Barclays 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Barclays annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Barclays PLC

Annual Report 2006

Earn, invest and grow

Table of contents

-

Page 1

Barclays PLC Annual Report 2006 Earn, invest and grow -

Page 2

... Executive management structure Chairman's statement Group Chief Executive's review Consolidated income statement and balance sheet summary Financial review Risk factors Risk management Critical accounting estimates Section 2 Governance Board and Executive Committee Directors' report Corporate... -

Page 3

...lend, invest and protect money for over 27 million customers and clients the world over. Our business purpose is to help our customers and clients achieve their objectives. Our goal is to deliver top quartile total shareholder return relative to our peers, consistently over time. John Varley Group... -

Page 4

... from that date and are not directly comparable to 2006. 'Absa Capital' is the portion of Absa's results that is reported by Barclays within the Barclays Capital business. Glossary of terms The cost:income ratio is defined as operating expenses compared to total income net of insurance claims. The... -

Page 5

... Financial highlights and performance indicators Executive management structure Chairman's statement Group Chief Executive's review Consolidated income statement and balance sheet summary Financial review Risk factors Risk management Critical accounting estimates Barclays PLC Annual Report 2006 1 -

Page 6

... 1,613 International branches including Absa 780,000 Business customers 6.4m International cards in issue Barclays PLC is a major global financial services provider engaged in retail and commercial banking, credit cards, investment banking, wealth management and investment management services. We... -

Page 7

....7% Return on average shareholders' equity Increase in economic profit Tier 1 capital ratio to £2,704m Investment Banking and Investment Management Barclays Global Investors US$1,814bn Assets under management Barclays Wealth £93bn Total client assets "Barclays had an excellent year in 2006. We... -

Page 8

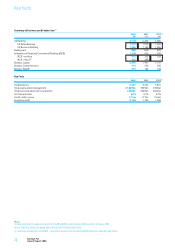

Key facts Summary of business profit before tax(c) 2006 £m 2005 £m 2004(a) £m UK Banking UK Retail Banking UK Business Banking Barclaycard International Retail and Commercial Banking (IRCB) IRCB - ex Absa IRCB - Absa(b) Barclays Capital Barclays Global Investors Barclays Wealth Key Facts 2,578... -

Page 9

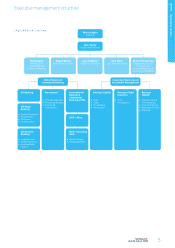

...) Barclays Capital Barclays Global Investors Barclays Wealth Rates Credit Private Equity Absa Capital • Asset Management International and Private Banking Financial Planning Investment Services Brokerage Personal Customers Home Finance UK Premier Local Business IRCB - Absa UK... -

Page 10

... officers Date appointed 2005 2004 2004 2007 2006 Jonathan Britton Lawrence Dickinson Patrick Gonsalves Mark Harding Robert Le Blanc Financial Controller Company Secretary Joint Secretary, Barclays Bank PLC General Counsel Risk Director 2006 2002 2002 2003 2004 6 Barclays PLC Annual Report... -

Page 11

... 1 Operating review Delivering growth An excellent year with total shareholder return of 25% Marcus Agius Chairman Barclays PLC B arclays had an excellent 2006. Profit before tax rose by 35%, with outstanding performances from Barclays Capital and Barclays Global Investors. Of particular note is... -

Page 12

...GRCB brings together: UK Banking, International Retail and Commercial Banking and Barclaycard. GRCB gives Barclays a single point of strategic direction and control to these businesses, thereby increasing our capability to drive growth and synergies globally and to enter new markets. We believe this... -

Page 13

... growth in the years ahead. John Varley Group Chief Executive Capital management Our strong credit rating and disciplined approach to capital management remain sources of competitive advantage. Our capital management policies are designed to optimise the returns to shareholders whilst maintaining... -

Page 14

...per share Dividends per ordinary share Dividend payout ratio Profit attributable to the equity holders of the parent as a percentage of: average shareholders' equity average total assets Cost:income ratio Cost:net income ratio Average United States Dollar exchange rate used in preparing the accounts... -

Page 15

...year Selected financial statistics Basic earnings per share Diluted earnings per share Dividends per ordinary share Dividend payout ratio Attributable profit as a percentage of: average shareholders' funds average total assets Average United States Dollar exchange rate used in preparing the accounts... -

Page 16

...' equity Total liabilities and shareholders' equity Risk weighted assets and capital ratios Risk weighted assets Tier 1 ratio(b) Risk asset ratio(b) Selected financial statistics Net asset value per ordinary share Year-end United States Dollar exchange rate used in preparing the accounts Year-end... -

Page 17

...asset ratio Selected financial statistics Net asset value per ordinary share Year-end United States Dollar exchange rate used in preparing the accounts Year-end Euro exchange rate used in preparing the accounts The financial information shown here is extracted from the UK GAAP published accounts for... -

Page 18

14 Barclays PLC Annual Report 2006 -

Page 19

... - excluding Absa International Retail and Commercial Banking - Absa Investment Banking and Investment Management Barclays Capital Barclays Global Investors Barclays Wealth Barclays Wealth - closed life assurance activities Head office functions and other operations Results by nature of income and... -

Page 20

... Rand terms, reflecting very strong growth in mortgages, credit cards and commercial property finance. The benefits of Barclays ownership are evident in 46% attributable earnings growth in both Absa Card and Absa Capital (reported in Barclays Capital), with total synergy benefits well ahead of plan... -

Page 21

... top quartile total shareholder return (TSR) relative to a peer group of 11 other UK and international financial services institutions. TSR is defined as the value created for shareholders through share price appreciation, plus reinvested dividend payments. In 2004, we announced a new performance... -

Page 22

18 Barclays PLC Annual Report 2006 -

Page 23

... Wealth Head office - closed life functions Barclays assurance and other Wealth activities operations £m £m £m Analysis of results by business For the year ended 31st December 2006 Barclays Capital £m Barclays Global Investors £m Group £m Net interest income Net fee and commission income... -

Page 24

... 43 5,495 (46) 5,449 (188) 5,261 (3,220) (2) (3,222) 5 42 2,086 59% 61% £360m 35% £1,086m 2004 Loans and advances to customers Customer accounts Total assets Risk weighted assets Key Facts Number of UK branches £123.9bn £142.4bn £139.9bn £84.9bn 2,014 £118.2bn £129.7bn £130.3bn £79.9bn... -

Page 25

... improvement in 2007 to 51%. 2005/04 UK Banking profit before tax in 2005 increased 5% (£114m) to £2,200m (2004: £2,086m) driven by good income growth and strong cost management. The cost:income ratio improved by three percentage points to 56% (2004: 59%). Barclays PLC Annual Report 2006 21 -

Page 26

... 2004 Loans and advances to customers Customer accounts Total assets Risk weighted assets Key Facts Personal Customers Number of UK current accounts Number of UK savings accounts Total UK mortgage balances (residential) Number of household insurance policies Local Business and UK Premier Number of... -

Page 27

...: £1,131m). There was strong current account income growth in Personal Customers and Local Business. UK Premier delivered strong growth reflecting higher income from banking services, mortgage sales and investment advice. Net premiums from insurance underwriting activities decreased 4% (£11m) to... -

Page 28

... Barclays Capital and Barclaycard. UK Business Banking provides asset financing and leasing solutions through a specialist business. 2006 £m 2005 £m Net interest income Net fee and commission income Net trading income Net investment income Principal transactions Other income Total income... -

Page 29

... rise in income from foreign exchange and derivatives business transacted through Barclays Capital on behalf of Business Banking customers. Income from principal transactions was £30m (2005: £17m), primarily reflecting the profit realised on a number of equity investments. As expected, impairment... -

Page 30

...Loans and advances to customers Total assets Risk weighted assets Key Facts Number of Barclaycard UK customers Number of retailer relationships UK credit cards - average outstanding balances UK credit cards - average extended credit balances UK loans - average consumer lending balances International... -

Page 31

... performed strongly, with Germany and Spain delivering excellent results. Excluding Barclaycard US, Barclaycard International profit before tax was £22m (2004: £8m), with income ahead 22%. The loss before tax for Barclaycard US was £59m (2004: loss of £2m). Barclays PLC Annual Report 2006 27 -

