Big Lots 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BIG LOTS, INC. ANNUAL REPORT 2 013

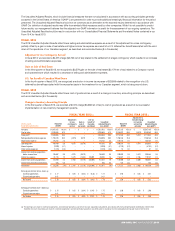

The Unaudited Adjusted Results, which include financial measures that are not calculated in accordance with accounting principles generally

accepted in the United States of America ("GAAP"), are presented in order to provide additional meaningful financial information for the period

presented. The Unaudited Adjusted Results should not be construed as an alternative to the reported results determined in accordance with

GAAP. Our definition of adjusted results may differ from similarly titled measures used by other companies. While it is not possible to predict

future results, our management believes that the adjusted non-GAAP information is useful for the assessment of our ongoing operations. The

Unaudited Adjusted Results should be read in conjunction with our Consolidated Financial Statements and the related Notes contained in our

Form 10-K for fiscal 2013.

FISCAL 2013

The 2013 Unaudited Adjusted Results reflect lower selling and administrative expense as a result of the adjustment for a loss contingency

partially offset by a gain on sale of real estate and higher income tax expense as a result of a U.S. deferred tax benefit associated with the wind

down of the operations of our Canadian segment, as described and reconciled below ($ in thousands):

Adjustment to Loss Contingency Accrual

In fiscal 2013, we recorded a $4,375 charge ($2,760 net of tax) related to the settlement of a legal contingency which resulted in an increase

of selling and administrative expenses.

Gain on Sale of Real Estate

In the third quarter of fiscal 2013, we recognized a $3,579 gain on the sale of real estate ($2,179 net of tax) related to a Company-owned

and operated store which resulted in a decrease of selling and administrative expenses.

U.S. Tax Benefit of Canadian Wind Down

In the fourth quarter of fiscal 2013, we recognized a reduction in income tax expense of $23,899 related to the recognition of a U.S.

deferred tax benefit associated with the excess tax basis in the investment in our Canadian segment, which is being wound down.

FISCAL 2012

The 2012 Unaudited Adjusted Results reflect lower cost of goods sold as a result of a change in inventory accounting principle, as described

and reconciled below ($ in thousands):

Change in Inventory Accounting Principle

In the first quarter of fiscal 2012, we recorded a $5,574 charge ($3,388 net of tax) to cost of goods sold as a result of our successful

implementation of new inventory management systems.

Net sales $ 5,301,912 100.0% $ – $ – $ – $ 5,301,912 100.0% $ 5,367,165 100.0% $ – $ 5,367,165 100.0%

Cost of sales 3,236,606 61.0 – – – 3,236,606 61.0 3,254,837 60.6 (5,574 ) 3,249,263 60.5

Gross profit 2,065,306 39.0 – – – 2,065,306 39.0 2,112,328 39.4 5,574 2,117,902 39.5

Selling and administrative expenses 1,759,745 33.2 (4,375) 3,579 – 1,758,949 33.2 1,708,160 31.8 – 1,708,160 31.8

Depreciation expense 115,122 2.2 – – – 115,122 2.2 106,137 2.0 – 106,137 2.0

Operating profit 190,439 3.6 4,375 (3,579) – 191,235 3.6 298,031 5.6 5,574 303,605 5.7

Interest expense (3,339 ) ( 0.1) – – – (3,339 ) (0.1) (4,192 ) (0.1) – (4,192) (0.1)

Other income (expense) (1,213) (0.0) – – – (1,213) (0.0) 51 0.0 – 51 0.0

Income from continuing operations

before income taxes 185,887 3.5 4,375 (3,579 ) – 186,683 3.5 293,890 5.5 5,574 299,464 5.6

Income tax expense 61,118 1.2 1,615 (1,400 ) 23,899 85,232 1.6 116,921 2.2 2,186 119,107 2.2

Income from continuing operations 124,769 2.4 2,760 (2,179) ( 23,899) 101,451 1.9 176,969 3.3 3,388 180,357 3.4

Income from discontinued operations 526 0.0 – – – 526 0.0 152 0.0 – 152 0.0

Net income $ 125,295 2.4% $ 2,760 $ (2,179) $ (23,899) $ 101,977 1.9% $ 177,121 3.3% $ 3,388 $ 180,509 3.4%

Earnings per common share - basic: (g)

Continuing operations $ 2.17 $ 0.05 $ (0.04) $ (0.42) $ 1.77 $ 2.96 $ 0.06 $ 3.01

Discontinued operations 0.01 – – – 0.01 – – –

Net income $ 2.18 $ 0.05 $ (0.04) $ (0.42) $ 1.78 $ 2.96 $ 0.06 $ 3.02

Earnings per common share - diluted: (g)

Continuing operations $ 2.15 $ 0.05 $ (0.04) $ (0.41) $ 1.75 $ 2.93 $ 0.06 $ 2.98

Discontinued operations 0.01 – – – 0.01 – – –

Net income $ 2.16 $ 0.05 $ (0.04) $ (0.41) $ 1.76 $ 2.93 $ 0.06 $ 2.98

FISCAL YEAR 2013

(a)

FISCAL YEAR 2012

(a)

Adjustment to

exclude change

in inventory

accounting

principle

Reported

(GAAP)

Unaudited

Adjusted Results

(non-GAAP)

Unaudited

Adjusted Results

(non-GAAP)

Reported

(GAAP)

Adjustment

to loss

contingency

accrual

Gain on

sale of

real estate

U.S. tax

benefit of

Canadian

wind down

(g) The earnings per share for continuing operations, discontinued operations and net income are separately calculated in accordance with Accounting Standards Codification ("ASC") 260;

therefore, the sum of earnings per share for continuing operations and discontinued operations may differ, due to rounding, from the calculated earnings per share of net income.

($ in thousands,

except per share amounts)