Baker Hughes 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Baker Hughes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 ANNUAL REPORT

Table of contents

-

Page 1

2013 ANNUAL REPORT -

Page 2

-

Page 3

2013 Year in Review Selected Financial Highlights...2 Letter To Stockholders ...3 Innovative Results North America...6 Latin America...10 Europe / Africa / Russia Caspian ...14 Middle East / Asia Paciï¬c ...18 Sustainability...22 Executive Leadership Team ...24 Form 10-K Corporate Information ...... -

Page 4

Total Revenue (in Millions) 2011-2013, by Quarter $6,000 $5,000 $4,000 $3,000 Adjusted Net Income per Diluted Share (non-GAAP) 2011-2013, by Quarter $1.40 $1.20 $1.00 $0.80 $0.60 $2,000 $1,000 $0.40 $0.20 2011 2012 2013 2011 2012 2013 At Baker Hughes, our culture-that is, the behaviors and... -

Page 5

... Curve rotary-steerable system reduced drilling time from an average of four days for one well to less than one day. Our Dhahran Research and Technology Center in Saudi Arabia and the Reservoir Development Services Middle East Technology Center in Abu Dhabi will help Baker Hughes and our customers... -

Page 6

2013 Revenue by Segment Middle East / Asia Paciï¬c 18% Europe / Africa / Russia Caspian 17% North America Latin America 49% 10% Industrial Services 6% ENABLING INNOVATION Innovation both creates and is enabled by a work environment that supports it. At Baker Hughes, we continually strive ... -

Page 7

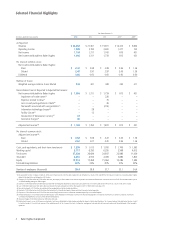

..., except per share amounts) 2013 2012 2011 2010(1) 2009(1) As Reported: Revenue Operating income Net income Net income attributable to Baker Hughes Per share of common stock: Net income attributable to Baker Hughes: Basic Diluted Dividends Number of shares: Weighted average common shares diluted... -

Page 8

... operations. We broke ground for our Western Hemisphere Training Center near Houston, with an expected opening date of early 2014, and opened key new ï¬,uids and chemicals laboratories for the Gulf of Mexico. Our $556-million investment in research and technology funded incremental developments... -

Page 9

... in low-pressure zones, to develop the SureTrakâ„¢ steerable drilling liner service-the ï¬rst technology of its kind, designed to drill and evaluate complex wells while simultaneously installing a liner. Unconventional operations also continued to expand outside North America, with Saudi Arabia and... -

Page 10

... submersible pumping (ESP) systems with products and services from our Completions Services and Upstream Chemicals product lines. Based on our FLEXPumpâ„¢ series ESP technology, the ProductionWave solution offers a range of commercial models to meet the customer's unique business objectives... -

Page 11

Innovative Results North America 6 Baker Hughes Incorporated -

Page 12

... commitment to innovation, collaboration, and safety that has made-and continues to make-North America the world leader in oil and gas exploration and development. Baker Hughes is a leader in the development and application of technologies and methodologies that continually extend the limits of what... -

Page 13

... combinations present an extreme challenge to ultra-deepwater operations. Baker Hughes and a major international oil company entered into a long-term research and development collaboration agreement in 2013 to develop completion technologies that will withstand temperatures approaching 500ËšF (260... -

Page 14

... oilï¬eld, Baker Hughes further expanded its International Association of Drilling Contractors- (IADC) accredited Competence Management Program (CMP) in 2013. The CMP provides a platform for human capital development across the enterprise and is supported by the Baker Hughes Operating System (BHOS... -

Page 15

Innovative Results Latin America 10 Baker Hughes Incorporated -

Page 16

...or reversing declining production from Latin America's mature ï¬elds requires creative application of leading-edge technology and innovative business models that change traditional working relationships between operators and service providers, to the mutual beneï¬t of both. 2013 Annual Report 11 -

Page 17

... Results Latin America Operators in Mexico are beginning to award full-ï¬eld management contracts for mature ï¬elds to qualiï¬ed service providers such as Baker Hughes, who can provide resources and know-how to help accelerate production, add to the reserve base, and generate more revenues. The... -