Page 32

... and Commercial Banking - Absa. International Retail and Commercial Banking works closely with all other parts of the Group to leverage synergies from product and service propositions. 2006 £m 2005 £m 2004(a) £m Net interest income Net fee and commission income Net trading income Net investment... -

Page 33

... from International Retail and Commercial Banking - Absa of £298m(a) and strong organic growth in Africa and Europe. From 1st January 2005, following the application of IAS 39 and IFRS 4, life assurance products are divided into investment contracts and insurance contracts. Investment income from... -

Page 34

... Absa Income Proï¬t before tax Contribution to Group profit £1,134m £572m 8% 2006 £m 2005 £m 2004(a) £m International Retail and Commercial Banking - excluding Absa provides a range of banking services, including current accounts, savings, investments, mortgages and loans to personal... -

Page 35

... increased 10% to £138m (2004: £125m) reflecting continued investment and balance sheet growth across the businesses. The post-tax profit from associates decreased £10m to £39m (2004: £49m) due to a lower contribution from FirstCaribbean International Bank. Barclays PLC Annual Report 2006 31 -

Page 36

... finance, credit cards, bancassurance products and wealth management services; it also offers customised business solutions for commercial and large corporate customers. 2006 £m 2005(a) £m Net interest income Net fee and commission income Net trading income Net investment income Principal... -

Page 37

... Operating review 2006/05 International Retail and Commercial Banking - Absa profit before tax increased 134% to £698m (2005: £298m) reflecting the full year to 31st December 2006 compared with the five months ended 31st December 2005. Barclays acquired a controlling stake in Absa Group Limited on... -

Page 38

... investment banking business of Absa. Barclays Capital works closely with all other parts of the Group to leverage synergies from client relationships and product capabilities. 2006 £m 2005 £m 2004(a) £m Net interest income Net fee and commission income Net trading income Net investment income... -

Page 39

.... Investment expenditure, primarily in the front office, continued to be significant although less than 2004 as headcount growth slowed. The cost:net income ratio remained stable at 67%. Note (a) For 2005, this reflects the period from 27th July until 31st December 2005. Barclays PLC Annual Report... -

Page 40

... investment management products and services. BGI offers structured investment strategies such as indexing, global asset allocation and risk controlled active products including hedge funds and provides related investment services such as securities lending, cash management and portfolio transition... -

Page 41

...£71bn as a result of market movements. In US$ terms, the increase in assets under management to US$1,513bn from US$1,362bn (2004) included US$88bn of net new assets and US$121bn of market movements, partially offset by adverse exchange rate movements of US$58bn. Barclays PLC Annual Report 2006 37 -

Page 42

... providing private banking, asset management, stockbroking, offshore banking, wealth structuring and financial planning services. Barclays Wealth works closely with all other parts of the Group to leverage synergies from client relationships and product capabilities. Net interest income Net fee and... -

Page 43

.... The cost:income ratio improved three percentage points to 79% (2005: 82%). Total client assets, comprising customer deposits and client investments, increased 19% (£14.7bn) to £93.0bn (2005: £78.3bn) reflecting good net new asset inflows and favourable market conditions. Multi-Manager assets... -

Page 44

... Barclays Wealth - closed life assurance activities Barclays Wealth - closed life assurance activities comprise the closed life assurance businesses of Barclays and Woolwich in the UK. 2006 £m 2005 £m 2004(a) £m Net interest income Net fee and commission income Net trading income Net investment... -

Page 45

... £42m). 2005/04 Barclays Wealth - closed life assurance activities loss before tax reduced to £7m (2004: loss of £53m), predominantly due to lower funding and redress costs in 2005. Profit before tax excluding customer redress costs was £78m (2004: £44m). Total income decreased to £495m (2004... -

Page 46

... functions Businesses in transition Consolidation adjustments. Head office and central support functions comprise the following areas: Executive management, Finance, Treasury, Corporate Affairs, Human Resources, Strategy and Planning, Internal Audit, Legal, Corporate Secretariat, Property, Tax... -

Page 47

...Barclays Capital for capital raising and risk management advice of £39m (2004: £nil). Previously, capital raising fees were amortised over the life of the capital raising and taken as a charge to net interest income. Under IFRS they are recognised as a cost in the year of issue. Net trading income... -

Page 48

... the period from 27th July until 31st December 2005. (c) International Retail and Commercial Banking business margins, average balances and business net interest income for 2004 and 2005 have been restated on a consistent basis to reflect changes in methodology. 44 Barclays PLC Annual Report 2006 -

Page 49

... to: benefit of capital excluded from the business margin calculation, Head office functions and other operations; net funding on non-customer assets and liabilities; and Barclays Wealth - closed life assurance activities. 2006/05 UK Retail Banking assets margin decreased 8 basis points to 0.84... -

Page 50

... Excluding Absa, fee and commission income grew by 10%. The growth was driven by Barclays Global Investors, reflecting strong growth in net new assets, a strong investment performance and higher market levels, and by Barclays Capital, as a result of increased business volumes and higher market share... -

Page 51

... from 27th July until 31st December 2005. (c) Prior year analysis of loans and advances to customers between retail business and wholesale and corporate business has been reclassified to reflect enhanced methodology implemented in the current year (see page 95). Barclays PLC Annual Report 2006 47 -

Page 52

... associated with the Head office relocation to Canary Wharf. The Group cost:income ratio remained steady at 61%. This reflected improved productivity in UK Banking, Barclays Global Investors and Barclays Wealth; and a stable performance by International Retail and Commercial Banking, offset by an... -

Page 53

... Retail Banking UK Business Banking Barclaycard International Retail and Commercial Banking International Retail and Commercial Banking - ex Absa International Retail and Commercial Banking - Absa Barclays Capital Barclays Global Investors Barclays Wealth Head office and other operations Total Group... -

Page 54

...FirstCaribbean International Bank and £76m from the sale of interests in vehicle leasing and vendor finance businesses. 2005/04 The profit on disposal in 2004 relates mainly to the disposal of the Group's shareholding in Edotech, an investment in a management buy-out of the former Barclays in-house... -

Page 55

... profit purposes, includes historic goodwill, and is adjusted to reflect the impact of hedging, available for sale securities and retirement benefits. (c) The capital charge includes a charge for purchased goodwill and intangible assets from business acquisitions. Barclays PLC Annual Report 2006... -

Page 56

... doubtful lendings, including non-accrual lendings. Interest receivable on such lendings has been included to the extent to which either cash payments have been received or interest has been accrued in accordance with the income recognition policy of the Group. 52 Barclays PLC Annual Report 2006 -

Page 57

...,464 2.3 36.1% 33.3% 30.7% Notes (a) Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. (b) Average balances are based upon daily averages for most UK banking operations and monthly averages elsewhere. Barclays PLC Annual Report 2006 53 -

Page 58

... Total interest receivable: - in offices in the UK - in offices outside the UK 4,319 5,690 10,009 Notes (a) 2004 figures do not reflect the applications of IAS 32, and IAS 39 and IFRS 4 which became effective from 1st January 2005. (b) 2003 reflects UK GAAP. 54 Barclays PLC Annual Report 2006 -

Page 59

... UK Customer accounts - other time deposits - wholesale: - in offices in the UK - in offices outside the UK Debt securities in issue: - in offices in the UK - in offices outside the UK Dated and undated loan capital and other subordinated liabilities principally in offices in the UK External trading... -

Page 60

... (2005: £4.0bn). Total assets 2006 £m 2005 £m 2004(a) £m UK Banking UK Retail Banking UK Business Banking Barclaycard IRCB IRCB - ex Absa IRCB - Absa Barclays Capital Barclays Global Investors Barclays Wealth Barclays Wealth - closed life assurances activities Head office functions and other... -

Page 61

... acquired for hedging purposes. Risk weighted assets increased 21% to £4bn (2004: £3.3bn), reflecting assets held for hedging purposes. Note (a) 2004 figures do not reflect the applications of IAS 32, and IAS 39 and IFRS 4 which became effective from 1st January 2005. Barclays PLC Annual Report... -

