BP 2008 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2008

Notes on financial statements

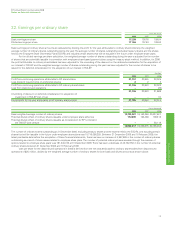

20. Taxation continued

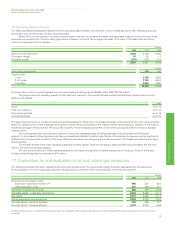

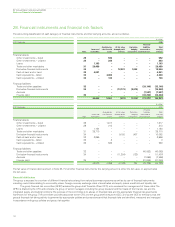

Deferred tax

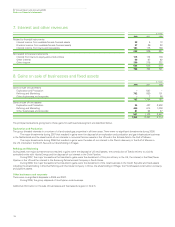

$ million

Income statement Balance sheet

2008 2007a2006a2008 2007a

Deferred tax liability

Depreciation 1,248 125 1,423 23,342 22,338

Pension plan surpluses 108 127 173 412 2,136

Other taxable temporary differences (2,471) 1,371 417 3,626 5,998

(1,115) 1,623 2,013 27,380 30,472

Deferred tax asset

Petroleum revenue tax 121 139 4 (192) (325)

Pension plan and other post-retirement benefit plan deficits 104 (72) 71 (2,414) (1,545)

Decommissioning, environmental and other provisions (333) (1,069) (754) (4,860) (5,107)

Derivative financial instruments 228 450 (115) (331) (541)

Tax credit and loss carry forward 118 (466) 220 (1,821) (1,822)

Other deductible temporary differences 111 2 (908) (1,564) (1,917)

349 (1,016) (1,482) (11,182) (11,257)

Net deferred tax (credit) charge and net deferred tax liability (766) 607 531 16,198 19,215

aA minor amendment has been made to the comparative amounts shown in the analysis of deferred tax by category of temporary difference.

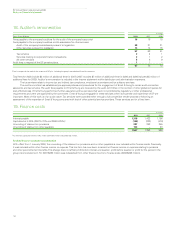

$ million

Analysis of movements during the year 2008 2007

At 1 January 19,215 18,116

Exchange adjustments (67) 42

Charge (credit) for the year on ordinary activities (766) 607

Charge (credit) for the year in the statement of recognized income and expense (2,492) 241

Acquisitions –199

Other movements 308 10

At 31 December 16,198 19,215

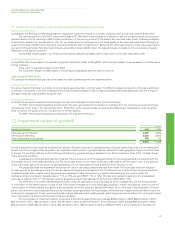

In 2008, there have been no changes in the statutory tax rates that have materially impacted the group’s tax charge. The enactment, in 2007, of a 2%

reduction in the rate of UK corporation tax on profits arising from activities outside the North Sea reduced the deferred tax charge by $189 million in

that year.

Deferred tax assets are recognized to the extent that it is probable that taxable profit will be available against which the deductible temporary

differences and the carry-forward of unused tax assets and unused tax losses can be utilized.

At 31 December 2008, the group had around $6.3 billion (2007 $5.0 billion) of carry-forward tax losses, predominantly in Europe, that would be

available to offset against future taxable profit. A deferred tax asset has been recognized in respect of $4.2 billion of losses (2007 $3.2 billion). No

deferred tax asset has been recognized in respect of $2.1 billion of losses (2007 $1.8 billion). Substantially all the tax losses have no fixed expiry date.

At 31 December 2008, the group had around $3.4 billion (2007 $4.1 billion) of unused tax credits in the UK and US. A deferred tax asset of

$0.5 billion has been recognized in 2008 for these credits (2007 $0.8 billion), which is offset by a deferred tax liability associated with unremitted

profits from overseas entities in jurisdictions with a lower tax rate than the UK. No deferred tax asset has been recognized in respect of $2.9 billion of

tax credits (2007 $3.2 billion). The UK tax credits do not have a fixed expiry date. The US tax credits, amounting to $1.8 billion, expire ten years after

generation, and substantially all expire in the period 2014-2018.

The major components of temporary differences at the end of 2008 are tax depreciation, US inventory holding gains (classified as other taxable

temporary differences), provisions, and pension plan and other post-retirement benefit plan deficits.

The group profit and loss account reserve includes $18,347 million (2007 $16,335 million) of earnings retained by subsidiaries and equity-accounted

entities.

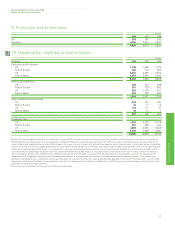

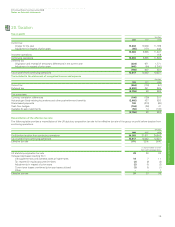

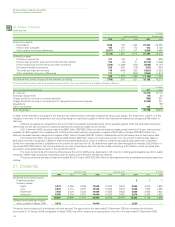

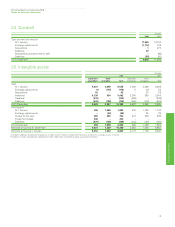

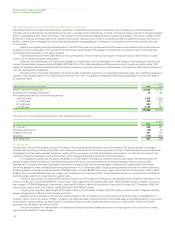

21. Dividends

pence per share cents per share $ million

2008 2007 2006 2008 2007 2006 2008 2007 2006

Dividends announced and paid

Preference shares 22 2

Ordinary shares

March 6.813 5.258 5.288 13.525 10.325 9.375 2,553 2,000 1,922

June 6.830 5.151 5.251 13.525 10.325 9.375 2,545 1,983 1,893

September 7.039 5.278 5.324 14.000 10.825 9.825 2,623 2,065 1,943

December 8.705 5.308 5.241 14.000 10.825 9.825 2,619 2,056 1,926

29.387 20.995 21.104 55.050 42.300 38.400 10,342 8,106 7,686

Dividend announced per ordinary

share, payable in March 2009 9.818 ––14.000 ––2,626 – –

The group does not account for dividends until they are paid. The accounts for the year ended 31 December 2008 do not reflect the dividend

announced on 3 February 2009 and payable in March 2009; this will be treated as an appropriation of profit in the year ended 31 December 2009.

136