Page 18

... Innovation in Houston and at our pressure pumping technology facility in Tomball, Texas. Engineers from our Argentina team were trained in Oklahoma City, Oklahoma and Odessa, Texas, and the project was executed with help from ï¬eld personnel from Mexico. The North America operations team supported... -

Page 19

Innovative Results Europe / Africa / Russia Caspian 14 Baker Hughes Incorporated -

Page 20

... Markets From emerging deepwater markets in East and West Africa to stranded reserves and harsh environments in the North Sea and Russia, innovations in technology and the transfer of knowledge are driving efï¬ciencies and improving the economics of safe energy production. 2013 Annual Report 15 -

Page 21

... to continue at high levels for the near term. Similarly, a record number of ï¬elds are currently in operation on the Norwegian shelf, and 20 new discoveries were made in 2013. Baker Hughes has contributed to North Sea development since its inception, and our technological leadership here continues... -

Page 22

...rst dual-lift, concentric production-injection completion in Russia's Volga-Urals region. For this project, we designed the ESP system for SureTrakTM Unlocks Stranded Reserves in the North Sea The world's ï¬rst application of the SureTrakâ„¢ steerable drilling liner technology enabled Statoil, the... -

Page 23

Innovative Results Middle East / Asia Paciï¬c 18 Baker Hughes Incorporated -

Page 24

... production from unconventional tight formations and shale reservoirs. Baker Hughes has made breakthrough technological advances that are helping to redeï¬ne how the industry will unlock the potential of unconventional reservoirs in the Middle East and throughout the world. 2013 Annual Report... -

Page 25

...teams based at the DRTC, the Abu Dhabi RDS technology center, and in clients' ofï¬ces use our JewelSuiteâ„¢ reservoir modeling software to provide operators with a comprehensive view 20 Baker Hughes Incorporated of their reservoirs and to shorten building times for highly accurate reservoir models... -

Page 26

... Research and Technology Center in Saudi Arabia has a dual mission-to be close to Middle East shale gas development activity, and to be a center for technology development and transfer to increase reservoir access and hydrocarbon recovery. alternative to either standard or managed-pressure drilling... -

Page 27

... natural gas use. Other advances include the further development of environmentally-preferred chemicals and new technologies that reduce the amount of fresh water required. Our visible leadership team and the daily efforts of all our employees have helped Baker Hughes become a sustainable company... -

Page 28

... efï¬ciency and climate change. For the third year, we were the leader in the Energy sector of the Bloomberg environment, social and governance (ESG) index. We were the highestranking service company in the Energy sector based on our overall sustainability performance. 2013 Annual Report 23 -

Page 29

... Leadership Team (left to right) Belgacem Chariag; Art Soucy (seated); Mario Ruscev; Martin Craighead; Alan Crain; Peter Ragauss (seated); Derek Mathieson; Maria Borras; Khaled Nouh; Dmitry Kuzovenkov; Richard Williams (seated); Didier Charreton; Archana Deskus. 24 Baker Hughes Incorporated -

Page 30

... as of the last business day of the registrant's most recently completed second fiscal quarter (based on the closing price on June 28, 2013 reported by the New York Stock Exchange) was approximately $20,378,655,000. As of February 7, 2014, the registrant has outstanding 437,191,478 shares of common... -

Page 31

... Legal Proceedings Mine Safety Disclosures Part II Item 5. Item 6. Item 7. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Selected Financial Data Management's Discussion and Analysis of Financial Condition and Results of Operations... -

Page 32

... telephone number: Baker Hughes Incorporated 2929 Allen Parkway, Suite 2100 Houston, TX 77019-2118 Attention: Investor Relations Telephone: (713) 439-8600 ABOUT BAKER HUGHES Baker Hughes is a leading supplier of oilfield services, products, technology and systems to the worldwide oil and natural gas... -

Page 33

..., headquartered in Houston, Texas, which includes the downstream chemicals business and the process and pipeline services business. Certain support operations are organized at the enterprise level and include the supply chain and product line technology organizations. The supply chain organization... -