Page 62

... issued are included within Shareholders' equity excluding minority interests in the Barclays Bank PLC Group. 2006 £m 2005 £m 2004(a) £m Barclays Bank PLC Group Shareholders' equity excluding minority interests Minority interests Shareholders' equity Undated loan capital Dated loan capital Total... -

Page 63

...of loan capital partially offset by exchange rate movements of £0.6bn and redemptions of £0.4bn. Similar movements are reflected in the risk weighted assets and total net capital resources of Barclays Bank PLC Group, however the retention by Barclays PLC of dividends paid by Barclays Bank PLC gave... -

Page 64

... £m Barclays PLC Group £m 2005 Barclays Bank PLC Group £m Barclays PLC Group £m UK GAAP 2004(a) Barclays Bank PLC Group £m Capital resources (as defined for regulatory purposes) Tier 1 Called up share capital Eligible reserves Minority interests Tier One Notes Less: Intangible assets Total... -

Page 65

...banks and customers accounts. Average: year ended 31st December 2006 £m 2005 £m Deposits from banks Customers in the United Kingdom Customers outside the United Kingdom: Other European Union United States Africa Rest of the World Total deposits from banks Customer accounts Customers in the United... -

Page 66

...34,287 47,912 4.2 11.2 4.5 4.5 The yield for each range of maturities is calculated by dividing the annualised interest income prevailing at 31st December 2006 by the fair value of securities held at that date. Note (a) The book value represents the fair value. 62 Barclays PLC Annual Report 2006 -

Page 67

... in Note 60 (o) to the accounts. Derivatives on own shares During the period Barclays entered into a cash-settled total return swap referencing its own ordinary shares. This instrument provides a hedge against the employers' national insurance liability arising on employee share schemes, where... -

Page 68

... in the income it receives from fees and commissions and interest. The Group's capital management activities seek to maximise shareholder value by optimising the level and mix of its capital resources. Capital risk is mitigated by: • • • ensuring access to a broad range of investor markets... -

Page 69

... payment cards and payment systems businesses of the Group and on its retail banking activities in the EU countries in which it operates. In the UK, in September 2005 the Office of Fair Trading (OFT) received a super-complaint from the Citizens Advice Bureau relating to payment protection insurance... -

Page 70

... consumer protection and regulating market conduct. In the United States, Barclays PLC, Barclays Bank PLC, and certain US subsidiaries and branches of the Bank are subject to a comprehensive regulatory structure, involving numerous statutes, rules and regulations, including the International Banking... -

Page 71

... Other market risks Capital and liquidity management Operational and business risk management Group model policy Taxation risk management Insurance risk management Disclosures about certain trading activities Derivatives Statistical information 90 91 91 92 92 94 95 Barclays PLC Annual Report 2006... -

Page 72

... international activities in the USA, Europe and South Africa expanded. Looking outside the UK, Barclaycard US has been growing its card portfolio and Absa also operated in a growing market in South Africa. The business model explicitly includes the benefits of risk diversification of new products... -

Page 73

...outside Barclays Capital, which mainly include interest rate exposures within the various banking books and some Treasury risks, remained very modest, consistent with the Group's policy of hedging these positions to a material degree. Barclays defined benefit pension risks are also closely monitored... -

Page 74

... and half-yearly impairment allowances and regulatory reports. Both Committees also receive reports dealing in more depth with specific issues relevant at the time. The proceedings of both Committees are reported to the full Board, which also receives a concise quarterly risk report. Internal Audit... -

Page 75

... Credit risk Corporate/ Wholesale Credit risk Market risk Operational risk All other risks Business Risk Directors UK Banking Barclays Capital Barclaycard International Retail and Commercial Bank Barclays Wealth Barclays Global Investors âœ" x x Barclays PLC Annual Report 2006... -

Page 76

... Control Report Manage and Challenge Risk Appetite Risk Appetite is the level of risk Barclays chooses to take to reach its strategic objectives, recognising a range of possible outcomes, as business plans are implemented. Barclays framework, approved by the Board Risk Committee, combines... -

Page 77

... to the business plans of the Group, including the achievement of annual financial targets, payment of dividends, funding of capital growth and maintenance of acceptable capital ratios. The portfolio is analysed in this way at four representative levels: Stress testing The Risk Appetite numbers are... -

Page 78

... pension deficit from shareholders' equity. The average supply of capital to support the economic capital framework is set out below(a): 2006 £m 2005 £m Shareholders' equity excluding minority interests less goodwill(b) Retirement benefits liability Cash flow hedging reserve Available for sale... -

Page 79

...050 05 06 UK Retail Banking UK Business Banking Barclaycard International Retail and Commercial Banking - Absa International Retail and Commercial Banking - ex Absa Barclays Capital Barclays Global Investors Barclays Wealth Head office functions and other operations(a) Group centre(b) In... -

Page 80

... Committee). The Board Audit Committee also reviews the impairment allowance as part of financial reporting. Credit risk measurement Barclays uses statistical modelling techniques throughout its business in its credit rating systems. These systems assist the Bank in frontline credit decisions on new... -

Page 81

... expected loss rates in the Local Business portfolio. The increase in Barclaycard RT was £310m, the total rising to £1,410m (2005: £1,100m). This reflected the deterioration in credit conditions in the UK credit card and unsecured loan market as well as loan balance growth. International Retail... -

Page 82

... comprises lending to businesses, banks and other financial institutions to the Group Wholesale Credit Risk Management Committee (WCRMC). The RCRMC, considers, among others metrics, the ratio of loan to value for home loans and the exposure by the Barclays Retail Grade (BRG) of the customer, whilst... -

Page 83

...more profitable than, a portfolio of lower risk loans. Loans and advances, balances and limits to wholesale customers by internal risk rating % Loan balances by internal rating - % of Total 1 2 Loans and advances to customers Geographical analysis of loans and advances to customers % 1. UK 2. Other... -

Page 84

...of total) Home loans Financial services Other personal Business and other Property Wholesale and retail Manufacturing Finance lease Energy and water Transport Construction Agriculture Postal and Comms Analysis of loan-to-value ratios of mortgages in the UK home loan portfolio (At most recent credit... -

Page 85

... loan commitments The Group is exposed to loss through the financial guarantees it issues to clients and commitments to provide loan finance which cannot be withdrawn once entered in to. The credit risks associated with such contracts are managed in a similar way to loans and advances, and form... -

Page 86

... of the booking office. In 2004-2006 they were disclosed by location of customers. (b) Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. 0.2 0 0.7 0.4 0.3 05 IFRS 02 UK GAAP 03 04(b) 82 Barclays PLC Annual Report 2006 0.2 06 1.6 06 -

Page 87

.... Two key inputs to the cash flow calculation are the valuation of all security and collateral and the timing of all asset realisations, after allowing for all attendant costs. This method applies in the corporate portfolios - Business Banking, Barclays Capital and certain areas within International... -

Page 88

... increase in UK Business Banking, reflecting higher charges in Medium Business and growth in lending balances. UK Banking Barclaycard International Retail and Commercial Banking Barclays Capital Barclays Global Investors Barclays Wealth Head office and other operations Total impairment charges 461... -

Page 89

... to £126m (2005(b): £20m) reflecting a full year of business and normalisation of credit conditions in South Africa following a period of low interest rates. The total impairment charges and other credit provisions in Barclays Capital included losses of £83m (2005: £nil) on an 'available... -

Page 90

...principal risks of this type are defined benefit pension scheme risk and asset management structural market risk. Risk type Trading risk ...managed by Barclays Capital and reviewed by market risk and... • Traded Products Risk Review Committee. Market risk Director Asset and liability risk... -

Page 91

... to the Market Risk Director for review. Outside Barclays Capital, stress testing is carried out by the business centres and is reviewed by the senior management and business-level asset and liability committees. The stress testing is tailored to the business and is typically scenario analysis and... -

Page 92

... Asset management structural market risk is the risk that the value of funds managed by Barclays on behalf of clients might reduce leading to a reduction in fee and commission income. It affects Barclays Global Investors, Global Retail and Commercial Banking, Barclays Wealth and Barclays Life. The... -

Page 93

... projections for the next day, week and month as these are key periods for liquidity management. This is based on principles agreed by the FSA. In addition to cash flow management, Treasury also monitors unmatched medium-term assets and the level and type of undrawn lending commitments, the usage of... -

