Barclays 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Barclays annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Barclays PLC

Annual Report 2006

16

Financial review

collections throughout 2006 and, as a consequence, believes we have

passed the worst in Barclaycard UK impairment in the second half of

2006. There has also been a review of some partnership businesses and

lending to higher risk customers. An operational review is also under

way, to improve efficiency and enhance Barclaycard’s ability to provide

the best service to customers, wherever they are in the world.

We continued to invest in Barclaycard US. Since we bought the

business in December 2004, outstandings have grown from US$1.4bn

to US$4.0bn, and cards in issue have increased from 1.1 million to

4.2 million. Income grew 73% in 2006. We are on track to become

profitable in 2007.

International Retail and Commercial Banking achieved a step

change in profitability to £1,270m (2005: £633m), reflecting the

inclusion of Absa for a full year, the impact of corporate development

activity and growth in key geographies.

International Retail and Commercial Banking – excluding Absa

achieved a profit before tax of £572m (2005: £335m), including a

gain of £247m from the disposal of our interest in FirstCaribbean

International Bank. Excluding this gain, profit before tax was £325m

(2005: £335m). Good organic growth in the businesses across

continental Europe was offset by incremental investment in distribution

capacity and technology across the businesses in 2006. We expect to

double the rate of investment in infrastructure and distribution in 2007.

International Retail and Commercial Banking – Absa contributed

£698m profit before tax in the first full year of ownership and is

performing well ahead of our acquisition business case. Absa Group

Limited achieved year on year growth in profit before tax of 24% in

Rand terms, reflecting very strong growth in mortgages, credit cards

and commercial property finance. The benefits of Barclays ownership

are evident in 46% attributable earnings growth in both Absa Card and

Absa Capital (reported in Barclays Capital), with total synergy benefits

well ahead of plan.

Barclays Capital produced an outstanding performance with profit

before tax rising 55% to £2,216m. Income growth of 39% was driven

by doing more business with new and existing clients and was broadly

based across asset classes and geographies. Growth was particularly

strong in areas where we have invested in recent years, including

commodities, equity products and credit derivatives. Profit growth

was accompanied by improvements in productivity: income and

profits grew significantly faster than Daily Value at Risk, risk weighted

assets, economic capital, regulatory capital and costs. The ratio of

compensation costs to net income improved two percentage points

to 49% and the cost:net income ratio improved three percentage points

to 64%. We continued to invest for future growth, increasing headcount

3,300 including 1,300 from the acquisition of HomEq, a US mortgage

servicing business.

Barclays Global Investors delivered excellent results, with profit

before tax up 32% to £714m. Income growth of 26% was attributable

to increased management fees, particularly in the iShares and active

businesses. Assets under management grew US$301bn to US$1.8trn,

including net new assets of US$68bn, reflecting very strong inflows in

iShares and active assets. The cost:income ratio improved two

percentage points to 57%.

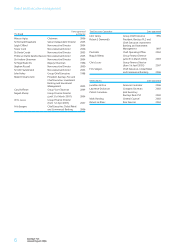

Group financial performance

The Group’s profit before tax in 2006 increased 35% (£1,856m) to

£7,136m (2005: £5,280m). Income increased 25% (£4,262m) to

£21,595m (2005: £17,333m) whilst operating expenses rose 20%

(£2,147m) to £12,674m (2005: £10,527m). Impairment charges

rose 37% (£583m) to £2,154 (2005: £1,571m).

Earnings per share rose 32% to 71.9p (2005: 54.4p), diluted earnings

per share rose 33% to 69.8p (2005: 52.6p). Dividends per share rose

17% to 31p (2005: 26.6p). Return on average shareholders’ funds was

25% (2005: 21%). Economic profit was up 54% (£952m) to £2,704m

(2005: £1,752m).

Business performance

In UK Banking we made significant strides towards our strategic priority

of building the best bank in the UK. Strong growth in income enabled us

to increase our profit before tax 17% to £2,578m. The improvement in

the cost:income ratio was four percentage points in headline terms to

52% (2005: 56%). Excluding the impact of property gains and

accelerated investment, the improvement in the cost:income ratio was

three percentage points making a cumulative total for 2005-2006 of

six percentage points. This means that we have achieved our target of

a six percentage point improvement over the period 2005-2007, one

year ahead of schedule. We continue to target a further two percentage

point improvement in the cost:income ratio for 2007 to 51%.

UK Retail Banking delivered a 17% profit before tax increase to

£1,213m. This was driven by broadly based income growth of 7%, with

particularly strong performances in savings, Local Business and UK

Premier and good growth in current accounts. Our mortgage market

share and processing capacity also increased strongly leading to a net

market share of 4% for the second half of the year. We doubled

investment across the business. We focused on upgrading distribution

capabilities, transforming the performance of the mortgage business,

revitalising product offerings, and improving core operations and

processes. The additional investment substantially offset the impact of

property gains, leading to broadly flat costs. In 2007 we expect to make

further significant investment, including the restructuring of the branch

network and the migration of Woolwich customers.

UK Business Banking delivered very strong growth in profit before tax

of 18% to £1,365m. Strong growth in loans and deposits drove income

growth of 11%. Profit before business disposals grew 11%. UK Business

Banking maintained its competitive position and also funded significant

investment in improving its infrastructure and customer service.

At Barclaycard profit before tax fell 40% to £382m. Good income

growth of 8%, driven by very strong momentum in Barclaycard

International, was more than offset by a further rise in impairment

charges, principally in the UK lending portfolios, and by higher costs,

mainly as a result of continued investment in Barclaycard US. In the UK,

high debt levels and changing attitudes to bankruptcy and debt default

contributed to increased impairment charges. As the consumer lending

market in the UK changes, Barclaycard is repositioning its business to

achieve sustainable, profitable growth. Higher borrowing by UK

consumers, lower disposable household incomes and a tougher

regulatory environment have seen Barclaycard take a number of actions.

The business focused on tighter lending criteria and improved