Page 34

... chemical application systems to provide flow assurance, integrity management and production management for upstream hydrocarbon production. Pressure Pumping - includes cementing, stimulation, including hydraulic fracturing, and coil tubing services used in the completion of new oil and natural gas... -

Page 35

... engages in research and development activities directed primarily toward the development of new products, processes and services, the improvement of existing products and services and the design of specialized products to meet specific customer needs. We have technology centers located in the... -

Page 36

... of our products and services, as well as customers' budgetary cycles. Examples of seasonal events which can impact our business include: • The severity and duration of both the summer and the winter in North America can have a significant impact on activity levels. In Canada, the timing and... -

Page 37

... he will retire by December 31, 2014. President, Latin America Region of the Company since October 2013. President, Europe Region from August 2011 to October 2013 and Vice President, Global Marketing from May 2009 to July 2011. Various positions within operations, product line management, and... -

Page 38

... Seismic Services from January 2012 to August 2012. Chief Executive Officer of FormFactor from 2008 to 2010. Various positions at Schlumberger for 20 years. Employed by the Company in 2012. President, Europe, Africa and Russia Caspian Region of the Company since 2013. Vice President of the Company... -

Page 39

... financial statements. We continue to focus on reducing future environmental liabilities by maintaining appropriate company standards and improving our assurance programs. ITEM 1A. RISK FACTORS An investment in our common stock involves various risks. When considering an investment in Baker Hughes... -

Page 40

... our business, financial condition, results of operations and cash flows and, thus, the value of an investment in Baker Hughes. Risk Factors Related to the Worldwide Oil and Natural Gas Industry Our business is focused on providing products and services to the worldwide oil and natural gas industry... -

Page 41

... and services can impact our ability to defend, maintain or increase prices for our products and services, maintain market share and negotiate acceptable contract terms with our customers. In order to be competitive, we must provide new technologies, reliable products 11 Baker Hughes Incorporated -

Page 42

... resource to developing, manufacturing and delivering our products and services to our customers around the world. Our ability to manage the recruiting, training, retention and efficient usage of the highly skilled workforce required by our plans and to manage the associated costs could impact our... -

Page 43

... our ability to continue to manage our agents and business partners, and supervise, train and retain competent employees. Our compliance program is also dependent on the efforts of our employees to comply with applicable law and the Baker Hughes Business Code of Conduct. We could be subject to... -

Page 44

... our operating costs, and/or greatly reduce or eliminate demand for the Company's hydraulic fracturing services. The EPA and other governmental bodies are studying hydraulic fracturing operations. Government actions relating to the development of unconventional oil and natural gas resources may... -

Page 45

... the environment. Our results of operations could be adversely affected by unexpected claims not covered by insurance. Control of oil and natural gas reserves by state-owned oil companies may impact the demand for our services and create additional risks in our operations. Much of the world's oil... -

Page 46

...; Tyumen, Russia Dubai, United Arab Emirates; Dhahran, Saudi Arabia; Singapore, Singapore; Chonburi, Thailand Latin America: Europe/Africa/Russia Caspian: Middle East/Asia Pacific: Principal properties for the Industrial Services segment include locations in Houston, Texas and Barnsdall, Oklahoma... -

Page 47

... seeks information and documents relating to, among other things, natural gas development and hydraulic fracturing. We are discussing the subpoena with the New York Attorney General's office. ITEM 4. MINE SAFETY DISCLOSURES Our barite mining operations, in support of our drilling fluids products and... -

Page 48

... Plan, the agent repurchased a number of shares of our common stock determined under the terms of the 10b5-1 Plan each trading day based on the trading price of the stock on that day. Average price paid includes commissions. During 2013, our Board of Directors increased the authorization to purchase... -

Page 49

... total return on investment (change in year-end stock price plus reinvested dividends) assumes that $100 was invested on December 31, 2008 in Baker Hughes common stock, the S&P 500 Index and the S&P 500 Oil and Gas Equipment and Services Index. The corporate performance graph and related information... -

