BP 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2008

Performance review

Provisions and contingencies

The group holds provisions for the future decommissioning of oil and

natural gas production facilities and pipelines at the end of their economic

lives. The largest asset removal obligations facing BP relate to the

removal and disposal of oil and natural gas platforms and pipelines

around the world. The estimated discounted costs of dismantling and

removing these facilities are accrued on the installation of those facilities,

reflecting our legal obligations at that time. A corresponding asset of an

amount equivalent to the provision is also created within property, plant

and equipment. This asset is depreciated over the expected life of the

production facility or pipeline. Most of these removal events are many

years in the future and the precise requirements that will have to be met

when the removal event actually occurs are uncertain. Asset removal

technologies and costs are constantly changing, as well as political,

environmental, safety and public expectations. Consequently, the timing

and amounts of future cash flows are subject to significant uncertainty.

Changes in the expected future costs are reflected in both the provision

and the asset.

Decommissioning provisions associated with downstream and

petrochemicals facilities are generally not provided for, as such potential

obligations cannot be measured, given their indeterminate settlement

dates. The group performs periodic reviews of its downstream

and petrochemicals long-lived assets for any changes in facts

and circumstances that might require the recognition of a

decommissioning provision.

The timing and amount of future expenditures are reviewed

annually, together with the interest rate used in discounting the cash

flows. The interest rate used to determine the balance sheet obligation at

the end of 2008 was 2%, unchanged from the end of 2007. The interest

rate represents the real rate (i.e. adjusted for inflation) on long-dated

government bonds.

Other provisions and liabilities are recognized in the period when

it becomes probable that there will be a future outflow of funds resulting

from past operations or events and the amount of cash outflow can be

reliably estimated. The timing of recognition requires the application of

judgement to existing facts and circumstances, which can be subject to

change. Since the actual cash outflows can take place many years in the

future, the carrying amounts of provisions and liabilities are reviewed

regularly and adjusted to take account of changing facts and

circumstances.

A change in estimate of a recognized provision or liability would

result in a charge or credit to net income in the period in which the

change occurs (with the exception of decommissioning costs as

described above).

Provisions for environmental clean-up and remediation costs are

based on current legal and constructive requirements, technology, price

levels and expected plans for remediation. Actual costs and cash

outflows can differ from estimates because of changes in laws and

regulations, public expectations, prices, discovery and analysis of site

conditions and changes in clean-up technology.

The provision for environmental liabilities is reviewed at least

annually. The interest rate used to determine the balance sheet obligation

at 31 December 2008 was 2%, the same rate as at the previous balance

sheet date.

As further described in Financial statements – Note 44 on

page 174, the group is subject to claims and actions. The facts and

circumstances relating to particular cases are evaluated regularly in

determining whether it is ‘probable’ that there will be a future outflow of

funds and, once established, whether a provision relating to a specific

litigation should be adjusted. Accordingly, significant management

judgement relating to contingent liabilities is required, since the outcome

of litigation is difficult to predict.

Pensions and other post-retirement benefits

Accounting for pensions and other post-retirement benefits involves

judgement about uncertain events, including estimated retirement dates,

salary levels at retirement, mortality rates, rates of return on plan assets,

determination of discount rates for measuring plan obligations, healthcare

cost trend rates and rates of utilization of healthcare services by retirees.

These assumptions are based on the environment in each country.

Determination of the projected benefit obligations for the group’s defined

benefit pension and post-retirement plans is important to the recorded

amounts for such obligations on the balance sheet and to the amount of

benefit expense in the income statement. The assumptions used may

vary from year to year, which will affect future results of operations. Any

differences between these assumptions and the actual outcome also

affect future results of operations.

Pension and other post-retirement benefit assumptions are

reviewed by management at the end of each year. These assumptions

are used to determine the projected benefit obligation at the year-end

and hence the surpluses and deficits recorded on the group’s balance

sheet, and pension and other post-retirement benefit expense for the

following year.

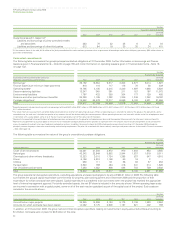

The pension and other post-retirement benefit assumptions at

31 December 2008, 2007 and 2006 are provided in Financial statements

– Note 38 on page 159.

The assumed rate of investment return, discount rate and the

US healthcare cost trend rate have a significant effect on the amounts

reported. A sensitivity analysis of the impact of changes in these

assumptions on the benefit expense and obligation is provided in

Financial statements – Note 38 on page 159.

In addition to the financial assumptions, we regularly review the

demographic and mortality assumptions. Mortality assumptions reflect

best practice in the countries in which we provide pensions and have

been chosen with regard to the latest available published tables adjusted

where appropriate to reflect the experience of the group and an

extrapolation of past longevity improvements into the future. BP’s most

substantial pension liabilities are in the UK, US and Germany and the

mortality assumptions for these countries are detailed in Financial

statements – Note 38 on page 159.

Performance review

63