Page 94

... database and reported monthly to the Operational Risk Executive Committee. Barclays also uses a database of external public risk events and is part of a consortium of international banks that share anonymised loss data information to assist in risk identification and assessment. Key risk scenarios... -

Page 95

...management and control of its tax affairs and related tax risk. Group model policy Barclays has a large number of models in place across the Group, covering all risk types, including Credit Risk, Market Risk, Operational Risk, and Finance. To minimise the risk of loss through model failure, a Group... -

Page 96

... insured risk, advances in medical care and social conditions are the key factors that increase longevity. The Group manages its exposure to risk by operating in part as a unit linked business, prudent product design, applying strict underwriting criteria, transferring risk to reinsurers, managing... -

Page 97

... commodity and commodity derivative activities are included within dealing profits. Physical commodity positions are held at fair value and reported under the Trading Portfolio in Note 12 on page 174. Total 2006 £m Total 2005 £m Fair value of contracts outstanding at the beginning of the period... -

Page 98

... a specified date. Commodity derivatives The Group's principal commodity-related derivative contracts are swaps, options, forwards and futures. The main commodities transacted are base metals, precious metals, oil and oil-related products, power and natural gas. 94 Barclays PLC Annual Report 2006 -

Page 99

... and other operations comprises discontinued business in transition. (b) Prior year analysis of loans and advances between retail business and wholesale and corporate business has been reclassified to reflect enhanced methodology implemented in the current year. Barclays PLC Annual Report 2006 95 -

Page 100

...483 113,771 31,606 20,665 28,907 7,910 202,859 163,759 38,923 22,925 33,221 13,514 272,342 Note (a) Where a loan is earning a fixed rate of interest on the reporting date, it is included as a fixed rate loan, regardless of the term for which the rate is fixed. 96 Barclays PLC Annual Report 2006 -

Page 101

...and fishing Manufacturing Construction Property Energy and water Wholesale and retail distribution and leisure Transport Postal and communication Business and other services Home loans(b) Other personal Overseas customers(c) Finance lease receivables Loans and advances to customers in the UK 14,011... -

Page 102

... Construction Property Energy and water Wholesale and retail distribution and leisure Transport Postal and communication Business and other services Home loans(b) Other personal Overseas customers(c) Finance lease receivables Loans and advances to customers in the United States See note under... -

Page 103

... fishing Manufacturing Construction Property Energy and water Wholesale and retail distribution and leisure Transport Postal and communication Business and other services Home loans(b) Other personal Finance lease receivables Loans and advances to customers in Africa See note under Table 7. 2,821... -

Page 104

... 31st December 2006 United Kingdom Corporate lending(a) Other lending to customers in the United Kingdom Total United Kingdom Other European Union United States Africa Rest of the World Loans and advances to customers On demand £m Not more than three months £m Over ten years £m Total £m 22... -

Page 105

... reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. Further explanation is provided on page 148. (b) Includes credit derivatives held as economic hedges which are not designated as hedges for accounting purposes. Barclays PLC Annual Report 2006 101 -

Page 106

...15 3,212 335 298 117 153 4,115 566 24 - - - 590 4 - - - - 4 3,461 231 383 145 85 4,305 687 3 - - - 690 4 - - - 2 6 3,479 173 744 124 148 4,668 Note (a) Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. 102 Barclays PLC Annual Report 2006 -

Page 107

... the original effective rate of interest which was used to discount the expected future cash flows for the purpose of measuring the impairment loss. £88m (2005: £70m, 2004: £n/a) of this related to domestic impaired loans and the remainder related to foreign impaired loans. Table 20: Analysis of... -

Page 108

...(77) (1,220) 106 1,484 2,998 Notes (a) Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. (b) Does not reflect the impairment of available for sale assets or other credit risk provisions in 2005 and 2006. 104 Barclays PLC Annual Report 2006 -

Page 109

... (127) (106) 1,486 (2) 1,484 Notes (a) Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. (b) Does not reflect the impairment of available for sale assets or other credit risk provisions in 2005 and 2006. Barclays PLC Annual Report 2006 105 -

Page 110

...forestry and fishing Manufacturing Construction Property Energy and water Wholesale and retail distribution and leisure Transport Postal and communication Business and other services Home loans Other personal Overseas customers(b) Finance lease receivables Overseas Total See note under Table 28. 67... -

Page 111

...forestry and fishing Manufacturing Construction Property Energy and water Wholesale and retail distribution and leisure Transport Postal and communication Business and other services Home loans Other personal Overseas customers(b) Finance lease receivables Overseas Total See note under Table 28. 13... -

Page 112

... accounting policies and critical accounting estimates with the Board Accounts Committee. Fair value of financial instruments Some of the Bank's financial instruments are carried at fair value through profit or loss, including derivatives held for trading or risk management purposes. The fair value... -

Page 113

... the triennial valuation in 2004, was a surplus of £1.3bn (2005: £0.9bn). Cash contributions to the main UK scheme were £351m (2005: £354m). Further information on retirement benefit obligations, including assumptions is set out in Note 35 to the accounts. Barclays PLC Annual Report 2006 109 -

Page 114

110 Barclays PLC Annual Report 2006 -

Page 115

2 Governance Board and Executive Committee Directors' report Corporate governance report Remuneration report Accountability and audit Corporate responsibility page 112 114 117 125 141 143 2 Governance Barclays PLC Annual Report 2006 111 -

Page 116

... in organisations including Rand Europe (UK), JP Morgan Fleming Claverhouse Investment Trust, and Riverside Mental Health Trust. She was also a member of the Senior Salaries Review Board. She is a member of the Board Audit Committee. 6 Sir Andrew Likierman Non-executive Director Age 63 Sir Andrew... -

Page 117

... all Barclays retail and commercial banking operations globally, including UK Banking (Retail and Business), International Retail and Commercial Banking and Barclaycard. He is also a nonexecutive Director of Absa Group Limited. Frits joined the Board from Citigroup, where he previously held a number... -

Page 118

... Boards of Directors of Barclays PLC and Barclays Bank PLC is identical and biographical details of the Board members are set out on pages 112 and 113. Frits Seegers was appointed as an executive Director with effect from 10th July 2006. Fulvio Conti and Marcus Agius were appointed as non-executive... -

Page 119

... Group is a major global financial services provider engaged in retail and commercial banking, credit cards, investment banking, wealth management and investment management services. The Group operates through branches, offices and subsidiaries in the UK and overseas. Community Involvement The total... -

Page 120

... Remuneration Committee receives annual reports on health and safety performance from the Human Resources Director. As part of its Partnership Agreement with trade union Amicus in the UK, Barclays funds seven full time Health and Safety Representatives. Creditors' Payment Policy Barclays values its... -

Page 121

...Matthew Barrett would retire as Chairman at the end of 2006 and that Marcus Agius would succeed him as Chairman. Marcus joined the Board on 1st September 2006 as a non-executive Director. He became Chairman on 1st January 2007 and was independent on appointment. Barclays PLC Annual Report 2006 117 -

Page 122

..., involving the Chairman, Group Chief Executive and non-executive Directors only, to consider the respective appointments of Frits Seegers and Marcus Agius to the Board. The additional meeting to consider the appointment of Marcus Agius was chaired by Sir Nigel Rudd. 118 Barclays PLC Annual Report... -

Page 123

...Committees. Strategy execution updates presented in 2006 included UK Retail Banking, International Retail and Commercial Banking, Barclays Capital, Barclaycard, Barclays Global Investors and UK Business Banking. The Board also received strategy updates from the Chief Information Officer and a report... -

Page 124

... monitored the completion of the actions on behalf of the Board. It also received updates on changes in corporate governance best practice and developments in company law, particularly the new statement of Directors' Duties contained in the Companies Act 2006. 120 Barclays PLC Annual Report 2006 -

Page 125

...in the UK or globally. The Committee reviewed a short-list of internal and external candidates. Marcus Agius emerged as the candidate with the experience and capability to succeed Matthew Barrett as Chairman. I facilitated a series of meetings between Marcus, the Group Chief Executive and members of... -

Page 126

... taken. We also received a number of in-depth reports from some of the Group's main business areas and functions on their control environment, with presentations from Absa, UK Retail Banking, Barclaycard, Barclays Wealth and the Chief Information Office. Our aim is to review in detail the control... -