Page 50

... attributable to Baker Hughes Per share of common stock: Net income attributable to Baker Hughes: Basic Diluted Dividends Balance Sheet Data: Cash, cash equivalents and short-term investments Working capital (current assets minus current liabilities) Total assets Long-term debt Total equity Notes To... -

Page 51

... 58,800 employees as of December 31, 2012. BUSINESS ENVIRONMENT In North America, customer spending decreased in 2013 compared to 2012, resulting in a 7% decrease in the North America rig count. Natural gas-directed drilling activity decreased 23% in 2013 compared to 2012 as increased production in... -

Page 52

...global oil supplies. Despite overall flat oil prices, our customers' activity and spending levels increased moderately in 2013 compared to 2012. As a result, the international rig count grew by 5% in 2013 compared to 2012, with the largest gains seen in Africa, the Middle East and Continental Europe... -

Page 53

...Canada North America Latin America North Sea Continental Europe Africa Middle East Asia Pacific Outside North America Worldwide 2013 Compared to 2012 The rig count in North America decreased 7% in 2013 compared to 2012 primarily driven by a 23% decline in natural gas-directed rigs. The oil-directed... -

Page 54

... reservoirs. In Canada, many operators curtailed their drilling plans in the second half of 2012 due to reduced cash flows from natural gas activities and high oil price differentials as compared to WTI. Overall, Canada rig counts declined 13% in 2012 compared to 2011. Outside North America, the rig... -

Page 55

...: net interest expense, corporate expenses, and certain gains and losses not allocated to the segments. 2013 Compared to 2012 Year Ended December 31, 2013 2012 Revenue: North America Latin America Europe/Africa/Russia Caspian Middle East/Asia Pacific Industrial Services Total Revenue $ 10,878 2,307... -

Page 56

...in the Gulf of Mexico were increased activity in our drilling and completion fluids, pressure pumping, completion systems and wireline services product lines. Despite a 9% decline in the U.S. onshore rig count in 2013 compared to 2012, driven by lower natural gas-directed rigs, total revenue for our... -

Page 57

... Arabian Gulf due to increased demand for our drilling services and wireline services product lines in United Arab Emirates, as well as for wireline services in India. Within Asia Pacific, revenue growth was strongest in South East Asia for drilling services, completion systems and pressure pumping... -

Page 58

... prices, increased raw material expenses and higher personnel costs in our pressure pumping product line in North America. Additional provisions for doubtful accounts in Latin America and high operating costs and third party expenses related to new integrated operations contracts in the Middle East... -

Page 59

... 5% in 2012 compared to 2011 despite rig counts declining 1%. The primary catalysts for the revenue growth in North America include sustained high oil prices during 2012 compared to historical prices and new innovative technologies for drilling and completion systems and wireline services that have... -

Page 60

..., drilling services and drilling fluids product lines in Saudi Arabia, as well as new integrated operations contracts and increased wireline services and upstream chemicals activity in Iraq. In Asia Pacific, increased activity, particularly for completion systems in Australia and pressure pumping in... -

Page 61

...Cost of revenue as a percentage of revenue was 81% and 77% for 2012 and 2011, respectively. The increase in cost of revenue was due primarily to lower margins in our pressure pumping product line in North America, startup and third party costs associated with the new integrated operations activities... -

Page 62

... access to resources to develop and produce oil and natural gas, their ability to fund their capital programs and the impact of new government regulations. Our outlook for exploration and development spending is based upon our expectations for customer spending in the markets in which we operate... -

Page 63

...annual rig count is expected to be flat, in part reflecting improved efficiencies in drilling performance. Overall service activity has increased in North America as customers demand robust technologies such as advanced directional drilling, complex completion systems and pressure pumping to develop... -

Page 64

... 2013, which indicates high levels of corruption. We devote significant resources to the development, maintenance, communication and enforcement of our Business Code of Conduct, our anti-bribery compliance policies, our internal control processes and procedures and other compliance related policies... -

Page 65

... of the use of commercial sales representatives and processing agents, including the reduction of customs agents. We use technology to monitor and report on compliance matters, including a web-based antiboycott reporting tool and a global trade management software tool. We have a program designed to... -

