Barclays 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 Barclays annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310

|

|

Barclays PLC

Annual Report 2006

8

Earn, invest and grow

Delivering on our strategy

John Varley Group Chief Executive Barclays PLC

start this review by thanking the 123,000 employees of the Barclays

Group, whose dedication and creativity helped us achieve record

results. Our strategy of ‘earn, invest and grow’ continued to deliver

very strong growth in profits in 2006. Our ambition is to become one

of the handful of universal banks leading the global financial services

industry. I believe that the universal banking model is helping us

drive the higher growth for shareholders that I set out to achieve three

years ago, by providing us with new options in products, services

and markets.

In our business, strategy simply stated is anticipation followed by

service: we anticipate the needs of customers and clients. We then serve

them, by helping them achieve their goals. The needs of customers and

clients are changing. The drivers of change include: the privatisation

of welfare; wealth generation and wealth transfer; explosive growth in

demand for banking products in emerging markets; the securitisation

of assets and cash flows; the use of derivatives in risk management; the

significant growth in the use of credit cards for payment and borrowing;

and the opportunity for capital markets and private equity to fund

infrastructure development around the world.

To capitalise on these sources of growth, I have put a new structure in

place by creating Global Retail and Commercial Banking (GRCB) under

the leadership of Frits Seegers, who joined Barclays in July 2006. GRCB

brings together: UK Banking, International Retail and Commercial

Banking and Barclaycard. GRCB gives Barclays a single point of strategic

direction and control to these businesses, thereby increasing our

capability to drive growth and synergies globally and to enter new

markets. We believe this will enable us to replicate success from one

part of the world in another. This GRCB structure mirrors the

organisation of Investment Banking and Investment Management

under Bob Diamond, which also gives a single point of strategic

direction and control to a group of global businesses which enjoy

substantial synergies.

My obligation as Group Chief Executive is to assemble the best team

I can. We have added significantly to our management bench strength

in 2006, particularly in GRCB, and have concentrated on supplementing

our existing talent with deep specialist retail and commercial banking

and card experience across a range of international markets.

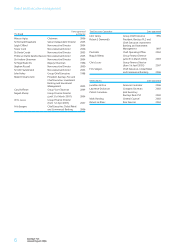

Performance versus goals

For the three years from 31st December 2003 to 31st December 2006,

Barclays delivered a total shareholder return (TSR) of 66% and was

positioned 6th within its peer group, which is second quartile.

The TSR of the FTSE 100 Index for this period was 54%. For the year to

31st December 2006, we delivered a TSR of 25% and were positioned

5th in our peer group. The TSR for the FTSE 100 for the year was 14%.

Economic profit for 2006 was £2.7bn, which, added to the £3.3bn

generated in 2004 and 2005, delivered a cumulative total of £6.0bn for

the goal period to date. This equates to compound annual growth in

economic profit of 28% per annum over the period, which is well ahead

of our target range.

Group Chief Executive’s review

IOur strategy of ‘earn, invest and

grow’ continued to deliver strong

growth in profits.