Cathay Pacific 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 Cathay Pacific annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Letter

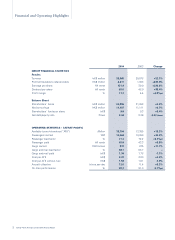

In 2004 the Group achieved its second best ever result with an attributable

profit for the year of HK$4,417 million, compared to a profit of HK$1,303

million in 2003. The result would have been even more impressive had it

not been for the sharp rise in the price of fuel. Turnover increased by 32.1%

to HK$39,065 million.

Our passenger capacity increased by 24.9%.

This increase, combined with higher load factors

and yields which rose 5.8% to HK45.8 cents,

contributed to a passenger revenue record

of HK$26,407 million.

The launch of a new non-stop service to New York,

new codeshare services to Barcelona, Madrid and

Moscow and more frequent services to Bahrain,

Brisbane, Colombo, Dubai, Manila, Osaka, Riyadh,

Surabaya, Sydney and Taipei further strengthened

Hong Kong as a global aviation hub.

We also commenced a daily passenger service

to Beijing and in early 2005 launched a thrice weekly

service to Xiamen. A second daily service to Beijing

will be introduced later this year.

Cathay Pacific Airways achieved a new annual

cargo record of 972,416 tonnes and a cargo revenue

record of HK$10,549 million. This resulted from

the continued growth in demand from Europe,

Japan and the United States for goods manu-

factured in Mainland China. A new thrice weekly

freighter service to Munich strengthened

our European operations. Daily freighter services

to Shanghai commenced in January 2005.

The full effect of higher fuel prices was tempered

by hedging gains and surcharges on both passenger

and cargo services. In 2004 fuel accounted for

23.9% of our total operating cost, up from 19.8%

in 2003. The high price of fuel remains a cause for

concern, not least because most of our hedging

gains have now been realised.

In December, we acquired a 10% equity stake

in Air China at its initial public offering.

Our strategic partnership with this key Mainland

carrier establishes a platform for co-operation

on a number of commercial and operational fronts

and creates the opportunity to strengthen network

connections in Hong Kong and Beijing.

Cathay Pacific Airways took delivery of a sixth

Boeing 747-400 freighter in February 2005.

Our fleet expansion continues with the acquisition

of eight used B747-400 aircraft, which will be

reconfigured to join our passenger and cargo fleets,

and by the introduction of two new Boeing and

six new Airbus passenger aircraft. Air Hong Kong

now operates its own fleet of five Airbus 300-600

freighters. Within two years, Cathay Pacific Airways

and Air Hong Kong will together operate more than

110 wide-bodied aircraft.

Volatile fuel prices and the steady emergence

of low cost carriers within the region will place

further pressure on us to improve productivity and

reduce unit costs. However, we remain optimistic

over our future and we will continue to expand

the airline, strengthen Hong Kong’s position as a

premier global aviation hub, and continue to deliver

superior service and value to our customers.

David Turnbull

Chairman

9th March 2005

Cathay Pacific Airways Limited 2004 Annual Report 3