Page 66

...in accounts receivable in 2011 was primarily due to an increase in activity as well as an increase in days sales outstanding due to temporary invoicing delays resulting from the implementation of our enterprise wide software system for BJ Services in North America. An increase in inventory used cash... -

Page 67

... into new markets or product lines. We may also from time to time sell business operations that are not considered part of our core business. During 2013, 2012 and 2011, we did not have any significant business acquisitions or dispositions. Financing Activities We had net repayments of commercial... -

Page 68

...sufficient capital resources and liquidity to manage our working capital needs, meet contractual obligations, fund capital expenditures, and support the development of our short-term and long-term operating strategies. If necessary, we may issue commercial paper or other short-term debt to fund cash... -

Page 69

... change as new events occur, as more experience is acquired, as additional information is obtained and as the business environment in which we operate changes. We have defined a critical accounting estimate as one that is both important to the portrayal of either our financial condition or results... -

Page 70

...judgments regarding long-term forecasts of future revenue and costs and cash flows related to the assets subject to review. These forecasts are uncertain in that they require assumptions about demand for our products and services, future market conditions and technological developments. Income Taxes... -

Page 71

... are updated to reflect our actual and expected experience. The discount rate enables us to determine expected future cash flows at a present value on the measurement date. The development of the discount rate for our largest plans was based on a bond matching model whereby the 41 41 Baker Hughes... -

Page 72

... regarding our business outlook, including changes in revenue, pricing, capital spending, profitability, strategies for our operations, impact of any common stock repurchases, oil and natural gas market conditions, the business plans of our customers, market share and contract terms, costs and... -

Page 73

...our fixed rate long-term debt and the related weighted average interest rates by expected maturity dates as of December 31, 2013 and 2012. (In millions) As of December 31, 2013 2013 2014 2015 21 $ 2016 17 $ 2017 11 2018 $ 1,013 7.41% $ 1,000 7.28% $ Thereafter $ 2,849 5.36% 2,800 5.17% Total $3,911... -

Page 74

...the Company's independent registered public accounting firm, has issued an attestation report on the effectiveness of the Company's internal control over financial reporting. /s/ MARTIN S. CRAIGHEAD Martin S. Craighead Chairman and Chief Executive Officer Houston, Texas February 12, 2014 /s/ PETER... -

Page 75

... ACCOUNTING FIRM To the Board of Directors and Stockholders of Baker Hughes Incorporated Houston, Texas We have audited the accompanying consolidated balance sheets of Baker Hughes Incorporated and subsidiaries (the "Company") as of December 31, 2013 and 2012, and the related consolidated statements... -

Page 76

BAKER HUGHES INCORPORATED CONSOLIDATED STATEMENTS OF INCOME Year Ended December 31, (In millions, except per share amounts) Revenue: Sales Services Total revenue Costs and expenses: Cost of sales Cost of services Research and engineering Marketing, general and administrative Impairment of trade ... -

Page 77

... attributable to noncontrolling interests Comprehensive income attributable to Baker Hughes (61) 33 (28) 1,075 (7) $ 1,068 78 1 79 1,396 (6) $ 1,390 (44) (92) (136) 1,607 (3) $ 1,604 2013 $ 1,103 2012 $ 1,317 2011 $ 1,743 See Notes to Consolidated Financial Statements 47 Baker Hughes Incorporated -

Page 78

BAKER HUGHES INCORPORATED CONSOLIDATED BALANCE SHEETS (In millions, except par value) ASSETS Current Assets: Cash and cash equivalents Accounts receivable - less allowance for doubtful accounts (2013 - $238; 2012 - $308) Inventories, net Deferred income taxes Other current assets Total current ... -

Page 79

... December 31, 2012 Comprehensive income: Net income Other comprehensive loss Activity related to stock plans Repurchase and retirement of common stock Stock-based compensation cost Cash dividends ($0.60 per share) Net activity related to noncontrolling interests Balance at December 31, 2013 $ 432... -

Page 80

... of period Cash and cash equivalents, end of period Supplemental cash flows disclosures: Income taxes paid, net of refunds Interest paid Supplemental disclosure of noncash investing activities: Capital expenditures included in accounts payable Year Ended December 31, 2013 2012 2011 $ 1,103 1,698... -

