Barclays 2006 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2006 Barclays annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Barclays PLC

Annual Report 2006 9

Operating review

1

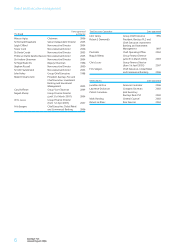

Group performance

We made substantial progress on our strategic priorities and delivered

record financial results. Profit before tax increased 35% to £7,136m.

Earnings per share rose 32% to 71.9p, and economic profit was up 54%

to £2,704m. Profit excluding business disposals of £323m increased

29% to £6,813m, and earnings per share increased 23% to 66.8p.

We increased the total dividend payout to 31p, a rise of 17%.

Income grew 25% to £21,595m, well ahead of expense growth of 20%.

The growth was broadly based by business and geography, reflecting

momentum in each business. All businesses made significant

contributions, with especially strong performances from Barclays

Capital, UK Banking and Barclays Global Investors, and a substantial

contribution to income from Absa in its first full year of ownership.

Excluding Absa, Group income grew 18%, compared with expense

growth of 13%. The mix of income and profit continued to evolve.

Approximately half our profits came from outside the UK, up from

about 30% in 2003.

Operating expenses increased 20% to £12,674m. The Group

cost:income ratio improved two percentage points to 59%.

We continue to target top quartile productivity for all businesses,

and in 2006 the ratio improved or remained flat in all businesses.

Operating expenses include gains on the sale of properties of £432m

partly offset by accelerated incremental investment expenditure of

approximately £280m.

Impairment charges rose 37% to £2,154m. Excluding Absa, impairment

charges on loans and advances increased 26%. The increase was

mostly attributable to the challenging credit environment in UK

unsecured retail lending, which was partly due to the continued rise in

the level of personal insolvencies. In the second half of 2006, as a result

of a number of management actions, flows into delinquency decreased

and arrears balances declined across the UK cards and unsecured loans

portfolios. We therefore believe that we passed the worst in Barclaycard

UK impairment in the second half of 2006. UK mortgage impairment

charges remained negligible, and the wholesale and larger corporate

sectors continued to be stable with a low level of defaults.

When I look at these results, I am pleased to see increased productivity

in our use of capital, risk and costs. Return on average shareholders’

funds improved four percentage points to 25%; profits grew much

faster than Daily Value at Risk and risk weighted assets and the

associated consumption of capital; and income growth exceeded cost

growth by five percentage points.

Capital management

Our strong credit rating and disciplined approach to capital

management remain sources of competitive advantage. Our capital

management policies are designed to optimise the returns to

shareholders whilst maintaining our credit rating.

At the end of 2006, our Tier 1 capital ratio was 7.7% (2005: 7.0%).

The improved capital ratio was driven by the strong capital generation

of our business portfolio, the impact of disposals, including our stake in

FirstCaribbean International Bank, and the efficient management of the

balance sheet through the use of the capital markets. We have invested

almost £2bn to support the capital required for our organic growth

throughout the portfolio at a very attractive rate of return and we also

increased the dividend to shareholders by 17%.

We commenced parallel running for Basel II at the end of 2006. Whilst

there are still areas in which the regulators have not yet defined the

requirements for detailed implementation, we continue to anticipate

a modest benefit to our capital ratios from Basel II. For 2007 we will

continue to report our capital ratios under Basel I.

Executive management

I want to acknowledge the significant contributions of two executive

directors who are leaving Barclays. David Roberts, previously Chief

Executive of International Retail and Commercial Banking, left Barclays

at the end of 2006 after 23 years of outstanding service. Naguib Kheraj

has been a generator of very significant value for the Group over the last

ten years in a number of different roles at Barclays, most recently as

Group Finance Director. He will be leaving us in 2007. I thank David and

Naguib warmly for their dedication to the success of Barclays and I wish

them well for the future. Our new Group Finance Director, Chris Lucas

joins us in April and brings a wealth of experience in financial services.

Outlook

We enter 2007 with strong income momentum in Barclays, driven

by high levels of customer activity and good risk control. The global

economic outlook continues to be positive and we are well positioned

to capture further growth in the years ahead.

John Varley

Group Chief Executive