Carnival Cruises 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page10 | Carnival Corporation & plc

NOTE2—SummaryofSignificant

AccountingPolicies

BasisofPresentation

Weconsolidateentitiesoverwhichwehavecontrol(see

Note3),astypicallyevidencedbyadirectownershipinterest

ofgreaterthan50%.Foraffiliateswheresignificantinfluence

overfinancialandoperatingpoliciesexists,astypicallyevi-

dencedbyadirectownershipinterestfrom20%to50%,the

investmentisaccountedforusingtheequitymethod.

CashandCashEquivalentsandShort-TermInvestments

Cashandcashequivalentsincludeinvestmentswithmatur-

itiesofthreemonthsorlessatacquisition,whicharestatedat

cost.AtNovember30,2006and2005,cashandcashequiva-

lentsincluded$936millionand$980millionofinvestments,

respectively,primarilycomprisedofmoneymarketfunds,

timedepositsandcommercialpaper.

AsofNovember30,2006and2005,ourshort-terminvest-

mentswerenotsignificant.Purchasesandsalesofshort-term

investmentsincludedinourConsolidatedStatementsofCash

Flowsconsistedofinvestmentswithoriginalmaturitiesgreater

thanthreemonthswithvariableinterestrates,whichtypically

resetevery28days.Despitethelong-termnatureoftheir

statedcontractualmaturities,wehavetheabilitytoquickly

liquidatethesesecurities.Allincomegeneratedfromthese

investmentswasrecordedasinterestincome.

Inventories

Inventoriesconsistofprovisions,giftshopandartmerchan-

diseheldforresale,fuelandsuppliescarriedatthelowerof

costormarket.Costisdeterminedusingtheweighted-average

orfirst-in,first-outmethods.

PropertyandEquipment

Propertyandequipmentarestatedatcost.Depreciation

andamortizationwerecomputedusingthestraight-linemethod

overourestimatesofaverageusefullivesandresidualvalues,

asapercentageoforiginalcost,asfollows:

Residual

Values Years

Ships.......................... 15% 30

Shipimprovements............... 0%or15% 3toremaining

lifeofship

Buildingsandimprovements ....... 0–10% 5–35

Transportationequipment

andother..................... 0–15% 2–20

Leaseholdimprovements,

includingportfacilities ..........

Shorterof

leaseterm

orrelated

assetlife

Shipimprovementcoststhatwebelieveaddvaluetoour

shipsarecapitalizedtotheships,anddepreciatedoverthe

improvements’estimatedusefullives,whilecostsofrepairs

andmaintenanceandminorreplacementcostsarechargedto

expenseasincurred.Uponreplacementorrefurbishmentof

previouslycapitalizedshipcomponents,theseassets’esti-

matedcostandaccumulateddepreciationarewrittenoff.We

capitalizeinterestonshipsandothercapitalprojectsduring

theirconstructionperiod.

Wereviewourlong-livedassetsforimpairmentwhenever

eventsorchangesincircumstancesindicatethatthecarrying

amountoftheseassetsmaynotbefullyrecoverable.The

assessmentofpossibleimpairmentisbasedonourabilityto

recoverthecarryingvalueofourassetbasedonourestimate

ofitsundiscountedfuturecashflows.Iftheseestimated

undiscountedfuturecashflowsarelessthanthecarrying

valueoftheasset,animpairmentchargeisrecognizedforthe

excess,ifany,oftheasset’scarryingvalueoveritsestimated

fairvalue.

Dry-dockCosts

Dry-dockcostsprimarilyrepresentplannedmajormainte-

nanceactivitiesthatareincurredwhenashipistakenoutof

serviceforscheduledmaintenance.During2006weelected

tochangeourmethodofaccountingfordry-dockcostsfrom

thedeferralmethod,underwhichweamortizedourdeferred

dry-dockcostsovertheestimatedperiodofbenefitbetween

dry-docks,tothedirectexpensemethod,underwhichwe

expensealldry-dockcostsasincurred.Webelievethedirect

methodispreferableasiteliminatesthesignificantamountof

timeandsubjectivitythatisneededtodeterminewhichcosts

andactivitiesrelatedtodry-dockingshouldbedeferred.In

connectionwithadoptingthischangeinaccountingpolicy,

weelectedtoearlyadoptStatementofFinancialAccounting

Standards(“SFAS”)No.154,“AccountingChangesandError

Corrections,”whichrequiresthatwereportchangesin

accountingpolicybyretrospectivelyapplyingthenewpolicies

toallpriorperiodspresented,unlessitisimpracticaltodeter-

minethepriorperiodimpacts.Accordingly,wehavepreviously

adjustedourfinancialstatementsforallperiodspresentedfor

thischangeindry-dockpolicy.Theeffectsofthischangein

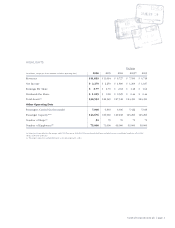

accountingpolicyfortheyearsendedandatNovember30

wereasfollows(inmillions,exceptearningspershare):

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS(continued)