Page 81

... Incorporated Notes to Consolidated Financial Statements NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Nature of Operations Baker Hughes Incorporated ("Baker Hughes," "Company," "we," "our," or "us,") is a leading supplier of oilfield services, products, technology and systems used for drilling... -

Page 82

Baker Hughes Incorporated Notes to Consolidated Financial Statements Research and Engineering Research and engineering expenses are expensed as incurred and include costs associated with the research and development of new products and services and costs associated with sustaining engineering of ... -

Page 83

... interest and penalties related to uncertain tax positions as income taxes in our financial statements. Environmental Matters Estimated remediation costs are accrued using currently available facts, existing environmental permits, technology and enacted laws and regulations. For sites where we are... -

Page 84

... denominated balances. The impact of this devaluation was a loss of $23 million that was recorded in marketing, general and administrative expense in the first quarter of 2013. Financial Instruments Our financial instruments include cash and cash equivalents, accounts receivable, accounts payable... -

Page 85

Baker Hughes Incorporated Notes to Consolidated Financial Statements instruments in our consolidated statements of income were not material in each of the three years ended December 31, 2013. New Accounting Standards Updates In February 2013, the FASB issued ASU No. 2013-02, Reporting of Amounts ... -

Page 86

...13.79 2012 5.4 0.9% 41.4% 1.4% 14.51 2011 5.0 1.8% 40.8% 0.9% 24.20 Expected life (years) Risk-free interest rate Volatility Dividend yield Weighted average fair value per share at grant date $ $ $ The following table presents the changes in stock options outstanding and related information (in... -

Page 87

... of the 15% cash discount Fair value per share of the look-back provision Total weighted average fair value per share at grant date We calculated estimated volatility using historical daily prices based on the expected life of the stock purchase plan. The risk-free interest rate is based on the... -

Page 88

... Change in valuation allowances related to foreign losses Adjustments of prior years' tax positions State income taxes - net of U.S. tax benefit Impact of reorganization of certain foreign subsidiaries Other - net Total effective tax rate During the fourth quarter of 2013, we recognized a net tax... -

Page 89

... of state tax credits which expire in 2018. At December 31, 2013, we had $282 million of tax liabilities for total gross unrecognized tax benefits related to uncertain tax positions, which includes liabilities for interest and penalties of $37 million and $17 million, 59 Baker Hughes Incorporated -

Page 90

... in which we operate. These jurisdictions are those we project to have the highest tax liability for 2014. Jurisdiction Earliest Open Tax Period Jurisdiction Earliest Open Tax Period Canada Germany Netherlands 2005 2008 2008 Norway Saudi Arabia U.S. 1999 2003 2010 2013 Annual Report 60 -

Page 91

Baker Hughes Incorporated Notes to Consolidated Financial Statements NOTE 4. EARNINGS PER SHARE A reconciliation of the number of shares used for the basic and diluted earnings per share ("EPS") computations is as follows for the years ended December 31: 2013 443 1 444 2012 440 1 441 2011 436 2 438... -

Page 92

... life of 3 years, which we began amortizing in 2012 on an accelerated basis. The following table details the impairment charge by segment: 2011 North America Latin America Europe/Africa/Russia Caspian Middle East/Asia Pacific Industrial Services Total $ $ 105 64 48 47 51 315 2013 Annual Report 62 -

Page 93

Baker Hughes Incorporated Notes to Consolidated Financial Statements Intangible assets are generally amortized on a straight-line basis with estimated useful lives ranging from 3 to 30 years. Amortization expense included in net income for the years ended December 31, 2013, 2012 and 2011 was $119 ... -

Page 94

... in the following table: 2013 Segments Revenue Profit (Loss) Before Tax Revenue 2012 Profit (Loss) Before Tax Revenue 2011 Profit (Loss) Before Tax North America Latin America Europe/Africa/Russia Caspian Middle East/Asia Pacific Industrial Services Total Operations Corporate and other Interest... -

