.7%, mainly due to weak demand

out of Europe and North Asia. Growth in cargo tonnage carried from Mainland China

continued, despite an increasing number of carriers offering direct flights. High fuel prices

had a negative impact throughout the year with some shift from airfreight to marine transport

as a result. Overall we remain optimistic about Hong Kong’s role as an airfreight hub.

ATK (million) Load factor (%) Yield

2007 2006 Change 2007 2006 Change Change

Cathay Pacific 12,502 10,391 +20.3% 67.5 68.3 -0.8%pt -7.7%

• We added one more aircraft to our freighter fleet in

2007 – our sixth Boeing 747-400BCF. One more

Boeing 747-400BCF will arrive in 2008 with the

conversion of an existing Boeing 747-400.

• We announced our biggest-ever order for new

freighters in November, with an order for 10 Boeing

747-8Fs for delivery between 2009 and 2012. These

new generation aircraft offer greatly improved

efficiency and will enable us to carry more cargo

over longer distances.

• We will also take delivery of six new Boeing 747-

400ERFs, Extended Range Freighters, starting

May 2008.

• High fuel prices continued to have a big impact on

our cargo business, only partially offset by fuel

surcharges.

• The negative effect of fuel prices was particularly

felt on our older, more inefficient Boeing 747-200F

freighters. We will start to withdraw these from

service as new freighters arrive in 2008.

• Demand from Mainland China continued to be strong

and flights out of Hong Kong to North America were

full for much of the year. The freighter service to

Atlanta and Dallas was turned into a daily operation.

• We also increased our freighter frequency to

Chennai and Toronto.

• Demand to and from Australia rose significantly during

the second half of the year, helping to boost yield.

• We saw a marked decline on the Japanese route in

both directions, with tonnage and yield affected by a

modal shift to marine freight.

Cathay Pacific Airways Limited Annual Report 2007

16