BP 2011 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156 BP Annual Report and Form 20-F 2011

Additional information for shareholders

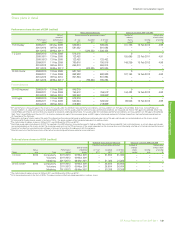

Provisions and contingencies

The group holds provisions for the future decommissioning of oil and

natural gas production facilities and pipelines at the end of their economic

lives. The largest decommissioning obligations facing BP relate to the

plugging and abandonment of wells and the removal and disposal of oil

and natural gas platforms and pipelines around the world. The estimated

discounted costs of performing this work are recognized as we drill the

wells and install the facilities, reflecting our legal obligations at that time.

A corresponding asset of an amount equivalent to the provision is also

created within property, plant and equipment. This asset is depreciated

over the expected life of the production facility or pipeline. Most of these

decommissioning events are many years in the future and the precise

requirements that will have to be met when the removal event actually

occurs are uncertain. Decommissioning technologies and costs are

constantly changing, as well as political, environmental, safety and public

expectations. Consequently, the timing and amounts of future cash flows

are subject to significant uncertainty. Any changes in the expected future

costs are reflected in both the provision and the asset.

Decommissioning provisions associated with downstream and

petrochemicals facilities are generally not recognized, as such potential

obligations cannot be measured, given their indeterminate settlement

dates. The group performs periodic reviews of its downstream

and petrochemicals long-lived assets for any changes in facts and

circumstances that might require the recognition of a decommissioning

provision.

The timing and amount of future expenditures are reviewed

annually, together with the interest rate used in discounting the cash flows.

The interest rate used to determine the balance sheet obligation at the end

of 2011 was 0.5% (2010 1.5%). The interest rate represents the real rate

(i.e. excluding the impacts of inflation) on long-dated government bonds.

Other provisions and liabilities are recognized in the period when

it becomes probable that there will be a future outflow of funds resulting

from past operations or events and the amount of cash outflow can

be reliably estimated. The timing of recognition and quantification of

the liability require the application of judgement to existing facts and

circumstances, which can be subject to change. Since the actual cash

outflows can take place many years in the future, the carrying amounts

of provisions and liabilities are reviewed regularly and adjusted to take

account of changing facts and circumstances.

A change in estimate of a recognized provision or liability would

result in a charge or credit to net income in the period in which the change

occurs (with the exception of decommissioning costs as described above).

Provisions for environmental remediation are made when a

clean-up is probable and the amount of the obligation can be reliably

estimated. Generally, this coincides with commitment to a formal plan

of action or, if earlier, on divestment or on closure of inactive sites. The

provision for environmental liabilities is estimated based on current legal

and constructive requirements, technology, price levels and expected

plans for remediation. Actual costs and cash outflows can differ from

estimates because of changes in laws and regulations, public expectations,

prices, discovery and analysis of site conditions and changes in clean-up

technology.

The provision for environmental liabilities is reviewed at least

annually. The interest rate used to determine the balance sheet obligation

at 31 December 2011 was 0.5% (2010 1.5%).

Information about the group’s provisions is provided in Financial

statements – Note 36.

As further described in Financial statements – Note 43 on page 249,

the group is subject to claims and actions. The facts and circumstances

relating to particular cases are evaluated regularly in determining whether

it is probable that there will be a future outflow of funds and, once

established, whether a provision relating to a specific litigation should be

established or revised. Accordingly, significant management judgement

relating to provisions and contingent liabilities is required, since the

outcome of litigation is difficult to predict.

Gulf of Mexico oil spill

Detailed information on the Gulf of Mexico oil spill, including the financial

impacts, is provided in Financial statements – Note 2 on pages 190-194.

As a consequence of the Gulf of Mexico oil spill, as described on

pages 76-79, BP continues to incur costs and has also recognized liabilities

for future costs. Liabilities of uncertain timing or amount and contingent

liabilities have been accounted for and/or disclosed in accordance with IAS

37 ‘Provisions, contingent liabilities and contingent assets’. BP’s rights and

obligations in relation to the $20-billion trust fund which was established

in 2010 are accounted for in accordance with IFRIC 5 ‘Rights to interests

arising from decommissioning, restoration and environmental rehabilitation

funds’.

The total amounts that will ultimately be paid by BP in relation to all

obligations relating to the incident are subject to significant uncertainty and

the ultimate exposure and cost to BP will be dependent on many factors

(including, with respect to certain of the obligations, any determination of

BP’s culpability based on any findings of negligence, gross negligence or

wilful misconduct). Furthermore, significant uncertainty exists in relation to

the amount of claims that will become payable by BP, the amount of fines

that will ultimately be levied on BP, the outcome of litigation and arbitration

proceedings, the amount and timing of payments under any settlements,

and any costs arising from any longer-term environmental consequences

of the oil spill, which will also impact upon the ultimate cost for BP. Any

further settlements which may be reached relating to the Deepwater

Horizon oil spill could impact the amount and timing of any future

payments. Although the provision recognized is the current best reliable

estimate of expenditures required to settle certain present obligations at

the end of the reporting period, there are future expenditures for which

it is not possible to measure the obligation reliably as noted below under

Contingent liabilities.

The magnitude and timing of possible obligations in relation to the

Gulf of Mexico oil spill are subject to a very high degree of uncertainty

as described further in Risk factors on pages 59-63. Furthermore, other

material unanticipated obligations may arise in future in relation to the

incident. Refer to Financial statements – Note 43 on page 249 for further

information.

Expenditure to be met from the $20-billion trust fund

In 2010, BP established the Deepwater Horizon Oil Spill Trust (the Trust) to

be funded in the amount of $20 billion over the period to the fourth quarter

of 2013, which is available to satisfy legitimate individual and business

claims administered by the Gulf Coast Claims Facility (GCCF), state and

local government claims resolved by BP, final judgments and settlements,

state and local response costs, and natural resource damages and related

costs. It is currently expected that the cost of the proposed settlement

will be payable from the Trust. In 2010, BP contributed $5 billion to the

fund, and further regular contributions totalling $5 billion were made in

2011. During 2011, BP also contributed the cash settlements received

from MOEX, Weatherford and Anadarko amounting in total to $5.1 billion.

A further cash settlement from Cameron was received in January 2012

and was also contributed to the trust fund. As a result of these accelerated

contributions, it is now expected that the $20-billion commitment will have

been paid in full by the end of 2012.

Fines, penalties and claims administration costs are not covered by

the trust fund. BP’s obligation to make contributions to the trust fund was

recognized in full in the 2010 group income statement and the remaining

liability to fund the Trust is included within other payables on the balance

sheet after taking account of the time value of money. The establishment

of the trust fund does not represent a cap or floor on BP’s liabilities and BP

does not admit to a liability of this amount.

An asset has been recognized representing BP’s right to receive

reimbursement from the trust fund. This is the portion of the estimated

future expenditure provided for that will be settled by payments from

the trust fund. We use the term “reimbursement asset” to describe this

asset. BP will not actually receive any reimbursements from the trust fund,

instead payments will be made directly to claimants from the trust fund,

and BP will be released from its corresponding obligation.