Page 95

... $ (643) (158) (279) (148) (3,814) 5,044 2 (2) $ - $ $ 2011 (641) (191) (296) (148) (3,280) 4,557 1 (1) - North America Latin America Europe/Africa/Russia Caspian Middle East/Asia Pacific Industrial Services Shared assets Total Operations Corporate and other Total 65 Baker Hughes Incorporated -

Page 96

...the following table: Capital Expenditures Increase/(decrease) Segments 2012 $ (40) (12) (16) (13) (523) 604 $ - $ $ 2011 (31) (9) (12) (10) (289) 351 - North America Latin America Europe/Africa/Russia Caspian Middle East/Asia Pacific Industrial Services Shared assets Total 2013 Annual Report 66 -

Page 97

... table presents geographic consolidated revenue based on where the product is shipped or the services are performed for the years ended December 31: 2013 U.S. Canada and other North America Latin America (1) Europe/Africa/Russia Caspian Middle East/Asia Pacific Total (1) 2012 $ 9,903 1,598 11,501... -

Page 98

... rates. We also provide certain postretirement health care benefits ("other postretirement benefits"), through an unfunded plan, to a closed group of U.S. employees who retire and have met certain age and service requirements. This plan was amended during 2012 and as a result was closed to new... -

Page 99

Baker Hughes Incorporated Notes to Consolidated Financial Statements The amounts recognized in the consolidated balance sheets consist of the following at December 31: Non-U.S. Pension Benefits 2013 2012 Other Postretirement Benefits 2013 2012 U.S. Pension Benefits 2013 2012 Noncurrent assets ... -

Page 100

...$ 14 Weighted average assumptions used to determine net periodic cost for these plans are as follows for the years ended December 31: Non-U.S. Pension Benefits 2013 2012 2011 Other Postretirement Benefits 2013 2012 2011 U.S. Pension Benefits 2013 2012 2011 Discount rate Expected long-term return... -

Page 101

Baker Hughes Incorporated Notes to Consolidated Financial Statements Health Care Cost Trend Rates Assumed health care cost trend rates have a significant effect on the amounts reported for other postretirement benefits. As of December 31, 2013, the health care cost trend rate was 7.7% for employees ... -

Page 102

Baker Hughes Incorporated Notes to Consolidated Financial Statements 2013 Total Asset Value Level One Level Two Level Three Total Asset Value Level One 2012 Level Two Level Three Asset Category Cash and Cash Equivalents Fixed Income U.S. Equity (3) Hedge Funds (4) Real Estate Funds Real Estate ... -

Page 103

... Private Equity Fund U.S. Real Estate Fund Non-U.S. Real Estate Fund U.S. Hedge Funds Non-U.S. Insurance Contracts Total Balance at December 31, 2010 Unrealized gains Sales Purchases Balance at December 31, 2011 Unrealized (losses) gains Sales Purchases Balance at December 31, 2012 Unrealized... -

Page 104

Baker Hughes Incorporated Notes to Consolidated Financial Statements Expected Cash Flows For all pension plans, we make annual contributions to the plans in amounts equal to or greater than amounts necessary to meet minimum governmental funding requirements. In 2014, we expect to contribute between ... -

Page 105

... million for the years ended December 31, 2013, 2012 and 2011, respectively. We have not entered into any significant capital leases during the three years ended December 31, 2013. LITIGATION We are subject to a number of lawsuits and claims arising out of the conduct of our business. The ability to... -

Page 106

... cash flows. We were among several unrelated companies who received a subpoena from the Office of the New York Attorney General, dated June 17, 2011. The subpoena received by the Company seeks information and documents relating to, among other things, natural gas development and hydraulic fracturing... -

Page 107

Baker Hughes Incorporated Notes to Consolidated Financial Statements on our consolidated financial statements. We also had commitments outstanding for purchase obligations related to capital expenditures, inventory and services under contracts, for each of the five years in the period ending ... -

Page 108

...Quarter Third Quarter Fourth Quarter Total Year 2013 Revenue Gross Profit Net income attributable to Baker Hughes Basic earnings per share attributable to Baker Hughes Diluted earnings per share attributable to Baker Hughes Dividends per share Common stock market prices: High Low 2012 Revenue Gross... -