Page 127

... best practices among other UK public companies. Our Board annually reviews the independence of our non-executive Directors, taking into account the guidance in the Code and the criteria we have established for determining independence, which are described on page 119. Barclays PLC Annual Report... -

Page 128

... the effective and efficient management of their shareholding. The main methods of communicating with private shareholders are the Annual Report, the Annual Review, the dividend mailings and the AGM. We have continued to encourage shareholders to hold their shares in Barclays Sharestore, where their... -

Page 129

... Commercial Banking in addition to keeping under review the existing compensation strategies for Barclays Capital, BGI and Barclays Wealth; reviewing and developing policies to manage the governance of Barclays pension plans; in-depth monitoring of the development of senior talent in all businesses... -

Page 130

... in the form and context in which it appears. (b) Barclays Guiding Principles were introduced during 2005 and provide all parts of the Group with a unifying set of values. They are: Winning Together, Best People, Client/Customer Focused, Pioneering and Trusted. 126 Barclays PLC Annual Report 2006 -

Page 131

... by way of Special Company Contribution (Bonus Sacrifice). (b) Please refer to Note 51 to the accounts on page 225 for further information on PSP. (c) Please refer to Note 35 to the accounts on page 203 for further information on the Group's pension plans. Barclays PLC Annual Report 2006 127 -

Page 132

... to participate in the following benefits: life cover, use of company car or cash equivalent, medical insurance and the ill-health income plan. In addition, Chris Lucas will receive a cash allowance of 25% of his annual base salary in lieu of pension contributions. The service contract provides for... -

Page 133

...eligible employees including executive Directors. Under Sharepurchase, participants are able to purchase up to £1,500 worth of Barclays shares each year, which, if kept in trust for five years, can be withdrawn from Sharepurchase tax-free. Any shares in Sharepurchase will earn dividends in the form... -

Page 134

... service (John Varley's pension accrual is provided through the scheme in accordance with his service contract as set out in the notes to the pensions table on page 134). The Group's closed UK defined benefit pension arrangement also provides that, in the event of death before retirement, a cash... -

Page 135

... the terms of the BGI EOP, options are granted at fair value to key BGI employees over shares in Barclays Global Investors UK Holdings Limited (BGI Holdings) within an overall cap of 20% of the issued ordinary share capital of BGI Holdings. All grants of options are approved by the Committee. The... -

Page 136

...Group's auditors, PricewaterhouseCoopers LLP, have audited the information contained on pages 133 to 139. Note (a) Marcus Agius was a non-executive Director during 2006 and became Chairman on 1st January 2007. Details of his service contract are set out on page 128. 132 Barclays PLC Annual Report... -

Page 137

... include life and disability cover, the use of a Company owned vehicle or cash equivalent, medical insurance and tax advice. Benefits are provided on similar terms to other senior executives. No Director has an expense allowance. (c) Total remuneration for 2005 includes any amounts waived by way of... -

Page 138

... in the Group's US non-contributory defined benefit arrangement and the US Restoration Plan have been converted to Pounds Sterling using the 2006 year-end exchange rate of US$1.96 (2005: US$1.72). (h) Robert E Diamond Jr is also a member of the Barclays Bank PLC 401K Thrift Savings Plan and Thrift... -

Page 139

... in value of Barclays PLC shares owned beneficially, or held under option or awarded under employee share plans during the year(a)(h) Number at 31st December 2006 Executive Share Option Scheme (ESOS)(e) Notional Notional value based value based on share on share Change in price of price of notional... -

Page 140

... at respect of 1st January the results 2006 for 2005(b) Released(c) Market price on Release date £ Market price on Exercise date £ Bonus shares lapsed Number at 31st December 2006 Exercised(d) Chairman Matthew W Barrett Executive Directors John Varley Robert E Diamond Jr(e) Gary Hoffman Naguib... -

Page 141

... Shares under number initial of shares allocation under award Scheduled at 31st at 31st vesting December December date 2006 2006 Market price on award date £(c) Performance period(d) Executive Directors John Varley 2005 2006 Total Robert E Diamond Jr 2005 2006 Total Gary Hoffman 2005 2006 Total... -

Page 142

... price of outstanding options £ Number held at 1st January 2006 Granted Exercised Exercise price per share £ Market price on date of exercise £ Number of shares held under option Date from which exercisable Latest expiry date Chairman Matthew W Barrett Executive Directors John Varley... -

Page 143

... a Director of Barclays PLC at that time. The BGI EOP is an option plan, approved by shareholders in 2000 and offered predominantly to participants in the US. Under the BGI EOP, participants receive an option to purchase shares in Barclays Global Investors UK Holdings Limited. The exercise price is... -

Page 144

...'A' ordinary shares in Barclays Global Investors UK Holdings Limited respectively. (f ) Appointed as an executive Director on 10th July 2006. (g) Appointed as a non-executive Director on 1st September 2006. (h) Appointed as a non-executive Director on 1st April 2006. 140 Barclays PLC Annual Report... -

Page 145

... (IFRSs) as adopted by the European Union and for the purposes of preparation of reconciliations to Generally Accepted Accounting Practices in the United States (US GAAP). Barclays PLC's internal control over financial reporting includes policies and procedures that pertain to the maintenance... -

Page 146

... Finance Director also concluded that no significant changes were made in our internal controls or in other factors that could significantly affect these controls subsequent to their evaluation. Signed on behalf of the Board Marcus Agius Chairman 8th March 2007 142 Barclays PLC Annual Report 2006 -

Page 147

...-executive Director on the Board. The Committee's role is to identify and manage issues of reputational significance to the Barclays Group. The Committee met three times during the year. The Community Partnerships Committee sets the policy and provides governance for our global community investment... -

Page 148

... from our work as the only bank participating in the Business Leaders' Initiative on Human Rights. The guidance has been shared with the United Nations Environment Programme - Finance Initiative and has been made available to their 167 members around the world. 144 Barclays PLC Annual Report 2006 -

Page 149

...benefit from improved pay and opportunities for training, as well as access to a pension, sick pay, increased holiday entitlements and annual leave. UK employment statistics 2006 2005 2004 Total employee headcount Average length of service (years) Percentage working part time Sickness absence rate... -

Page 150

... international participation up 63% compared to the previous year. We are a member of the PerCent Club - a group of companies that has undertaken to ensure that investment in the community over time amounts to at least 1% of UK pre-tax profit. Further information Our 2006 Corporate Responsibility... -

Page 151

...the Board of Directors and Shareholders of Barclays PLC Consolidated accounts Barclays PLC Accounting policies Accounting presentation Consolidated income statement Consolidated balance sheet Statement of recognised income and expense Consolidated cash flow statement Parent company accounts Notes to... -

Page 152

... Barclays Bank International Limited to Barclays Bank PLC. All of the issued ordinary share capital of Barclays Bank PLC is owned by Barclays PLC. The Annual Report for Barclays PLC also contains the consolidated accounts of, and other information relating to, Barclays Bank PLC. The Annual Report... -

Page 153

...of Barclays PLC for the year ended 31st December 2006 which comprise the Income Statements, Balance Sheets, Cash Flow Statements, Statements of Recognised Income and Expense and the related notes on pages 162 to 250. These financial statements have been prepared under the accounting policies set out... -

Page 154

... Registered Public Accounting Firm to the Board of Directors and Shareholders of Barclays PLC We have completed an integrated audit of Barclays PLC (the 'Company') and its subsidiary undertakings 31st December 2006 consolidated financial statements on pages 151 to 274 and of its internal control... -

Page 155

... banking, credit cards, investment banking, wealth management and investment management services. In addition, individual financial statements have been prepared for the holding company, Barclays PLC ('the Company'), under Section 226(2)(b) of the Companies Act 1985. Barclays PLC is a public limited... -

Page 156

... and customer business and from changes in market value caused by movements in interest and exchange rates, equity prices and other market variables. Trading positions are held at fair value and the resulting gains and losses are included in the Income statement, together with interest and dividends... -

Page 157

...prices, with long positions at bid and short positions at offer price. Unlisted securities are valued based on the Directors' estimate, which takes into consideration discounted cash flows, price earnings ratios and other valuation techniques. 3 Financial statements Barclays PLC Annual Report 2006... -

