Carnival Cruises 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CarnivalCorporation&plc|page17

Long-TermDebt

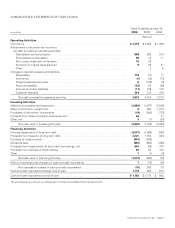

Long–termdebtconsistedofthefollowing(inmillions):

November30,

2006(a) 2005(a)

Secured

Floatingratenotes,collateralizedbyfourships,bearinginterestfromliborplus1.13%tolibor

plus1.29%(6.5%to6.8%at2006and4.9%to5.7%at2005),duethrough2015(b).............................. $672 $ 788

Fixedratenotes,collateralizedbytwoships,bearinginterestat5.4%and5.5%,duethrough2016(b)................... 379 380

Eurofloatingratenote,collateralizedbyoneship,bearinginterestateuriborplus0.5%(4.0%at2006

and2.75%at2005),duethrough2008................................................................... 43 64

Eurofixedratenote,collateralizedbyoneship,bearinginterestat4.74%,duethrough2012.......................... 134 142

Other................................................................................................ 12

TotalSecured........................................................................................ 1,229 1,376

Unsecured

Fixedratenotes,bearinginterestat3.75%to7.2%,duethrough2028(c).......................................... 2,542 2,239

Eurofixedratenotes,bearinginterestat4.4%in2006and5.57%in2005,duein2013(d)(e)........................... 985 355

Eurofloatingratenotes,bearinginterestateuriborplus0.25%toeuriborplus0.47%(3.83%at2006and

2.4%to2.6%at2005),duethrough2010(e)............................................................... 486 933

Sterlingfixedratenotes,bearinginterestat5.63%,duein2012................................................. 415 372

Sterlingfloatingratenote,bearinginterestatGBPliborplus0.33%(5.52%at2006and4.91%at2005),duein2010..... 322 285

Other................................................................................................ 34 34

Convertiblenotes,bearinginterestat2%,duein2021,withnextputoptionin2008................................ 599 600

Convertiblenotes,bearinginterestat1.75%,netofdiscount,withafacevalueof$889million,duein

2033,withfirstputoptionin2008....................................................................... 575 575

Zero-couponconvertiblenotes,netofdiscount,withafacevalueof$386millionat2006

and$510millionat2005,duein2021,withnextputoptionin2008............................................ 222 283

TotalUnsecured ..................................................................................... 6,180 5,676

7,409 7,052

Lessportionduewithinoneyear.......................................................................... (1,054) (1,325)

$6,355 $5,727

(a)Allinterestratesareasofyearends.AtNovember30,2006and2005,56%,30%and14%ofourlong-termdebtwasU.S.dollar,euroandsterling-denominated,

respectively,includingtheeffectofforeigncurrencyswaps.

(b)AportionoftwoPrincessshipshasbeenfinancedwithborrowingshavingbothfixedandvariableinterestratecomponents.

(c)InMay2006,weborrowed$352millionunderanunsecuredtermloanfacilitytopayaportionoftheCrownPrincesspurchaseprice.Thisfacilitybearsinterestat

4.51%andisrepayableinsemi-annualinstallmentsthroughMay2018.

(d)InNovember2006,weissued€750millionofbonds($985millionU.S.dollarsattheNovember30,2006exchangerate),whichhaveaneffectiveinterestrateof

4.4%andareduein2013.Thenetproceedsofthebondswereprimarilyusedtorepayoutstandingeurocommercialpaperandthebalancewillbeusedtorepay

othercurrentobligationssubsequenttoNovember30,2006.

(e)During2006,werepaid$ 361millionofCosta’sfixedrateeuronotesand$527millionoftheirfloatingrateeuronotes.