Page 109

...our management included a report of their assessment of the design and effectiveness of our internal controls over financial reporting as part of this Annual Report on Form 10-K for the fiscal year ended December 31, 2013. Deloitte & Touche LLP, the Company's independent registered public accounting... -

Page 110

... the Baker Hughes Incorporated 2002 Director & Officer Long-Term Incentive Plan, the BJ Services 2000 Incentive Plan, the BJ Services 2003 Incentive Plan, the Employee Stock Purchase Plan, all of which have been approved by our stockholders (in millions, except per share prices). 2013 Annual Report... -

Page 111

...Future Issuance Under Equity Compensation Plans (excluding securities reflected in the first column) Stockholder-approved plans (excluding Employee Stock Purchase Plan) Nonstockholder-approved plans Subtotal (except for weighted average exercise price) Employee Stock Purchase Plan Total (2) (1) 12... -

Page 112

... 17, 2011, between Baker Hughes Incorporated and The Bank of New York Mellon Trust Company, N.A., as trustee (including form of Notes) (filed as Exhibit 4.2 to the Current Report of Baker Hughes Incorporated on Form 8-K filed August 23, 2011). Officers' Certificate of Baker Hughes Incorporated dated... -

Page 113

... reference to Exhibit 4.4 to the Current Report of Baker Hughes Incorporated on Form 8-K filed on June 23, 2011). Form of Incentive Stock Option Assumption Agreement for BJ Services incentive plans (filed as Exhibit 4.5 to the Current Report of Baker Hughes Incorporated on Form 8-K filed on April 29... -

Page 114

...Purchase Plan effective as of April 25, 2013 (filed as Exhibit 10.2 to the Current Report of Baker Hughes Incorporated on Form 8-K filed on April 30, 2013). Form of Baker Hughes Incorporated Incentive Stock Option Agreement with Terms and Conditions for officers (filed as Exhibit 10.33 to the Annual... -

Page 115

... the Performance Unit Awards payable in shares granted in 2014 (filed as Exhibit 10.2 to the Current Report of Baker Hughes Incorporated on Form 8-K filed on January 28, 2014). BJ Services Company 2000 Incentive Plan (filed as Appendix B to the Proxy Statement of BJ Services Company dated December... -

Page 116

... BJ Services Company 2003 Incentive Plan (filed as Exhibit 10.1 to the Quarterly Report of BJ Services Company for the quarter ended March 31, 2009). Baker Hughes Incorporated Compensation Recoupment Policy effective January 1, 2014 (filed as Exhibit 10.10 to the Current Report of Baker Hughes... -

Page 117

... (Peter A. Ragauss) /S/ ALAN J. KEIFER (Alan J. Keifer) Chairman and Chief Executive Officer (principal executive officer) Senior Vice President and Chief Financial Officer (principal financial officer) Vice President and Controller (principal accounting officer) 87 Baker Hughes Incorporated -

Page 118

... (Pierre H. Jungels) /S/ JAMES A. LASH (James A. Lash) /S/ J. LARRY NICHOLS (J. Larry Nichols) /S/ JAMES W. STEWART (James W. Stewart) /S/ CHARLES L. WATSON (Charles L. Watson) Director Director Director Director Director Director Director Director Director Director 2013 Annual Report 88 -

Page 119

Baker Hughes Incorporated Schedule II - Valuation and Qualifying Accounts Balance at Beginning of Period Charged to Cost and Expenses Balance at End of Period (In millions) Writeoffs (1) Other Changes (2) (3) Year Ended December 31, 2013 Reserve for doubtful accounts receivable $ Reserve for ... -

Page 120

...Senior Vice President, Chief Legal and Governance Ofï¬cer Archana Deskus Vice President and Chief Information Ofï¬cer Dmitry Kuzovenkov Vice President, Health, Safety and Environment Derek Mathieson Vice President, Strategy and Corporate Development Khaled Nouh President, Middle East and Asia Paci... -

Page 121

bakerhughes.com 2929 Allen Parkway, Suite 2100 Houston, Texas 77019-2118 P.O. Box 4740 Houston, Texas 77210-4740 (713) 439-8600