Page 158

Consolidated accounts Barclays PLC Accounting policies In the case of private equity investments, listed and unlisted investments are stated at cost less any provision for impairment. 8. Impairment of financial assets The Group assesses at each balance sheet date whether there is objective evidence... -

Page 159

... be reported as advances. The asset acquired is recorded at the carrying value of the original advance updated as at the date of the exchange. Any subsequent impairment is accounted for as a specific provision. 9. Sale and repurchase agreements (including stock borrowing and lending) Securities may... -

Page 160

Consolidated accounts Barclays PLC Accounting policies valuation techniques, including discounted cash flow models and option pricing models as appropriate. All derivatives are included in assets when their fair value is positive, and liabilities when their fair value is negative, unless there is ... -

Page 161

... value accounting basis, as described in the section on derivatives used for trading purposes below, prior to being transferred to the trading portfolio. The profit or loss arising from the fair value measurement prior to the transfer to the trading portfolio is included in the category of income... -

Page 162

... impairment reviews, cash-generating units are the lowest level at which management monitors the return on investment on assets. 16. Financial guarantees Financial guarantee contracts are contracts that require the issuer to make specified payments to reimburse the holder for a loss it incurs... -

Page 163

... and investment income. Liabilities under unit-linked life insurance contracts (such as endowment policies) in addition reflect the value of assets held within unitised investment pools. Short-term insurance contracts Under its payment protection insurance products the Group is committed to paying... -

Page 164

... that result in the holding or placing of assets on behalf of individuals, trusts, retirement benefit plans and other institutions. These assets and income arising thereon are excluded from these financial statements, as they are not assets of the Group. 160 Barclays PLC Annual Report 2006 -

Page 165

... for Barclays PLC Group is set out in Note 60. Acquisitions 2006: On 1st November 2006, Barclays Bank PLC acquired the US mortgage servicing business of HomEq Servicing Corporation from Wachovia Corporation. 2005: On 1st June 2005, Barclays Asset and Sales Finance (BASF) acquired a 51% share and... -

Page 166

... accounts Barclays PLC Consolidated income statement Consolidated income statement For the year ended 31st December Notes 2006 £m 2005 £m 2004(a) £m Continuing operations Interest income Interest expense Net interest income Fee and commission income Fee and commission expense Net fee... -

Page 167

... excluding minority interests Minority interests Total shareholders' equity Total liabilities and shareholders' equity The accompanying notes form an integral part of the Consolidated accounts. Marcus Agius Chairman John Varley Group Chief Executive Naguib Kheraj Group Finance Director 12 13 13 14... -

Page 168

... accounts Barclays PLC Consolidated statement of recognised income and expense Consolidated statement of recognised income and expense For the year ended 31st December 2006 £m 2005 £m 2004(a) £m Available for sale reserve: - Net gains/(losses) from changes in fair value - Losses transferred... -

Page 169

...517 1,753 80,632 (71,180) 9,452 3,312 14,517 3 Financial statements In 2005 the opening cash and cash equivalents balance has been adjusted to reflect the adoption of IAS 32 and IAS 39. The accompanying notes form an integral part of the Consolidated accounts. Barclays PLC Annual Report 2006 165 -

Page 170

... form an integral part of the accounts. Marcus Agius Chairman John Varley Group Chief Executive Naguib Kheraj Group Finance Director 9,233 8,904 Note (a) Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. 166 Barclays PLC Annual Report... -

Page 171

... Purchase of shares in Barclays Bank PLC Net cash used in investing activities Proceeds from issue of shares Dividends paid Repurchase of ordinary shares Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash... -

Page 172

Notes to the accounts For the year ended 31st December 2006 1 Dividends per share The Directors have recommended the final dividends in respect of 2006 of 20.5p per ordinary share of 25p each and 10p per staff share of £1 each, amounting to a total of £1,307m, which will be paid on 27th April ... -

Page 173

..., money markets sales, trading and research, prime services and equity products; Credit related business includes primary and secondary activities for loans and bonds for investment grade, high yield and emerging market credits, as well as hybrid capital products, asset-based finance, commercial... -

Page 174

...-based schemes. Also included is £6m (2005: £nil, 2004: £nil) arising from cash settled share-based payments. The average number of persons employed by the Group worldwide during the year, excluding agency staff, was 118,600 (2005: 92,800, 2004: 77,000). 170 Barclays PLC Annual Report 2006 -

Page 175

... due diligence related to transactions and accounting consultations and audits in connection with such transactions. Auditors' remuneration for 2004 was as follows: audit fees £12m, audit related fees £3m, taxation services £5m and other services £2m. Barclays PLC Annual Report 2006 171 -

Page 176

...at standard UK corporation tax rate of 30% (2005: 30%, 2004: 30%) Adjustment for prior years Differing overseas tax rates Non-taxable gains and income (including amounts offset by previously unrecognised tax losses) Share-based payments Deferred tax assets not recognised Other non-allowable expenses... -

Page 177

... the conversion of outstanding options into shares within Absa Group Limited and Barclays Global Investors UK Holdings Limited. The weighted average number of ordinary shares excluding own shares held in employee benefit trusts, currently not vested, and shares held for trading, is adjusted for the... -

Page 178

Notes to the accounts For the year ended 31st December 2006 12 Trading portfolio 2006 £m 2005 £m Trading portfolio assets Treasury and other eligible bills Debt securities United Kingdom government bonds Other government bonds Other mortgage and asset backed securities Bank and building society ... -

Page 179

... to customers under investment contracts'. The increase/decrease in the value arising from the return on the investments and the corresponding increase/decrease in linked liabilities to customers is included in the Other income note in Note 6. 3 Financial statements Barclays PLC Annual Report 2006... -

Page 180

Notes to the accounts For the year ended 31st December 2006 14 Derivative financial instruments Financial instruments The Group's objectives and policies on managing the risks that arise in connection with derivatives, including the policies for hedging, are included in Note 52 to Note 56 under the... -

Page 181

... in issue, fixed rate loans to banks and customers and investments in fixed rate debt securities held. Currency derivatives are primarily designated as hedges of the foreign currency risk of net investments in foreign operations. The Group's total derivative asset and liability position as reported... -

Page 182

... authorities and these amounted to £1,262m at 31st December 2006 (2005: £1,218m). Information relating to effective interest rates can be found in Note 53. The geographical analysis is based on the location of the customer to which the lendings are made. 178 Barclays PLC Annual Report 2006 -

Page 183

... Construction Property Energy and water Wholesale and retail, distribution and leisure Transport Postal and communication Business and other services Home loans Other personal Finance lease receivables (Note 41) Less: Allowance for impairment (Note 17) Loans and advances to customers 33... -

Page 184

... Postal and communication Business and other services Home loans Other personal Finance lease receivables Loans and advances to customers outside the UK The geographical analysis is based on the location of the customer to which the lendings are made. Effective interest rates are included in Note 53... -

Page 185

... in relation to retail and small business portfolios is £1,809m or 87% (2005: £1,254m or 80%) of the total impairment charge in 2006. For larger accounts, impairment allowances are calculated on an individual basis using discounted expected future cash flows. Subjective judgements are made in... -

Page 186

...for sale financial investments. A maturity analysis of available for sale financial investments is included in Note 56. The basis of determining cost during the calculation of gains and losses on available for sale investments is on an instrument by instrument basis. 182 Barclays PLC Annual Report... -

Page 187

...borrowed are accounted for as collateralised loans. It is the Group's policy to seek collateral at the outset equal to 100% to 105% of the loan amount. The level of collateral held is monitored daily and further collateral calls made to bring the level of cash held and the market value of collateral... -

Page 188

...account is as follows: 2006 £m 2005 £m At beginning of year Income statement (charge)/credit Equity Available for sale investments Cash flow hedges Share-based payments Other equity movements Acquisitions and disposals Exchange...) 282 764 482 700 686 (14) 184 Barclays PLC Annual Report 2006 -

Page 189

.../(credit) in the income statement comprises the following temporary differences: 2006 £m 2005 £m Accelerated tax depreciation Pensions and other retirement benefits Allowance for impairment on loans Other provisions Tax losses carry forward Available for sale investments Cash flow hedges Share... -

