Carnival Cruises 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CarnivalCorporation&plc|page11

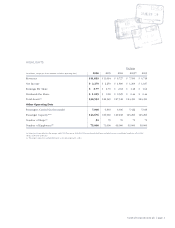

ConsolidatedStatementsofOperations

2006 2005 2004

Deferral Direct Effectof Deferral Direct Effectof Deferral Direct Effectof

Method(a) Method Change Method Method Change Method Method Change

Othershipoperatingexpenses ....... $1,484 $1,538 $ 54 $1,461 $1,465 $ 4 $1,270 $1,315 $ 45

Netincome....................... $2,333 $2,279 $(54) $2,257 $2,253 $ (4) $1,854 $1,809 $ (45)

Earningspershare

Basic .......................... $2.92 $2.85 $(0.07) $ 2.80 $ 2.80 $0.00 $ 2.31 $ 2.25 $(0.06)

Diluted......................... $2.83 $2.77 $(0.06) $ 2.70 $ 2.70 $0.00 $ 2.24 $ 2.18 $(0.06)

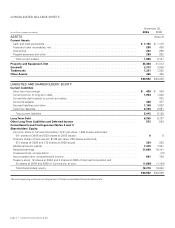

ConsolidatedBalanceSheets

2006 2005

Deferral Direct Effectof Deferral Direct Effectof

Method(a) Method Change Method Method Change

Prepaidexpensesandother................................... $ 434 $ 289 $(145) $ 352 $ 263 $(89)

Retainedearnings........................................... $11,746 $11,600 $(146) $10,233 $10,141 $(92)

Accumulatedothercomprehensiveincome ...................... $ 660 $ 661 $ 1 $ 156 $ 159 $ 3

(a)TheamountsdisclosedunderthedeferralmethodfortheyearendedandatNovember30,2006arebasedontheestimatedeffectofnotchangingourdry-dock

accountingmethodtothedirectexpensemethodforthiscurrentperiod.Accordingly,theseestimatedcurrentperiodamountshavenotbeenpreviouslyreported,

butarebeingdisclosedinaccordancewiththerequirementsofSFASNo.154.

Inaddition,asaresultofthischangeinaccountingmethod

retainedearningsatNovember30,2003decreasedby$43

millionto$7.15billionfrom$7.19billion.

Goodwill

Wereviewourgoodwillforimpairmentannually,or,when

eventsorcircumstancesdictate,morefrequently.Allofour

goodwillhasbeenallocatedtoourcruisereportingunits.

Therewerenosignificantchangestoourgoodwillcarrying

amountssinceNovember30,2004,otherthanthechanges

resultingfromusingdifferentforeigncurrencytranslationrates

ateachbalancesheetdateanda$20millionreductionto

goodwillinfiscal2006resultingfromtheresolutionofcertain

P&OPrincessCruisesplc’s(“P&OPrincess”)taxcontingency

liabilitiesthatexistedatthetimeoftheDLCtransaction.

Ourgoodwillimpairmentreviewsconsistofatwo-step

processoffirstdeterminingthefairvalueofthereportingunit

andcomparingittothecarryingvalueofthenetassetsallo-

catedtothereportingunit.Fairvaluesofourreportingunits

weredeterminedbasedonourestimatesofcomparablemarket

pricesordiscountedfuturecashflows.Ifthisfairvalueexceeds

thecarryingvalue,whichwasthecaseforourreportingunits,

nofurtheranalysisorgoodwillwrite-downisrequired.Ifthe

fairvalueofthereportingunitislessthanthecarryingvalue

ofthenetassets,theimpliedfairvalueofthereportingunitis

allocatedtoalltheunderlyingassetsandliabilities,including

bothrecognizedandunrecognizedtangibleandintangible

assets,basedontheirfairvalue.Ifnecessary,goodwillisthen

written-downtoitsimpliedfairvalue.

Trademarks

Thecostsofdevelopingandmaintainingourtrademarks

areexpensedasincurred.However,foracquisitionsmade

afterJune2001,wehaveallocatedaportionofthepurchase

pricetotheacquiree’sidentifiedtrademarks.Thetrademarks

thatCarnivalCorporationrecordedaspartofitsacquisitionof

P&OPrincess,whichareestimatedtohaveanindefiniteuse-

fullifeand,therefore,arenotamortizable,arereviewedfor

impairmentannually,or,wheneventsorcircumstancesdictate,

morefrequently.Ourtrademarkswouldbeconsideredimpaired

iftheircarryingvalueexceedstheirestimatedfairvalue.

DerivativeInstrumentsandHedgingActivities

Weutilizederivativeandnonderivativefinancialinstruments,

suchasforeigncurrencyswapsandforeigncurrencydebt

obligationstolimitourexposuretofluctuationsinforeign

currencyexchangerates,andinterestrateswapstomanage

ourinterestrateexposureandtoachieveadesiredproportion

ofvariableandfixedratedebt(seeNotes5and10).

Allderivativesarerecordedatfairvalue,andthechanges

infairvalueareimmediatelyincludedinearningsifthederiva-

tivesdonotqualifyasbeingeffectivehedges.Ifaderivative

isafairvaluehedge,thenchangesinthefairvalueofthe

derivativeareoffsetagainstthechangesinthefairvalueof

theunderlyinghedgeditem.Ifaderivativeisacashflow

hedge,thenchangesinthefairvalueofthederivativeare

recognizedasacomponentofaccumulatedothercompre-

hensiveincome(“AOCI”)untiltheunderlyinghedgeditem

isrecognizedinearnings.Ifaderivativeoranonderivative

financialinstrumentisdesignatedasahedgeofournet