Page 190

... in a profit of £247m. Following this transaction, there were no individually significant associates or joint ventures. Of the £46m share of post-tax results of associates and joint ventures, FirstCaribbean International Bank contributed £41m (2005: £37m). 186 Barclays PLC Annual Report 2006 -

Page 191

... share). 2006 FirstCaribbean International Bank £m Other associates £m Joint ventures £m FirstCaribbean International Bank £m 2005 Other associates £m Joint ventures £m Property, plant and equipment Financial investments Trading portfolio assets Loans to banks and customers Other assets Total... -

Page 192

... a growth rate of 8% to cash flows for the four years from 2010 to 2013 and a rate of 4% for the years from 2014 to 2020. Both businesses justify the use of longer cash flow projections due to the long-term nature of these businesses within the Barclays Group. 188 Barclays PLC Annual Report 2006 -

Page 193

... on internally generated and other software reflect impairment of certain capitalised IT assets following a review of the future economic benefits likely to be generated by them. Impairment charges detailed above have been included within other operating expenses. Barclays PLC Annual Report 2006... -

Page 194

... office building in our UK property portfolio. In 2007 the freehold of the building will be disposed of by either a short- or long-term leaseback, depending on the conclusions of the review. Consequently the value has been written down to fair value, less cost of sale. The carrying value of property... -

Page 195

... please refer to Note 53. 19,163 55,534 1,418 891 593 1,406 367 190 79,562 14,292 27,521 5,140 4,508 28,101 79,562 13,924 54,620 2,488 1,168 442 725 1,288 472 75,127 7,307 23,496 7,418 4,192 32,714 75,127 3 Financial statements Barclays PLC Annual Report 2006 191 -

Page 196

... years Customer accounts By geographical area United Kingdom Other European Union United States Africa Rest of the World Customer accounts In offices in the United Kingdom: Current and Demand accounts - interest free Current and Demand accounts - interest bearing Savings accounts Other time deposits... -

Page 197

... be settled more than 12 months after the balance sheet date. Accruals and deferred income included £107m (2005: £113m) in relation to deferred income from investment contracts and £822m (2005: £819m) in relation to deferred income from insurance contracts. Barclays PLC Annual Report 2006 193 -

Page 198

...building in a margin to allow for the increasing burden of fixed costs on the UK closed life book of business. The inflation assumption is set by adding a margin to the market rate of inflation implied by index-linked gilt yields. Short-term business Short-term business - for single premium policies... -

Page 199

... insured risk, advances in medical care and social conditions are the key factors that increase longevity. The Group manages its exposure to risk by operating in part as a unit-linked business, prudent product design, applying strict underwriting criteria, transferring risk to reinsurers, managing... -

Page 200

... Perpetual Reserve Capital Instruments (the 'RCIs') (such issues, excluding the TONs and the RCIs, being the 'Undated Notes and Loans'). The TONs and the RCIs rank pari passu with each other and behind the claims of the holders of the Undated Notes and Loans. 196 Barclays PLC Annual Report 2006 -

Page 201

... in advance, based on London interbank rates. The Bank is not obliged to make a payment of interest on its Undated Notes and Loans excluding the 9.25% Perpetual Subordinated Bonds if, in the preceding six months, a dividend has not been declared or paid on any class of shares of Barclays PLC or... -

Page 202

...of principal or mandatory interest. Any repayments require the prior approval of the FSA. All issues of undated loan capital have been made in the eurocurrency market and/or under Rule 144A, and no issues have been registered under the US Securities Act of 1933. 198 Barclays PLC Annual Report 2006 -

Page 203

... Absa and Barclays Bank of Ghana Ltd (BBG) for general corporate purposes, comprise: Notes 2006 £m 2005 £m Non-convertible The Bank Floating Rate Unsecured Capital Loan Stock 2006 7.4% Subordinated Notes 2009 (US$400m) Subordinated Fixed to CMS-Linked Notes 2009 (¤31m) 12% Unsecured Capital Loan... -

Page 204

... earnings and other capital surplus accounts. (q) The dividends are compounded and payable semi-annually in arrears on 30th September and 31st March of each year. The shares were issued by Absa Group Limited on 1st July 2004 and the redemption dates commence on the first business day after the third... -

Page 205

... interest payment date unless a dividend is paid on any class of share capital and (ii) a payment of principal until six months after the respective maturity date with respect to such Notes. Repayment terms Unless otherwise indicated, the Group's dated loan capital outstanding at 31st December 2006... -

Page 206

Notes to the accounts For the year ended 31st December 2006 34 Securitisations During the year, the Group has engaged in securitisation transactions involving Barclays residential mortgage loans, business loans and credit card balances. In addition, the Group acts as a conduit for commercial paper,... -

Page 207

... employees recruited before July 1997 are members of this non-contributory defined benefit scheme. Pensions are calculated by reference to service and pensionable salary and are normally subject to a deduction from State pension age. The Retirement Investment Scheme (RIS) A defined contribution plan... -

Page 208

... of defined benefit obligation and fair value of plan assets for all the Group's pension schemes and post-retirement benefits (the latter are unfunded) and present the amounts recognised in the income statement including those related to post-retirement health care. Income statement charge 2006... -

Page 209

... of £286m defined benefit obligation (2005: £335m) and £286m fair value of plan assets (2005: £335m)). These balances are not recognised in the financial statements of the Absa Group Limited in accordance with South African legislative requirements. Barclays PLC Annual Report 2006 205 -

Page 210

... year ended 31st December 2006 35 Retirement benefit obligations (continued) Assumptions Obligations arising under defined benefit schemes are actuarially valued using the projected unit credit method. Under this method, where a defined benefit scheme is closed to new members, such as in the case... -

Page 211

... value of scheme assets Expected rate of return % Total % of total fair value of scheme assets Expected rate of return % Value £m Value £m Value £m UK equities US equities Other equities UK government bonds UK corporate bonds Other bonds Property Derivatives(a) Cash Other Fair value of plan... -

Page 212

... ratio(a) for the main UK scheme as at 31st December 2006 was estimated to be 121% (31st December 2005: 110%). Note (a) The PPF solvency ratio represents the funds assets as a percentage of pension liabilities calculated using a section 179 valuation model. 208 Barclays PLC Annual Report 2006 -

Page 213

.... The key terms of the Sharepurchase scheme are described in Note 51. The total number of Barclays shares held in Group employee benefit trusts at 31st December 2006 was 168 million (2005: 148 million). Dividend rights have been waived on nil (2005: nil) of these shares. The total market value of... -

Page 214

Notes to the accounts For the year ended 31st December 2006 37 Reserves Other reserves - Barclays PLC Group Capital redemption reserve £m Other capital reserve £m Available for sale reserve £m Cash flow hedging reserve £m Currency translation reserve £m Total £m At 1st January 2006 Net gains... -

Page 215

... and treasury shares - Barclays PLC Group Retained earnings £m Treasury shares £m Total £m At 1st January 2006 Profit attributable to equity holders of the parent Equity-settled share schemes Tax on equity-settled share schemes Amortisation on treasury shares/ESOP Dividends paid Net purchases of... -

Page 216

Notes to the accounts For the year ended 31st December 2006 38 Minority interests 2006 £m 2005 £m At beginning of year Share of profit after tax Dividend and other payments Equity issued by subsidiaries Available for sale reserve: net (loss)/gain from changes in fair value Cash flow hedges: net ... -

Page 217

...,679m). The following table summarises the nature and carrying amount of the assets pledged as security against these liabilities: 2006 £m 2005 £m Trading portfolio assets Loans and advances to banks Loans and advances to customers Available for sale investments Other Assets pledged 77,255 5,952... -

Page 218

... are included within loans and advances to customers (see Note 16). The Group's net investment in finance lease receivables was as follows: 2006 Gross investment in finance lease receivables £m Future finance income £m Present value of minimum lease payments receivable £m Unguaranteed residual... -

Page 219

... of assets held under finance leases at the balance sheet date was: 2006 £m 2005 £m Cost Accumulated depreciation Net book value 44 (25) 19 77 (18) 59 Operating lease commitments The Group leases various offices, branches and other premises under non-cancellable operating lease arrangements... -

Page 220

..., net of cash disposed Cash received in respect of disposal of ownership in Barclays Global Investors UK Holdings Limited through the exercise of options under the BGI EOP scheme Decrease in investment in subsidiaries 140 (80) 60 140 (116) (39) (15) 44 44 216 Barclays PLC Annual Report 2006 -

Page 221

... and cash equivalents acquired Net cash outflow on acquisition Cash paid in respect of acquisition of shares in Barclays Global Investors UK Holdings Limited Cash paid in respect of acquisition of shares in Absa Bank Limited Increase in investment in subsidiaries 45 Investment in Barclays Bank PLC... -

Page 222

... as well as other services. Group companies, principally within Barclays Global Investors, also provide investment management and custodian services to the Group pension schemes. The Group also provides banking services for unit trusts and investment funds managed by Group companies and are not... -

Page 223

... Directors' remuneration (continued) For the year ended and as at 31st December 2005 Entities under Joint common ventures directorships £m £m Pension funds unit trusts and investment funds £m Associates £m Total £m Income statement: Interest received Interest paid Fees received for services... -

Page 224

... of Barclays PLC and the Officers of the Group, certain direct reports of the Group Chief Executive and the heads of major business units. In the ordinary course of business, the Bank makes loans to companies where a Director or other member of Key Management Personnel (or any connected person) is... -

Page 225

... a non-executive Director of Absa Group Limited or Absa Bank Limited in 2005). In both 2005 and 2006 the fees were paid to Barclays. Directors' and Officers' shareholdings and options The beneficial ownership of the ordinary share capital of Barclays PLC by all Directors and Officers of Barclays PLC... -

Page 226

...year, Directors of Barclays PLC and persons connected with them and for Managers, within the meaning of the Financial Services and Markets Act 2000, of Barclays Bank PLC were: Number of Directors or Managers Number of connected persons Amount £m Directors Loans Quasi-loans and credit card accounts... -

Page 227

... Barclays Capital Securities Limited Barclays Global Investors Pensions Management Limited FIRSTPLUS Financial Group PLC Gerrard Investment Management Limited Barclays Bank of Ghana Limited Barclays Insurance (Dublin) Limited Barclays Assurance (Dublin) Limited Barclays Private Clients International... -

Page 228

... Limited 29 Park Investment No1 Limited(b) 29 Park Investment No2 Limited(b) 100 100 100 75 100 100 - - (7) (5) - 6 - 2 - - (2) (1 Notes (a) Barclays has 51% of voting rights in the entity. (b) Barclays appoint the majority of Directors of these entities. 224 Barclays PLC Annual Report 2006 -

Page 229

... an HM Revenue & Customs approved all-employee share plan. The plan is open to all eligible UK employees, including executive Directors. Under the plan, participants are able to purchase up to £1,500 worth of Barclays PLC ordinary shares per tax year, which, if kept in trust for five years, can be... -

Page 230

... 30-day volume weighted trading price on the JSE Limited. Options are redeemed by Absa on the final exercise date. Absa Group Limited Share Incentive Trust (AGLSIT) In terms of the rules of Absa Group Limited Share Incentive Trust the maximum number of shares which may be issued or transferred and... -

Page 231

... Limited Share Incentive Trust (AGLSIT) scheme. Shares are awarded at no cost to participants and the cash paid is equal to the market value of ordinary shares of Absa Group Limited. The performance of Absa over a three-year period determines the final number of notional shares that any cash payment... -

Page 232

...-5.03 - - 4.41-6.35 - - - - 4.41-6.35 - Notes (a) Options/award granted over Barclays PLC shares. (b) Options/award granted over Barclays Global Investors UK Holdings Limited shares. (c) Options/award granted over Absa Group Limited shares. (d) Nil cost award. 228 Barclays PLC Annual Report 2006 -

Page 233

...3.80 - 3.81 3.78 - 3.80 3.80 3 - (1) (2) - - - 164 - (148) (13) - 3 3 3.32 - 3.32 3.32 - - - 3.32 - 3.32 3.34 - 3.32 3.32 Notes (a) Options/award granted over Absa Group Limited shares. (b) Options/award granted over Barclays PLC shares. (c) Nil cost award. Barclays PLC Annual Report 2006 229 -

Page 234

...70,576 2,459,094 240,826 1,019,612 2,632 Notes (a) Options/award granted over Barclays PLC shares. (b) Options/award granted over Barclays Global Investors UK Holdings Limited shares. (c) Options/award granted over Absa Group Limited shares. (d) Nil cost award. 230 Barclays PLC Annual Report 2006 -

Page 235

... 44 18 101 3 2 - 240 81 49 5 42 8 4 - 189 Notes (a) Option/award granted over Barclays PLC shares. (b) Option/award granted over Barclays Global Investors UK Holdings Limited shares. (c) Option/award granted over Absa Group Limited shares. (d) Nil cost award. Barclays PLC Annual Report 2006 231 -

Page 236

... in Absa Group Limited if exercised. Notes (a) Options/award granted over Barclays PLC shares. (b) Options/award granted over Barclays Global Investors UK Holdings Limited shares. (c) Options/award granted over Absa Group Limited shares. (d) Nil cost award. 232 Barclays PLC Annual Report 2006 -

Page 237

...loss from any of the Group's customers, clients or market counterparties failing to fulfil their contractual obligations to the Group. Credit risk mainly arises from loans and advances, but may also arise where the downgrading of an entity's credit rating causes the fair value the Group's investment... -

Page 238

...by the Market Risk Management team that operates independently of the trading areas. Daily market risk reports are produced for the main Barclays Capital business areas covering the six main types of trading market risk: interest rate, inflation, credit spread, commodity, equity and foreign exchange... -

Page 239

...assuming a one-day holding period with a 99% level of confidence. For Barclays Capital's regulatory trading book, there were no instances in 2006 or 2005, of a daily trading revenue loss exceeding the corresponding back-testing DVaR. Asset and Liability Market Risk Interest rate exposures arise from... -

Page 240

... insured risk, advances in medical care and social conditions are the key factors that increase longevity. The Group manages its exposure to risk by operating in part as a unit-linked business, prudent product design, applying strict underwriting criteria, transferring risk to reinsurers, managing... -

Page 241

... banks Trading portfolio assets Financial assets designated at fair value: - held on own account - held in respect of linked liabilities to customers under investment contracts Derivative financial instruments Loans and advances to banks Loans and advances to customers Available for sale financial... -

Page 242

... held to maturity as part of the Group's trading strategies. For these instruments, which are mostly held by Barclays Capital, liquidity and repricing risk is managed through the Daily Value at Risk (DVaR) methodology, see Note 52 for more information. Retail deposits, which are repayable on demand... -

Page 243

... banks Trading portfolio assets Financial assets designated at fair value: - held on own account - held in respect of linked liabilities to customers under investment contracts Derivative financial instruments Loans and advances to banks Loans and advances to customers Available for sale financial... -

Page 244

... of the Group's trading strategies. For these instruments, which are mostly held by Barclays Capital, liquidity and repricing risk is managed through the Daily Value at Risk (DVaR) methodology, see Note 52 for more information. Retail deposits which are repayable on demand or at short notice form... -

Page 245

... the Group's loans and advances to customers comprises lending in respect of home loans. Home loan lending totalled £98.2bn at 31st December 2006 (2005: £89.5bn), which represents 34% (2005: 33%) of loans to customers. As collateral, Barclays requires a first mortgage over the residential property... -

Page 246

... (DVaR) methodology is used by the Group to estimate potential losses arising from exposure to market risk, including currency risk, on trading positions. The tables shown on page 235 show an analysis of DVaR for the market risk exposures in Barclays Capital. 242 Barclays PLC Annual Report 2006 -

Page 247

...ten years £m Total £m Assets Cash and balances with central banks 7,050 Items in course of collection from other banks 1,782 Trading portfolio assets 1,528 Financial assets designated at fair value: - held on own account 1,899 - held in respect of linked liabilities to customers under investment... -

Page 248

... banks Trading portfolio assets Financial assets designated at fair value: - held on own account - held in respect of linked liabilities to customers under investment contracts Derivative financial instruments Loans and advances to banks Loans and advances to customers Available for sale financial... -

Page 249